(Bloomberg) -- Investors added the most money on record to equity funds last week as the earnings season began on a positive note and global stocks continued to post record highs.

The rush to risk assets sparked a note of caution from Bank of America Merrill Lynch (NYSE:BAC) strategists, who see a “tactical pullback” in the stock market as likely in the first quarter, at least for the S&P 500. The bank’s “Bull & Bear” indicator has given the highest “sell” signal since March 2013, according to a report Thursday from the bank.

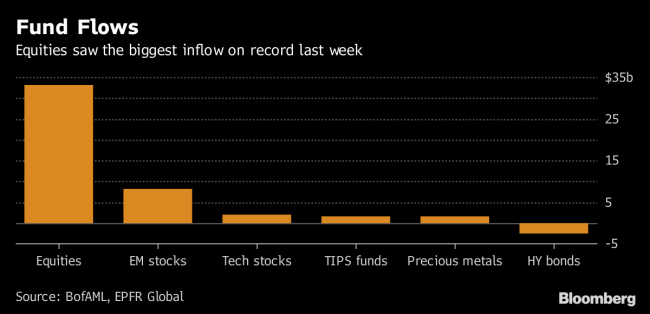

Investors poured $33.2 billion into stocks in the week to Jan. 24, Bank of America Merrill Lynch said in a research report, citing EPFR Global data. Actively managed equity portfolios, technology funds and Treasury Inflation Protected Securities all enjoyed record inflows.

U.S. stocks saw $7 billion of inflows while the $4.6 billion invested in European shares was the biggest in 37 weeks, the bank said. Emerging market equities received $8.1 billion in fresh money, the second biggest amount in the data series.

Investors have enjoyed a stellar start to 2018 as bets on broadening global economic growth and profit expansion pushed stocks to all-time highs this month. The MSCI ACWI Index, a gauge of both developed and emerging market equities, has risen 6.3 percent since the beginning of the year.

The euphoria didn’t extend to riskier corporate bonds, as high-yield funds saw $2.5 billion of outflows, the eleventh week of redemptions in the last 13. Emerging market bond funds continued to see demand, with $1.6 billion of inflows.

As for the “bull and bear” indicator, it may not be a flawless gauge. The last time the sell signal was this high, in March 2013, the S&P 500 still went on to gain more than 19 percent in the following 12 months.

(Adds reference to stock performance in 2013 and 2014, in final paragraph.)