By Carmel Yang

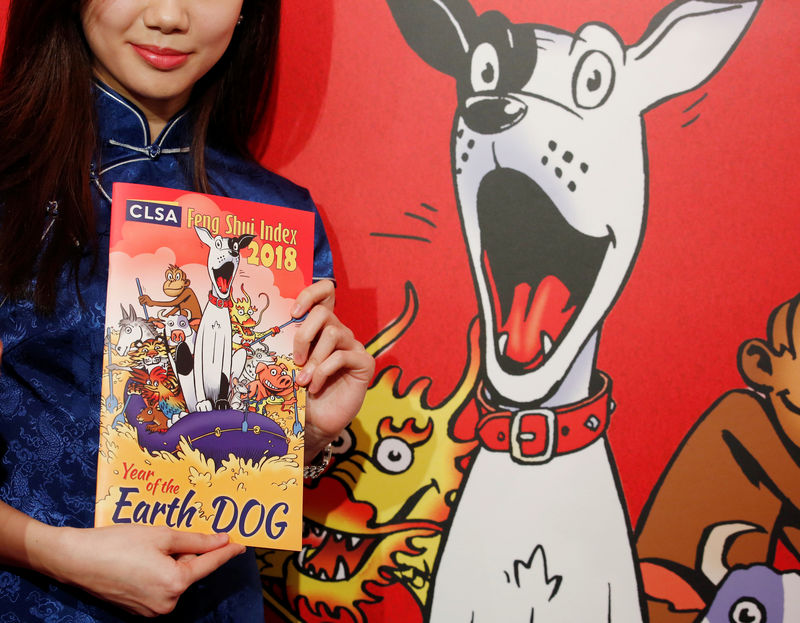

HONG KONG (Reuters) - Stock markets are expected to get off to a pouncing start in the Year of the Dog but investors might want to sniff around for value a bit later, Hong Kong brokerage CLSA said in its astrological predictions for the 2018 lunar year.

CLSA's Feng Shui Index, a tongue-in-cheek financial forecast for the Year of the Dog which begins on Feb. 16, forecasts "a most auspicious day" on Feb. 28, although it warns of a "summer of discontent".

The report, which cautions investors not to "bite off more than they can chew", draws on findings from a feng shui master, who looks at the five elements in Chinese astrology: wood, metal, earth, fire and water. 2018 is the year of the Earth Dog.

"It's not a year for metals to bark so don't expect much more than a whimper from banks and financials - we expect both to underperform from the previous two years," CLSA said.

"There's just enough earth in the charts to keep property and renewables anchored," it added.

September is a good time to hound down smart investments, with sectors such as healthcare and consumer, seen as wood-related, among the top picks for the year. A lack of metal element this year may see auto and machinery stocks underperform.

CLSA advises against taking bets on casino or transport stocks in March, when the market is likely to take a tumble, although these sectors should get a leg up in October.

Construction and resources stocks are expected to bloom from spring to mid-summer, but investors are told to be wary of banking and financials.

The Hang Seng Index (HSI) is expected to close on a high at the end of the year, it says.

Hong Kong got off to a strong start the calendar year, scaling a series of record highs, although the past few trading sessions have been volatile, tracking moves in global equities.

The financial hub's benchmark index (HSI) has risen around 7 percent so far this year after surging 36 percent in 2017.

The CLSA Feng Shui Index began in 1992, the Year of the Monkey, as a Lunar New Year card for clients.