Some economists think the U.S. economy may have hit peak growth, which is bullish for the euro reports Fawad Razaqzada.

Although slightly lower today, the EUR/USD has been holding its own rather well despite continued weakness in Eurozone data. In part, the exchange rates resilience has been due to ongoing weakness in the dollar rather than euro strength as investors have been lowering their expectations over further interest rate increases in the United States, while Eurozone interest rate expectations haven’t moved much recently. While we are unsure about the longer-term direction of the EUR/USD, we think there is a possibility that the exchange rate could appreciate further in the short-term outlook.

The recent sell-off in the stock markets underscore concerns over economic growth, as do the disappointing sales forecasts from Apple (NASDAQ:AAPL) and now Samsung (KS:005930) for their smartphones. Demand has been hit by the recent currency crisis in several emerging market economies, the impact of higher U.S. tariffs on Chinese exports and tighter monetary conditions in the United States, among other factors.

Although employment growth is still strong and wages have picked up, some economists think the U.S. economy may have hit peak growth as the impact of the past tax cuts start to fade away. The Federal Reserve has indicated it wants to pause hiking and assess the economic situation before deciding whether to tighten its belt further. Meanwhile, the European Central Bank continues to expect lifting interest rates after the summer, should economic conditions still warrant it.

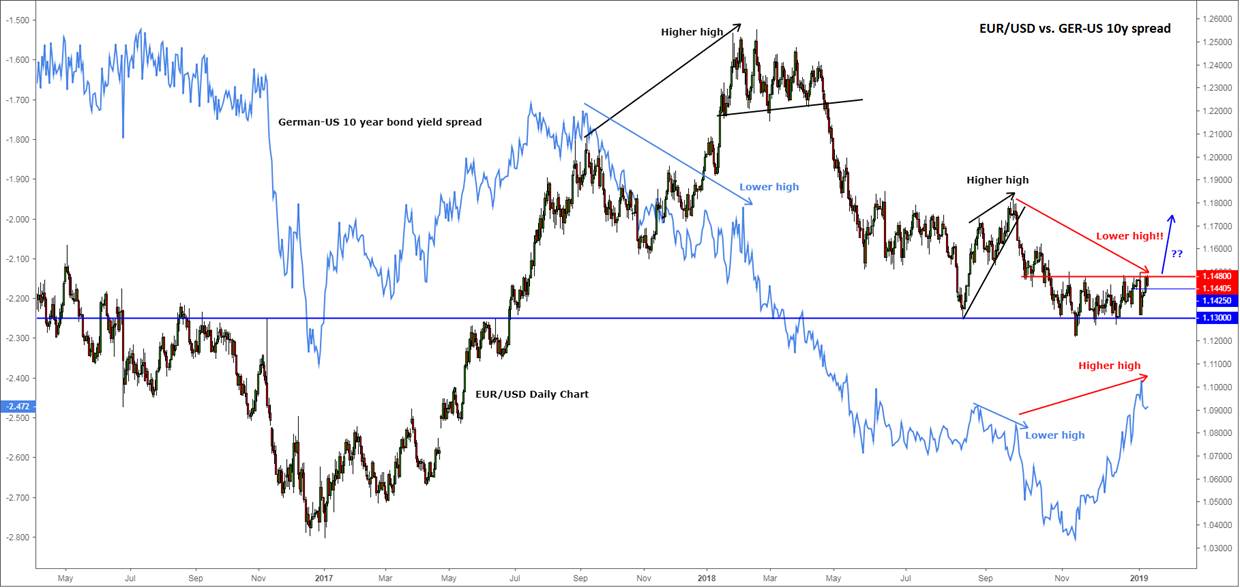

Also painting a moderately bullish picture for the EUR/USD is the fact that the German-US 10-year bond yield spread has widened in favor of Germany (see chart below). Yield-seeking investors are finding European assets marginally more valuable than U.S. assets, underpinning demand for the single currency. In fact, the yield spread has created a divergence as it has made a higher high, while the EUR/USD hasn’t created a corresponding higher high yet. This is a major warning sign for the EUR/USD bears as it indicates the exchange rate may have catching up to do. Note that the previous divergences saw the EUR/USD eventually go in the direction of the yield spread. What makes this particular divergence even more interesting is the fact that the EUR/USD has held its own above long-term support around the 1.13 handle and created a couple of interesting price candles on its monthly chart.

Source: TradingView and FOREX.com.

So, the potential is there for a breakout on the EUR/USD despite all the doom and gloom out there. But overall, price action on this pair is still (understandably) choppy and range bound. Conservative traders may therefore wish to wait for more signals to emerge before taking a directional view on the EUR/USD. Friday’s US CPI and next Tuesday’s Brexit vote in the UK parliament are among the most important short-term catalysts for this pair.