By Lawrence Delevingne

NEW YORK (Reuters) - Bridgewater Associates, the largest hedge fund manager in the world, continued its efforts to transition some responsibilities away from founder Ray Dalio.

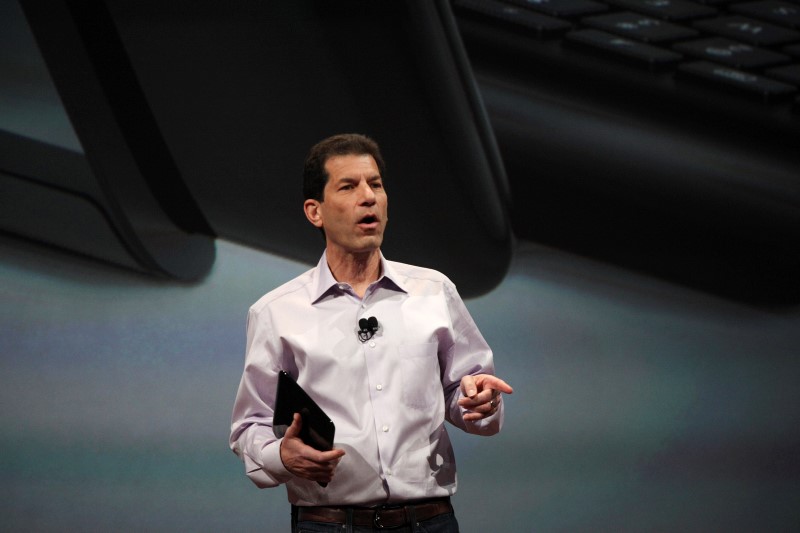

The latest move, announced in a client note seen by Reuters on Thursday, was to hire Jon Rubinstein, a longtime technology executive who spent years working with Steve Jobs at Apple (NASDAQ:AAPL). Rubinstein is set to join Bridgewater as co-Chief Executive Officer in May, according to the memo.

Rubinstein will take a role currently held by Greg Jensen, who is also co-Chief Investment Officer (CIO). Jensen will depart the co-CEO post but will remain co-CIO. Eileen Murray will continue to serve as co-CEO.

Bridgewater, known for a unique culture that emphasizes a radical form of transparency, is in the middle of a management transition process started in 2010.

Since then, the Westport, Connecticut-based firm has experimented with different combinations of leadership and new senior roles, including using one, two or three CEOs simultaneously.

Dalio, a billionaire, has no specific plans to leave the firm he launched in 1975, and remains a key figure in guiding Bridgewater's macroeconomic-themed investments.

Bridgewater is known for being run according to a set of management "principles" from Dalio that emphasize direct - if brutally honest - communication. Much of what's said inside the firm is recorded, and accessible for all to listen to.

The transition process, according to people familiar with it, is so that a team can help lead the increasingly large firm, especially its daily operations. Bridgewater now employs approximately 1,500 people and manages $154 billion, according to its website. That's far larger than the average hedge fund firm, which employs fewer than 100 people.

Jensen was never an anointed successor to Dalio as some in the media have speculated, nor will any one person ever be, according to the people.

Today, Dalio remains co-CIO with Jensen and Robert Prince, and co-executive chairman of a "stakeholder's committee" with former Microsoft (NASDAQ:MSFT) executive Craig Mundie, according to the memo. The group is essentially the firm's board of directors.

The core of Bridgewater's senior management, including Jensen and Prince, have been with the firm for decades.

Others are more recent hires as part of the approximately 10-year transition process, including now-president David McCormick (NYSE:MKC), a former U.S. Treasury department official who joined in 2009, and Gerry Pasciucco, who was hired in 2015 after helping unwind American International Group's Financial Products unit following the financial crisis. Pasciucco's exact role was unclear.

Some management committee members hired in recent years have already departed, including former GE Capital executive Joe Parsons, former HSBC executive Tony Murphy, and former Accenture executive Kevin Campbell.

“It’s impossible to replace Ray, and there’s been a ton of thought around finding a group of people to carry on his responsibilities and the culture together,” said Michael Sarnoff, an executive recruiter at Highland Road who has worked with Bridgewater.

SILICON VALLEY HIRE

Rubinstein was most recently senior vice president for product innovation in the personal systems group at HP, which he left in 2012. Rubinstein has also served as an executive at Palm Inc and was instrumental in creating Apple's iPod.

The Bridgewater memo said Rubinstein's technological prowess would help enhance the firm's systematized style of decision making.

Dalio routinely describes the global economy as a "machine" and uses large amounts of historical data to predict the movements of securities pricing. Bridgewater also uses technology to asses the strengths and weaknesses of each employee, who routinely rate each other on various attributes using proprietary software.

The Rubinstein hire followed a February report in The Wall Street Journal of tension between Jensen, 42, and Dalio, 66. Bridgewater called the account a "sensationalistic mischaracterization" shortly after it appeared.

Regardless, Bridgewater said in the new memo that it decided to spilt its CEO and CIO responsibilities given the size of the firm and its growth.

"We have concluded that in order to have pervasive excellent management, we need CEOs who can give their full attention to the company's management, and we want Greg to shift his full attentions to investment responsibilities," the memo said.

The firm's main hedge fund, Pure Alpha II, has produced average annual returns of approximately 12.4 percent net of fees since 1991, according to performance information seen by Reuters. This year, the fund is down 4.4 percent through March 4.

Clients are largely supportive of the firm's transition efforts.

“Bridgewater is a great organization - Dalio is a man with real vision," said one investment manager of a public pension fund client who asked to remain anonymous. "I think they will come through just fine."