By Jamie McGeever

(Reuters) - A look at the day ahead in Asian markets.

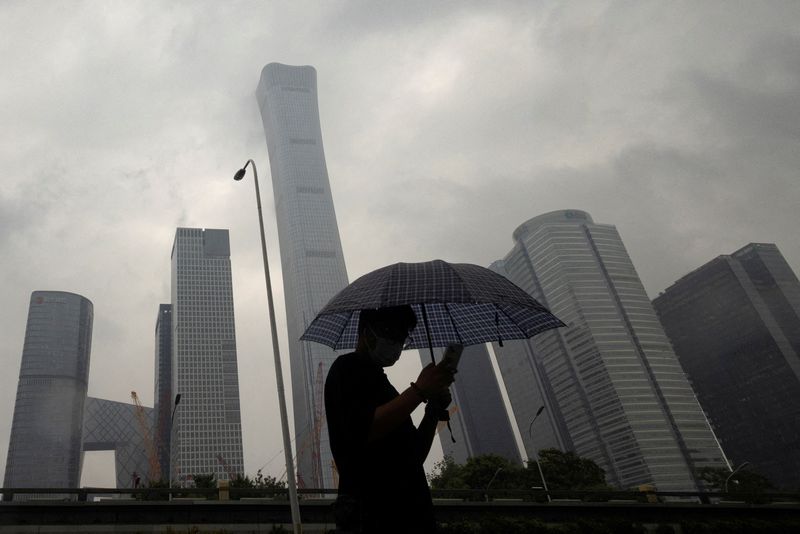

China's credit downgrade warning from ratings agency Moody's (NYSE:MCO) on Tuesday may have come as a surprise to some and a shock to few, but has fired up the debate for everyone around the darkening growth and market outlook for Asia's economic powerhouse.

The market fallout was immediate - blue chip stocks in Shanghai and Hong Kong's benchmark Hang Seng index slumped nearly 2%, and while the onshore yuan held up reasonably well the offshore yuan fell sharply too.

The CSI300 equity index slumped to its lowest since February 2019, and Chinese markets will likely be fragile again on Wednesday.

The main event on the Asian and Pacific calendar is the release of Australian third quarter GDP figures, a day after the Reserve Bank of Australia left interest rates on hold at a 12-year high of 4.35% until at least February.

The Aussie dollar was one of the biggest losers on global currency markets on Tuesday, falling 1% for its biggest daily loss since Oct. 12, as traders viewed the RBA's statement as less hawkish than expected and less hawkish than the previous one.

The Reuters poll consensus forecast is annual GDP growth slowed in the July-September period to 1.8% from 2.1%. This would be the slowest rate of growth since the first quarter of 2021, and fit with a dovish view on the RBA and Aussie dollar.

Investors will also be looking out for the latest inflation data from Taiwan and Japan's latest 'tankan' surveys of manufacturing and non-manufacturing activity in the country.

The annual rate of inflation in Taiwan is expected to have slowed in November to 2.8% from a 15-month high of 3.05% in October. Figures on Monday showed that inflation in South Korea and Japan's capital Tokyo last month was cooler than expected.

Asian markets open on Wednesday against a backdrop of rapidly declining global bonds yields, the latest trigger being an exclusive Reuters interview with influential European Central Bank policymaker Isabel Schnabel.

Falling rates and bond yields may not be enough to brighten sentiment in Asia though, after Moody's lowered the 'outlook' on China's A1 debt rating to "negative".

According to Moody's, the amount of money Beijing likely needs to provide to support debt-laden local governments and state firms poses "broad downside risks to China's fiscal, economic and institutional strength."

Rival ratings agency S&P Global warned that growth could slow to below 3% next year if the country's property crisis deepens further.

Growth that low in China is in many ways difficult to fathom. But if it is indeed on the looming horizon, it helps explain why foreign investors in China are pulling money out, and why those not already in China are reluctant to put their cash in.

Here are key developments that could provide more direction to markets on Wednesday:

- Australia GDP (Q3)

- Japan tankan surveys (December)

- Taiwan inflation (November)

(By Jamie McGeever; Editing by Josie Kao)