By Jonathan Stempel

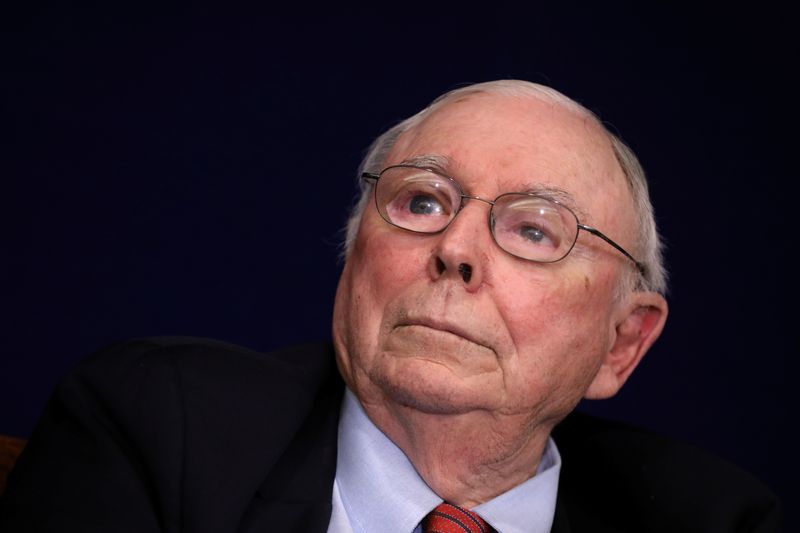

(Reuters) -Warren Buffett's trusted confidante Charlie Munger died on Tuesday at age 99, leaving a void at Berkshire Hathaway (NYSE:BRKa) that investors said would be impossible to fill despite the conglomerate's well-established succession plan.

Berkshire said Munger died peacefully at a hospital in California, where he lived. No cause was given. Munger would have turned 100 on Jan. 1.

"Berkshire Hathaway could not have been built to its present status without Charlie's inspiration, wisdom and participation," Buffett, Berkshire's 93-year-old chairman and chief executive, said in a statement.

The death of Munger, a Berkshire vice chairman since 1978, marks an end of an era in corporate America and investing.

Alongside Buffett, Munger was respected and adored by investors around the world, many of whom flocked to Berkshire's annual shareholder weekends in Omaha, Nebraska, to hear the duo’s folksy wisdom on investing and life.

Though Munger was not involved in Berkshire's day-to-day operations, his death leaves Buffett without his longtime sounding board.

Investors also said that while Berkshire has installed managers it could trust to keep the company going, Munger's loss would be deeply felt, and it prompted an outpouring of sorrow.

"It's a shock," said Thomas Russo, a partner at Gardner Russo & Quinn in Lancaster, Pennsylvania, and longtime Berkshire shareholder. "It will leave a big void for investors who have modeled their thoughts, words and activities around Munger and his insights."

PHILOSOPHICALLY ALIKE

Since becoming a Berkshire vice chairman, Munger worked closely with Buffett on allocating Berkshire's capital and not mincing words when he thought his business partner was making a mistake.

"He was certainly one of the greatest investors, as a team with Buffett," said Rick Meckler, partner at Cherry Lane Investments in New Jersey. "I'm sure it is an enormous loss for Buffett personally."

Munger was known for steering Buffett away from purchasing what Buffett called "cigar butts" — mediocre companies that had a puff of smoke left and could be bought for very cheap prices — and instead favoring quality.

"Charlie felt that buying very good businesses at fair prices that could keep compounding and reinvesting cash flow into continued growth was more consistent with how he and Warren were philosophically and liked to invest," said Paul Lountzis, president of Lountzis Asset Management in Wyomissing, Pennsylvania. "They liked to own businesses forever."

Money manager Whitney Tilson, who knew Munger personally, said a "generation of investment managers" learned some of their craft from Munger and Buffett.

"What really glued us to these men was their advice on living a full life by instructing people how to think clearly, to be honest with oneself, to learn from mistakes and to avoid calamities," he said.

Tilson said he attended dozens of meetings the men ran and that Munger once quipped to a private audience: "All I want to know is where I'm going to die so that I never go there."

BERKSHIRE'S FUTURE

Berkshire is unlikely to replace Munger and has not publicly discussed any need or desire to do so.

Two other vice chairmen, Greg Abel and Ajit Jain, have day-to-day oversight of Berkshire's non-insurance and insurance businesses, respectively.

Munger's death comes one week after Buffett donated about $866 million of Berkshire stock to four family charities and issued a rare shareholder letter acknowledging that his own time was finite, in the twilight of his own storied investing career.

In last week's letter, Buffett said Berkshire was "built to last" and would remain in good hands without him.

He has never publicly signaled a desire to step down, including after a prostate cancer diagnosis in 2012.

"At 93, I feel good but fully realize I am playing in extra innings," Buffett wrote.

Under Berkshire's succession plan, which Munger inadvertently mentioned at Berkshire's 2021 annual meeting, Abel would become chief executive once Buffett is no longer in charge.

Buffett's son Howard would become non-executive chairman, and one or two portfolio managers would take over investments.

Berkshire's businesses include the BNSF railroad, car insurer Geico, and an array of energy, industrial and retail operations, as well as familiar consumer names such as Dairy Queen, Duracell, Fruit of the Loom and See's Candies.

It also owns hundreds of billions of dollars of stocks, led by Apple (NASDAQ:AAPL).

CHANGES WITHOUT CHARLIE

Perhaps the most noticeable change to the public from Munger's death will be Berkshire's annual weekend, which draws tens of thousands of people to Omaha and is livestreamed worldwide.

No longer will Munger be there to share the stage with Buffett and answer dozens of shareholder questions over five hours.

Abel and Jain, who have answered some of those questions in recent years, may play more of a role.

"The annual meeting will never be the same without Charlie's terse, open and honest comments," Lountzis said. "He was so different from Warren, in the sense that Charlie said what he thought and didn't give a damn what anyone else thought."

Russo added: "Berkshire may be a little less fun without him."