By Dhirendra Tripathi

Investing.com – ASML (NASDAQ:ASML) ADRs were up short of 4% in Wednesday’s premarket after the company reported sales and margins that reflected the extreme tightness in the global market for semiconductors.

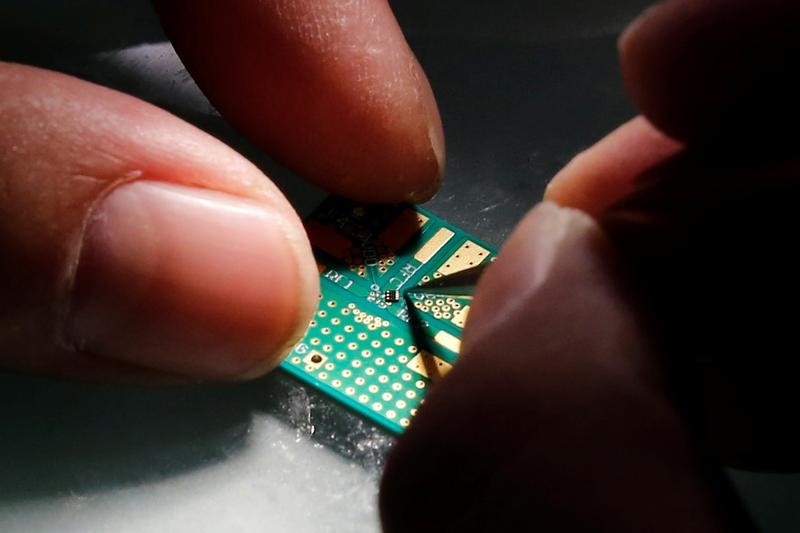

The Dutch company makes machines used by world’s top companies to produce chips that go into mobiles, laptops, TVs and cars. It also provides software and services that help those companies mass produce patterns on silicon.

First quarter sales were 4.4 billion euros ($5.28 billion), higher than the top end of the 3.9 billion euro-4.1 billion euro range it had given in its forecast on January 20. The numbers beat its own forecasts and ASML said it is seeing strong demand across its product portfolio.

Gross margin at 53.9% was also higher than the forecast of 50%-51%.

With its clients focused on products centered around higher-margin 5G services, AI and high-performance computing solutions, the company sees its “revenue growth towards 30% in 2021 compared to last year.”

Net booking for orders were 4.7 billion euros during January-March, up 12% from 4.2 billion euros in the immediate previous quarter.