By Geoffrey Smith

Investing.com -- Semiconductors are seen as 'the new oil' - the essential commodity (or semi-commodity) embedded in virtually every manufactured product. So when the factories run out of them, that's a problem - a big one.

The global shortage of semiconductors is likely to get worse before it gets better: the world’s biggest contract manufacturer of silicon chips said last week that the shortage will last all through 2021 and into 2022, forcing manufacturers and customers across the world to agonize for months over whether to grit teeth and pay higher prices, or to accept longer delivery times.

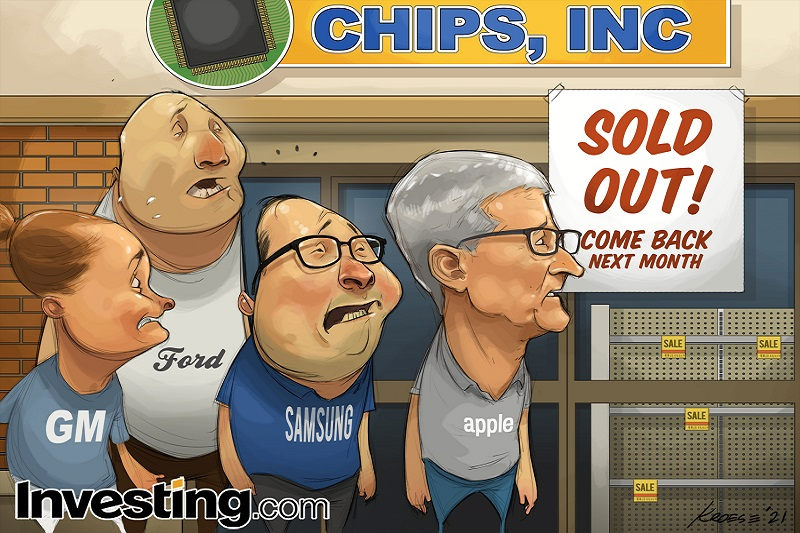

The problem is sparing no-one. Even Apple (NASDAQ:AAPL), with its enormous procurement power, is reportedly dialing down production of MacBooks and iPads, although for now, at least, its flagship phones aren't being affected. Rival Samsung (KS:005930) – a chipmaking powerhouse in its own right - has, by contrast, already warned that its new Galaxy Note smartphone may be delayed until 2022.

In the car sector, General Motors (NYSE:GM) and Ford have idled vast swathes of factories in the U.S., while Volkswagen (DE:VOWG_p) CEO Herbert Diess said last month that VW had already lost over 100,000 units of output to the shortage.

The cause of all this mayhem is no mystery: the Covid-19 pandemic triggered a vast shift in consumer spending patterns that led to a surge in demand for certain types of goods – notably consumer electronics – from an industry that cannot respond quickly to such surges (new factories are incredibly expensive and take ages to build). That has left buyers of low-spec chips in particular, such as the automotive industry, scrambling for supplies, and toward the back of a line of customers who typically pay better.

To make it worse, a series of freak events – a freeze in Texas, a fire at a Renesas factory in Japan, a drought in Taiwan that complicated a water-intensive manufacturing process – has disrupted the supply of chips even more.

Surely things can only get better? Well, yes and no. The weather and the accidents are obviously just short-term noise. Even the broader pandemic-driven factors are likely to be transitory, for the most part. At some stage, a vaccinated world will regain the freedom to go out and party, which will leave less money left over for PC, TV and phone upgrades.

However, such disruptions are upending a sector that is already facing long-term turmoil, due to the rivalry between the U.S. and China. The importance of semiconductors for cutting-edge applications in communications and defense has led to the U.S. slowly tightening restrictions on sales of chips to Chinese companies (notably Huawei), and strangling global trade in chips in the process.

Analysts at London-based research house TS Lombard predict that the rivalry will ultimately lead to a clear split in the world market for semiconductors, as China is forced to develop its own industry to match that of the U.S. and its allies. This will force the industry to uproot manufacturing capacity wholesale: some 83% of global foundry capacity is in Taiwan and South Korea, under the missiles of the People’s Liberation Army and its allies in North Korea.

The industry is already responding: Intel (NASDAQ:INTC), under the new management of Pat Gelsinger, has decided to build new two chip foundries in Arizona. Taiwan Semiconductor Manufacturing last week announced a $100 billion commitment to expand capacity over the next three years. Some of that, too, will go to building factories in Arizona.

Arguably, secular trends demand an increase in capacity in any case, and this is just one more long-term trend that the pandemic has accelerated.

“As the world becomes more interconnected, more automated and greener, each unit of GDP growth will contain a higher content of semiconductors,” TS Lombard’s Rory Green points out.

Yet building new capacity is extremely expensive – and the likely growth of a native Chinese industry makes for an uncertain long-term supply-demand balance. Ask any steelmaker or oil refiner what happens when China – at its government’s insistence – builds more capacity than its own economy can actually absorb. The chip that can kill the business cycle, or China's tendency to over-produce, is yet to be designed.

The worst may soon be over for buyers of chips, but volatility in the global market for "the new oil" is here to stay.