By Chavi Mehta and Jane Lanhee Lee

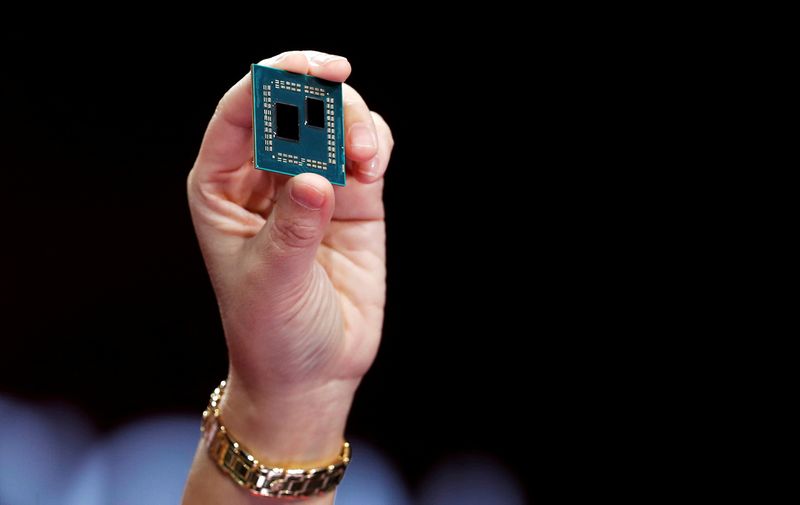

(Reuters) -U.S. chip maker Advanced Micro Devices (NASDAQ:AMD) Inc on Tuesday posted revenue that beat Wall Street targets and said it expected business to improve in the second half, enthusing investors who saw the company gaining on rival Intel.

Shares rose about 1.5% in after hours trading. Although AMD's forecast was behind expectations, it was not as weak as some worried. Recent earnings reports for both Intel and AMD show the once fast growing data center business will be more challenging for all chip makers as companies adjust their spending.

"AMD remained resilient and even made gains in their datacenter chips...against Intel," said Wayne Lam analyst at CCS Insight.

Chief Executive Lisa Su said she was confident AMD will keep gaining market share this year and that the second half would be stronger than the first.

While Intel Corp (NASDAQ:INTC). still dominates the PC and server processing chip markets with a share exceeding 70%, that is down from more than 90% in 2017, according to tech research firm IDC. A big chunk of that share was taken by AMD.

AMD's Data Center segment revenue grew 42% to $1.7 billion during the fourth quarter, offsetting a 51% drop in revenue of the client segment that includes PCs at $903 million.

PC shipments fell 16.5% to 292.3 million units in 2022, according to data from research firm IDC.

Su said that AMD was expecting the PC market this year to be down 10% and it would "continue to ship below consumption in the first quarter to reduce downstream inventory".

"First quarter should be the bottom for us in PCs and then grow from there into the second quarter and then into the second half," Su said on the earnings call.

The slumping PC business pummeled Intel's first-quarter outlook and Intel Chief Executive Pat Gelsinger said he was seeing "some of the largest inventory corrections literally that we've ever seen in the industry."

"I think we will still see pain across the industry for at least another few quarters before things turn around," said Anshel Sag, analyst at Moor Insights & Strategy.

"We believe AMD’s results continue to show softness across the PC and gaming markets," said Angelo Zino, analyst at CFRA Research. "We also expect revenue levels in both segments to trough in the first half of this year."

AMD had already started under-shipping last year in response to plummeting processor demand.

This decline led chipmakers to slash revenue forecasts, triggering a sell-off in chip stocks. AMD's stock fell 55% last year, underperforming the Philadelphia SE Semiconductor index during an industry downturn

Adjusted fourth-quarter revenue rose 16% to $5.60 billion. Analysts on average were expecting revenue of $5.50 billion, according to Refinitiv data.

The company forecast current-quarter revenue of $5.3 billion, plus or minus $300 million. Analysts on average expected revenue of $5.48 billion, according to Refinitiv data.