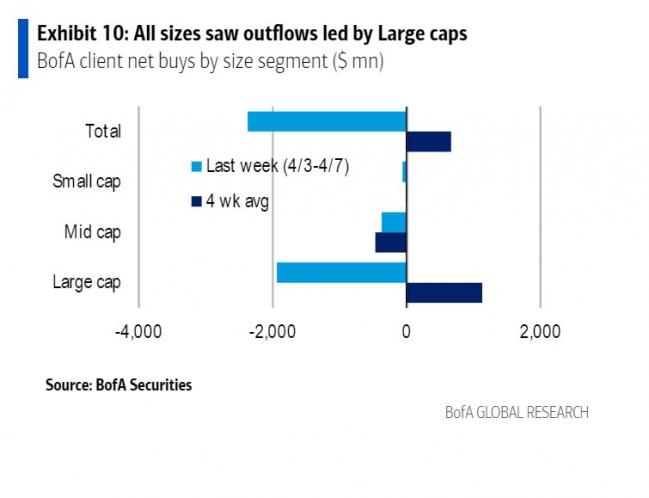

(Bloomberg) -- Bank of America Corp (NYSE:BAC). clients sold US equities of all sizes last week, pulling roughly $2.3 billion despite the relative quiet in the stock market.

That was the second consecutive week of outflows, BofA strategists led by Jill Carey Hall wrote in a note Tuesday. The analysts didn’t specify the reasons for the withdrawal, which was evident across all client groups. Selling was pronounced among institutional, retail and hedge-fund clients.

The outflows come as uncertainty brews about the staying power of this year’s rally in the S&P 500. Conviction among traders has been missing lately, with the gauge posting its sixth straight day of moves less than 0.6% in either direction on Tuesday — the longest stretch of stasis since 2021.

Following the always eagerly awaited Friday’s jobs report, investors have been bracing for Wednesday’s inflation print and the start of the first-quarter earnings season, which is expected to post the biggest contraction since the onset of the pandemic, according to data compiled by Bloomberg.

BofA’s clients yanked $451 million from real-estate stocks last week — the largest withdrawal since July 2021. On the flip side, communication services and staples were the only two sectors to see inflows.

Read: CPI Threatens to Shake Up Quiet, Unprepared Market: Taking Stock

©2023 Bloomberg L.P.