(Bloomberg) -- For financial stocks, it’s a Street divided.

Buy them, say strategists, the securities industry’s pundit class, whose top-down dissections lean on economic and policy trends for inspiration. Banks and insurers are their most-favored trade for 2018, with nine of 10 tracked by Bloomberg giving it the highest recommendation.

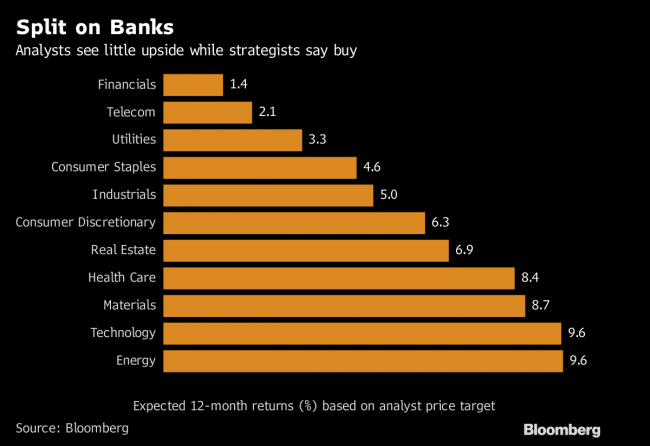

On the other side are analysts who concentrate on individual companies -- and see little upside. Combined price estimates for hundreds of forecasters tracked by Bloomberg imply the S&P 500 Financials Index will rise less than 2 percent in the next year, the worst expected return among 11 industries.

Once again, a market bifurcation has President Donald Trump at its center. Underpinning strategists’ bullish predictions are a greater expectation for easier regulation, tax cuts, and higher interest rates. Analysts see slow loan growth, a slump in trading revenue and flat profit margins hindering the group. While the benefits of lower taxes may be real, few have have factored them into their models.

Investors are siding with strategists. As Trump’s tax plan gathered momentum and the Fed raised interest rates for a third time this year, banks have bumped technology shares from the market’s lead. Up 12 percent over the past three months, the group’s return is almost twice that of the S&P 500’s. Bank of America (NYSE:BAC), Citigroup (NYSE:C) and JPMorgan Chase (NYSE:JPM) were all higher in trading Monday before the open of exchanges.

“Analysts are too caught up in the minutia of a quarter, the minutia of margin, and loan growth,” David Ellison, a Boston-based money manager at Hennessy Advisors Inc., said by phone. “It’s not about earnings now. Earnings are fine. It’s not about credits. Credits are fine. It’s about the long-term reasons to be in the industry.”

A deciding factor in the bull case is the improving prospects of banks relative to other industries, particularly technology, Ellison said. With taxes poised to fall and interest rates heading higher, the balance is tilting unfavorably for tech companies that already enjoy some of the lowest effective tax rates.

Divergent views are on display within Goldman Sachs (NYSE:GS). David Kostin, the firm’s chief U.S. equity strategist, last month downgraded tech stocks, touting banks as one of his top picks.

A reduction in effective corporate tax rates to 23 percent would boost financial earnings by 8 percent while driving tech income down by 3 percent, Kostin estimated. Rising interest rates and easier regulation will also help profits, allowing financial firms to boost dividends and buybacks, he said.

Richard Ramsden, Goldman’s banking analyst, isn’t as enthused, at least based on his share-price forecasts. Among seven stocks he covers, four traded below his targets, data compiled by Bloomberg show.

“Analysts are underestimating potential upside,” Kostin wrote in a Friday note to clients. “We expect the sector will outperform current analyst expectations.”

Part of the divergence rests in the definition of the two groups’ jobs. Strategists are charged almost exclusively with predicting broad market performance, while analysts have a greater obligation to the nuts and bolts of individual businesses. As such, it’s harder for the latter group to incorporate a tax plan that is still winding through Congress.

With the Republicans’ tax bill close to being finalized, some analysts have started to study the impact of tax and regulatory reform. In a Dec. 6 note, Erika Najarian at Bank of America Corp (NYSE:BAC). said bank stocks could rise an additional 30 percent under a “blue sky” scenario where both tax cuts and easier regulation materialize by 2019.

Credit Suisse (SIX:CSGN) Group AG’s Susan Roth Katzke followed a few days later with a similar assessment, saying tax cuts would mean at least 10 percent more upside in price targets. All the estimates will be reviewed once the bill is signed, she said.