By Geoffrey Smith

Investing.com -- Joe Biden edges into the lead in Georgia, as vote-counting reaches its final stages there and in other crucial close races. Gold is up again while the dollar skids, but stocks are taking a breather. Nonfarm payrolls are expected to grow much more slowly in October, while U.S. Covid-19 cases hit a new record high and deaths hit their highest in four months. Here's what you need to know in financial markets on Friday, November 6th.

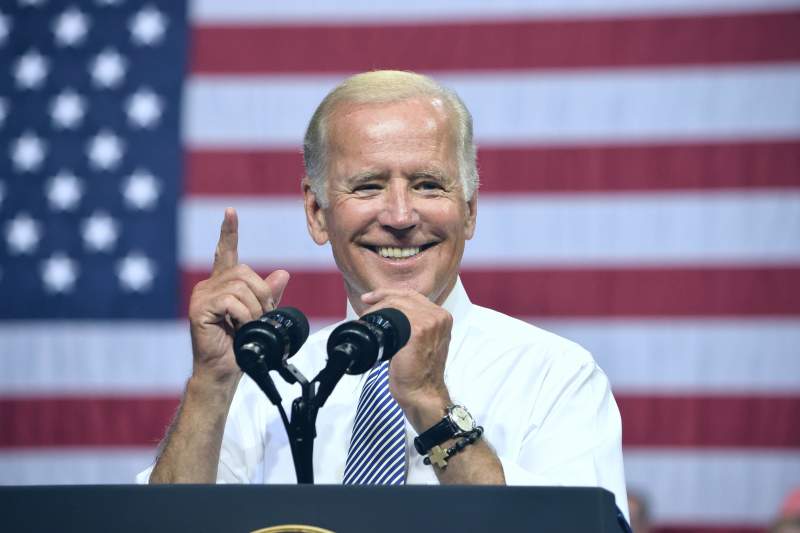

1. Biden takes lead in Georgia as Trump rages

Joe Biden moved closer to clinching the presidential election, moving into a narrow lead in the state of Georgia as the vote-counting process reached its final stages.

Ballots from Clayton County, which covers the southern fringes of Atlanta and some of its suburbs, pushed the Democratic Party nominee ahead in the early hours of Friday morning.

Vote-counting continues in Georgia, as well as in North Carolina, Arizona and Nevada. President Donald Trump has already formally requested a recount in Wisconsin, which has been called for Biden.

In his first public appearance since election night, Trump repeated accusations of electoral fraud, again without presenting evidence. Two legal actions by Trump’s team have already been thrown out by state courts.

2. Payrolls likely to show hiring slowdown

The U.S. will publish its official labor market report for October at 8:30 AM ET (1330 GMT), under the shadow of an ADP report earlier in the week that showed a sharp slowdown in private hiring. Before the ADP report of 365,000 jobs created, analysts had predicted a gain of 600,000 in nonfarm payrolls, down from 661,000 in September.

Analysts attributed much of that slowdown to the hospitality and other service sectors affected by the rising wave of Covid-19 cases nationwide. The number of new infections soared to a new record high of over 121,000 on Thursday, while the death toll fell to 1,108 from a four-month high of over 1,600 on Wednesday.

In his press conference on Thursday, Federal Reserve Chairman Jerome Powell had said the coronavirus still posed a serious threat to the economy, reiterating the Fed’s commitment to providing more monetary support if necessary.

3. Stocks retrace after rally

U.S. stock markets are set to open lower on Friday, taking a break after a breathless rally since the election’s preliminary results appeared to rule out a ‘Blue Wave’ that could have heralded steep rises both in corporate income tax and capital gains tax.

By 6:30 AM ET (1130 GMT), Dow 30 futures were down 139 points, or 0.5%, while S&P 500 futures were down 0.7% and Nasdaq futures, which had outperformed over the last two sessions, were giving back a little more, down 1.0%.

Automotive stocks may garner interest after Wards Autos figures showed new vehicle sales fell in October for the first time since April, due largely to light truck sales.

Earnings season continues apace, with early updates from CVS, Virtu, Hershey, Marriott and Coty (NYSE:COTY), among others.

4. Gold at 7-week high as dollar skids

Gold prices hit their highest in seven weeks as expectations of more loose fiscal and monetary policy in the U.S. hit the dollar.

By 6:30 AM ET, gold futures were up 0.5% at $1,957.20 a troy ounce, while the dollar index hit a two-month low of 92.263. The dollar has lost over 2% against its biggest trading partners this week, while losses against emerging-market currencies have been even larger.

In part, that’s because the FX market expects U.S. foreign policy to be less confrontational to countries such as China and Mexico. The yuan has been strengthening consistently since China contained the coronavirus in the spring; the peso’s gains have been more recent and moderate, but it’s still up over 3% over the last month.

5. Oil hit by OPEC market share fight

Oil prices came off sharply as the post-election risk rally ran out of steam and the market continued to absorb signs of OPEC members fighting for market share.

By 6:30 AM ET, U.S. crude futures were down 3.7% at $37.36 a barrel, while Brent futures were down 3.2% at $39.60 a barrel.

On Thursday, Saudi Arabia had announced bigger discounts to local benchmark prices in its official selling prices for December, while Iraq, OPEC’s second-biggest producer, said it had produced above its agreed quota in October, taking a free ride on the discipline of other members.

Baker Hughes’ rig count data for last week will round off the week later.