A look at the day ahead in markets from Anshuman Daga

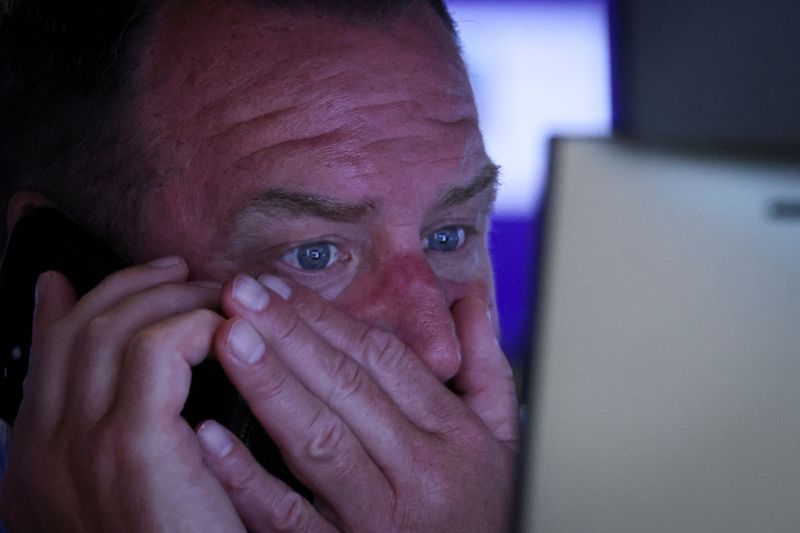

After a strong set of mostly upbeat earnings reports from both sides of the Atlantic last week, stock bulls will now want macro data to disappoint.

While the Fed has hiked interest rates by 225 basis points points already this year as it fights the worst inflation in four decades, disappointing economic news could force it to slow down, providing relief to jittery markets.

The Fed, the White House and economists all say that the economy is not in recession based on broader measures of activity, but Treasury yields are pricing in bad news.

U.S. 10-year Treasury yields fell 33 basis points in July, marking the largest monthly decline since March 2020.

As August kicks off with manufacturing surveys from around the world, there's hope for the bond and stock bulls.

Asian equities started Monday on a weak note, with China's factory activity contracting unexpectedly in July as virus flare-ups cloud the outlook for demand.

Japan's manufacturing activity also expanded at the weakest rate in 10 months in July.

The tepid growth outlook hit oil prices after they ended last month with their second straight monthly losses for the first time since 2020.

U.S. stock futures traded lower in Asia after both the S&P 500 and Nasdaq posted their biggest monthly percentage gains since 2020.

On the corporate front, banking titan HSBC sought to woo investors with a higher profitability target and bullish dividends outlook, while pushing back on a proposal by its top shareholder to split Europe's biggest bank.

Meanwhile, U.S. House speaker Nancy Pelosi began her tour of four Asian countries but did not mention Taiwan amid intense speculation she might visit the self-ruled island claimed by China.

Key developments that should provide more direction to markets on Monday:

Economic data - July global PMI final – across the world, Germany June retail sales, US July ISM (manufacturing)

Major earnings: HSBC, AXA and Heineken (OTC:HEINY)

China's factory activity contracts unexpectedly in July as COVID flares up -

Evergrande offers sweetener for debt revamp as China property crisis worsens -