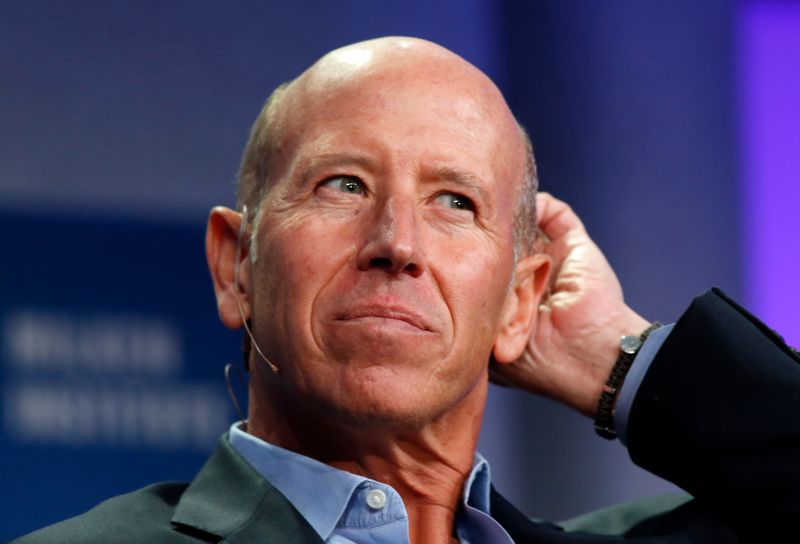

(Reuters) - Healthcare provider Cano Health LLC will be taken public through a merger with a blank-check company backed by real estate investor Barry Sternlicht, in a deal worth $4.4 billion deal, including debt, the companies said on Thursday.

Sternlicht's special purpose acquisition company (SPAC) Jaws Acquisition Corp (N:JWS) was listed on the New York Stock Exchange in May.

A SPAC is a shell company that uses IPO proceeds to buy another company, typically within two years, in a merger that will take the acquired company public. Investors are not notified in advance on what company the SPAC will buy.

SPACs have emerged as a popular IPO alternative for companies this year, providing a path to going public with less regulatory scrutiny.

Online betting firm DraftKings (O:DKNG) and billionaire investor Richard Branson's space tourism firm Virgin Galactic Holdings Inc (N:SPCE) have picked the SPAC route this year.

Founded in 2009, Cano Health runs a healthcare platform for 103,000 seniors, with more than 500 primary care physicians across 14 markets in Florida, Texas, Nevada and Puerto Rico.

As part of the deal, Cano Health will receive an investment of $800 million from investors including Sternlicht as well as funds related to and managed by Fidelity Management, BlackRock (NYSE:BLK), Third Point (NYSE:TPRE) and Maverick Capital.