(Bloomberg) -- Want the lowdown on European markets? In your inbox before the open, every day. Sign up here.

U.S. stocks held onto slight gains, while Treasuries edged higher as comments by Federal Reserve Chairman Jerome Powell did little to alter the view the central bank will cut rates in two weeks. The dollar fell.

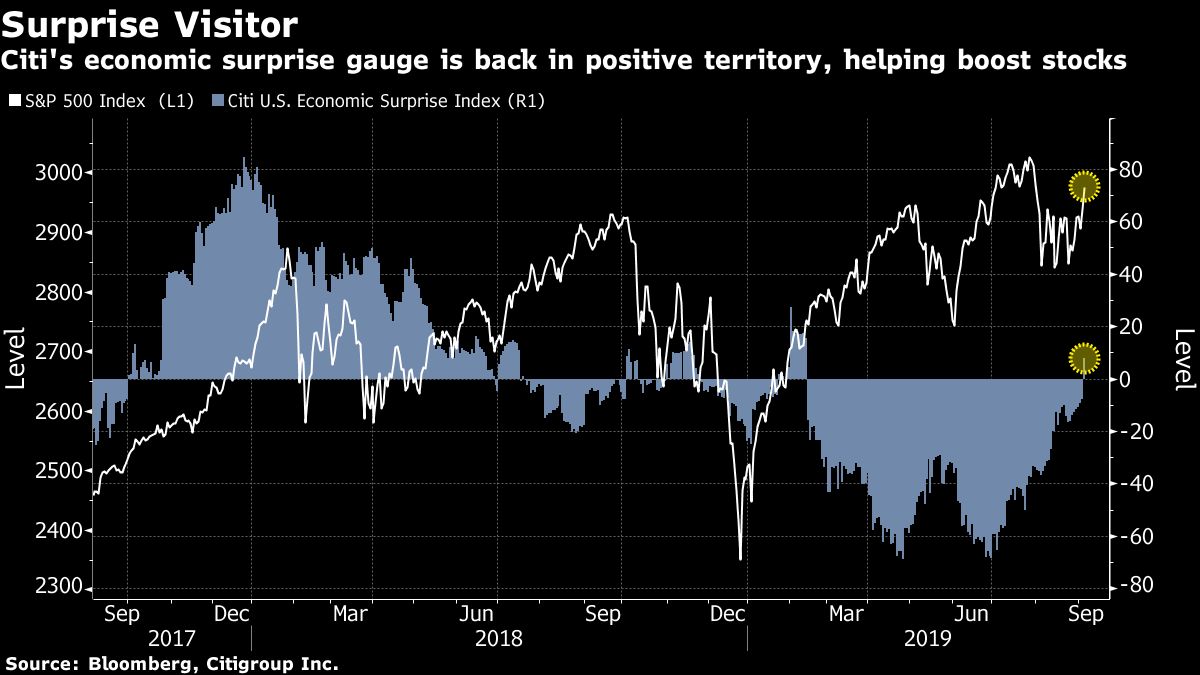

The S&P 500 headed for its second weekly gain after the Fed chief reiterated his stance that a recession is unlikley. Megacap technology stocks weighed on benchmarks after New York opened an antitrust probe into Facebook Inc (NASDAQ:FB). The 10-year Treasury yield remained lower, while the dollar headed for its fourth straight fall after an earlier jobs report signaled a solid labor market that isn’t too strong to deter further easing. Crude erased losses.

“Jobs have been a bit of a roller coaster these past few months. Today’s miss along with downward revisions for the prior two months solidifies that jobs gains are moderating,” said Mike Loewengart, vice president of investment strategy at E*TRADE Financial. “And it’s below expectations and depressed enough to fuel the Fed’s drive to cut rates this month, so in some ways there is something to like for everyone.”

Elsewhere, China cut the amount of cash banks must hold as reserves, injecting liquidity into an economy facing headwinds to growth. The MSCI Asia Pacific Index headed for its biggest weekly advance since June. The pound trimmed some of its recent gains as political turmoil in Britain dragged on.

The Bloomberg Softs Spot Subindex tracking coffee, sugar, and cotton headed for the 10th straight week of declines, the longest stretch since 1991 when the index started.

These are the main moves in markets:

Stocks

- The S&P 500 Index rose 0.2% as of 1 p.m. New York time.

- The Stoxx Europe 600 Index climbed 0.1%.

- The U.K.’s FTSE 100 Index fell 0.1%.

- The MSCI Asia Pacific Index gained 0.6%.

- The Bloomberg Dollar Spot Index fell 0.3%.

- The euro rose 0.1% at $1.1049.

- The British pound sank 0.2% to $1.2315.

- The Japanese yen advanced 0.1% to 106.80 per dollar.

- The yield on 10-year Treasuries fell less than a basis point to 1.55%.

- The yield on two-year Treasuries was steady at 1.52%.

- Germany’s 10-year yield fell three basis points to -0.62%.

- Britain’s 10-year yield declined nine basis points to 0.511%.

- Gold rose 0.2% to $1,528.80 an ounce.

- WTI oil dropped 0.8% to $55.83 a barrel.

- Brent crude decreased 0.4% to $60.68 a barrel.