By Peter Szekely and Sharon Bernstein

(Reuters) - Voters in four states joined several others in legalizing marijuana for recreational use on Election Day, while Oregon approved the country's first therapeutic use for psilocybin, the hallucinogenic drug known as magic mushrooms.

The ballot measures, some of which were undetermined until Wednesday, were among at least 124 wide-ranging statutory and constitutional questions put to voters this year in 32 U.S. states and the District of Columbia, according to the National Conference of State Legislatures (NCSL).

The pandemic dampened grass roots enthusiasm for circulating petitions to get measures on the ballot, as citizen-led initiatives this year dropped to 38 from 60 in 2018 and 72 in 2016, the NCSL said.

But the 2020 crop of ballot measures still covered a wide array of issues, from election laws, to abortion rights, to worker rights and taxes. Here are some of key results confirmed by the NCSL:

MARIJUANA

Voters in New Jersey, Arizona, South Dakota and Montana approved measures to legalize marijuana for recreational use, while South Dakota also okayed the drug's use for medical purposes, as did Mississippi.

Since 1996, 33 other states and the District of Columbia have allowed medical marijuana, 11 had previously approved its recreational use and 16, including some medical marijuana states, have decriminalized simple possession, according to the National Organization for the Reform of Marijuana Laws.

PSILOCYBIN, AKA MAGIC MUSHROOMSPsilocybin, a hallucinogen also known in its raw form as magic mushrooms, was approved by Oregon voters for therapeutic use for adults. Backers of the Psilocybin Services Act cited research showing benefits of the drug as a treatment for anxiety disorders and other mental health conditions. The approved measure sets a two-year schedule to review the matter and create a regulatory structure for its sale.

In a related measure, Washington, D.C., voters approved Initiative 81, which directs police to rank "entheogenic plants and fungi," including psilocybin and mescaline, among its lowest enforcement priorities.

MINIMUM WAGE

Voters in Florida approved a measure to amend the state constitution to gradually increase its $8.56 per hour minimum wage to $15 by Sept. 30, 2026.

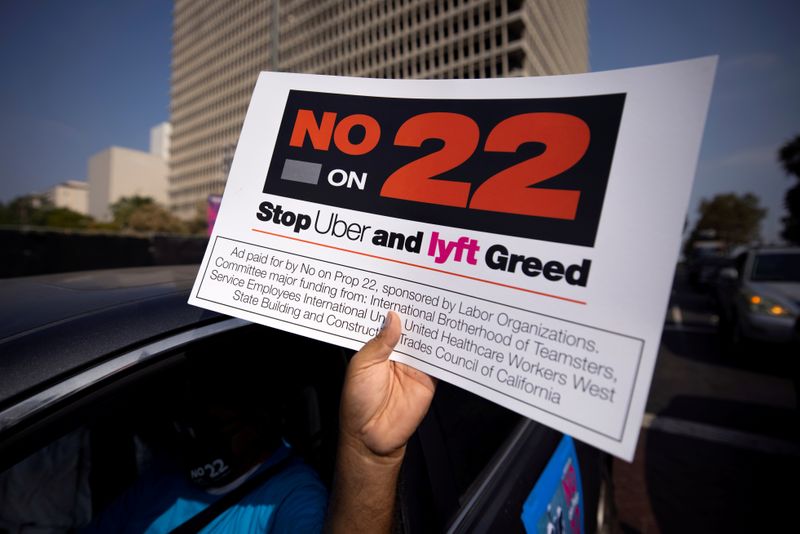

CALIFORNIA GIG WORKERS

California voters approved a measure that would exempt ride-share and delivery drivers from a state law that makes them employees, not contractors. The measure, Proposition 22, is the first gig-economy question to go before statewide voters in a campaign. Backers, including Uber Technologies Inc (N:UBER) and Lyft Inc (O:LYFT), spent more than $190 million on their campaign, making it the costliest ballot measure ever, according to the NCSL.

ABORTION

Colorado voters rejected a measure to ban abortions, except those needed to save the life of the mother, after 22 weeks of pregnancy.

In Louisiana, voters approved an amendment that makes clear that the state constitution does not protect abortion rights or funding for abortions. The amendment clears the way for the state to outlaw abortion if the U.S. Supreme Court overturns the landmark Roe v. Wade decision that protects abortion rights under the U.S. Constitution.

ELECTIONS

Ranked-choice voting, which lets voters select state and federal candidates in order of preference, was rejected by Massachusetts voters. Only Maine lets its voters use the method statewide. A citizen-initiated measure on the issue was also on the ballot in Alaska, but results there were incomplete.

California approved a measure to restore the right to vote to parolees convicted of felonies.

TAXES

In California, a proposal to roll back a portion of the state's landmark Proposition 13 law limiting property taxes was too close to call on Wednesday. The measure, Proposition 15 on the state's 2020 ballot, would leave in place protections for residential properties, but raise taxes on commercial properties worth more than $3 million.