(Bloomberg) -- Stock futures dipped and the yen advanced in the wake of escalating Middle East tensions as Asian financial markets return to full strength following New Year holidays.

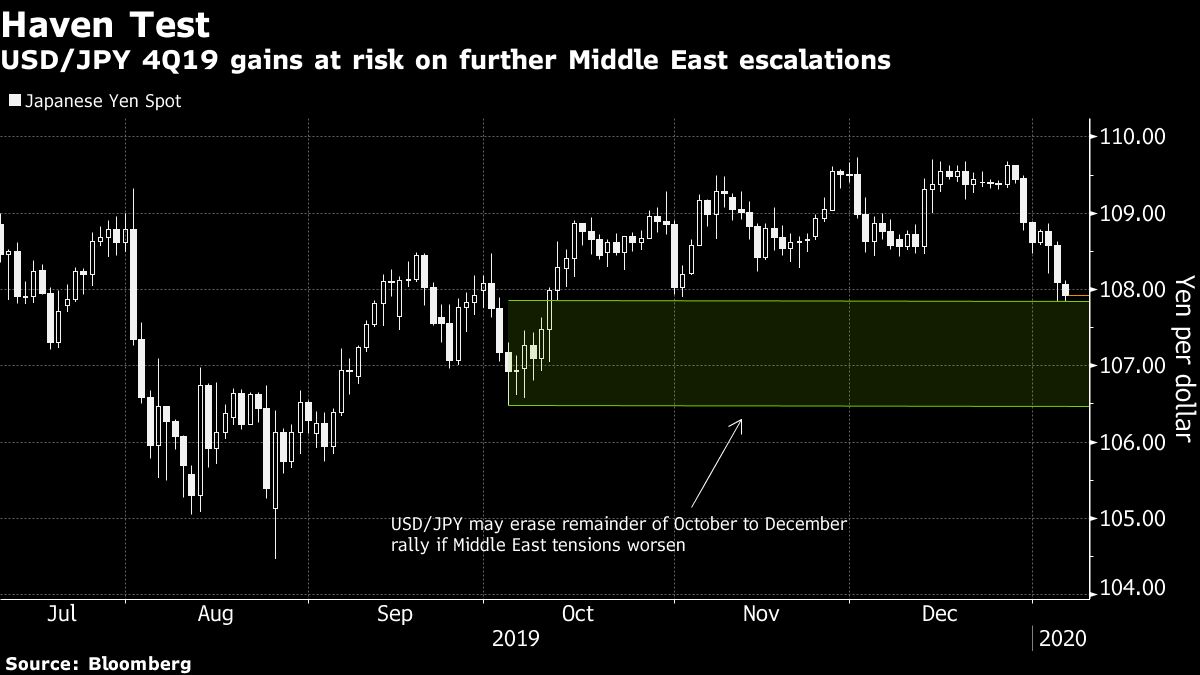

Japan’s currency matched a three-month high in the wake of fallout from the U.S. killing of a top Iranian military commander in Iraq. Japanese equity futures also slid, while Australian contracts were little changed. The S&P 500 Index posted its biggest loss in a month Friday in the wake of the killing, which threatened to spur escalating violence across the Middle East.

The tensions cast a cloud over largely positive forecasts for risk assets at the start of 2020, with a U.S.-China phase-one trade deal expected to be signed later this month. Moves by China to bolster economic growth, and signs of stabilization in Chinese manufacturing, have also offered hope for a rebound in commerce.

All of the Middle East’s major equity gauges fell on Sunday as the security situation appeared to deteriorate. Iran said it would no longer abide by any limits on its enrichment of uranium, while President Donald Trump said the U.S. had identified 52 Iranian sites it would hit if Tehran retaliates over its slain general, Qassem Soleimani.

Treasuries climbed in a flight to safety and oil surged on Friday in wake of the killing.

Here are some events to watch for this week:

- India reports its annual GDP estimate Tuesday.

- Federal Reserve officials Richard Clarida, John Williams (NYSE:WMB), James Bullard and Charles Evans speak on Thursday.

- The U.S. monthly employment report is due Friday.

Stocks

- Nikkei 225 futures fell 0.2% in Singapore.

- Australia’s S&P/ASX 200 Index slipped 0.1%.

- Hong Kong’s Hang Seng Index fell 0.1% earlier.

- The S&P 500 Index fell 0.7% Friday.

- The yen rose 0.2% to 107.84 per dollar.

- The offshore yuan was at 6.9689 per dollar.

- The euro was at $1.1162.

- The yield on 10-year Treasuries fell nine basis points to 1.79% on Friday.

- Australian 10-year yields fell about five basis points, to 1.20%.

- West Texas Intermediate crude increased 3.1% to $63.05 a barrel Friday.

- Gold rose 1.5% to $1,552.20 an ounce, hitting the highest since September Friday.