By Jamie McGeever

(Reuters) - A look at the day ahead in Asian markets from Jamie McGeever.

Investors waking up in Asia on Friday hoping for a quiet day to ease into the weekend will be as well going back to bed, following the volatility that slammed Wall Street on Thursday and crushed the banking sector in particular.

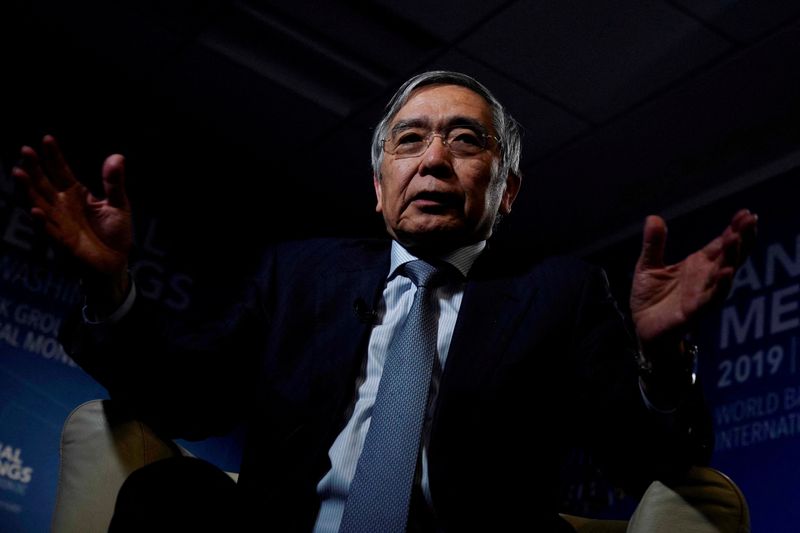

Not only will they pick up the pieces of Thursday's global equity selloff, they have the Bank of Japan's (BOJ) last policy decision under the stewardship of Governor Haruhiko Kuroda on tap and will be bracing for the latest U.S. employment report.

Risk appetite in equities, especially financials, will be minimal. The S&P 500 bank index plunged 6.5% on Thursday in its biggest one-day drop in nearly three years, following SVB Financial Group's share sale announcement and crypto bank Silvergate's decision to wind down operations.

For those who were around at the time, Thursday's sea of red across financials and near double-digit declines in bank stocks brought back hazy memories of 2007-09.

This is the market backdrop against which the BOJ delivers its last policy decision under Kuroda. It is widely expected to start reversing its super-loose policy later this year, once Kuroda has long left the building.

Kazuo Ueda, ratified by the lower house on Thursday and set to receive Senate approval on Friday, will take over from Kuroda on April 8.

It will be under his watch that Japan will attempt to steer a smooth exit from ultra-loose monetary policy which has seen interest rates anchored around zero for decades and the BOJ's balance sheet swell to a record 130% of GDP.

The BOJ already tweaked Kuroda's 'yield curve control' policy in December, doubling the effective cap on the 10-year government bond yield to 0.50%. Markets have bet heavily that the BOJ will be forced to restore 'normal' bond market functioning by raising it again soon or even abandoning it.

Although global and domestic pressures are pushing yields higher, the economic picture is less clear-cut. Inflation at 4.2% - the highest in 40 years - has driven the fastest fall in real wages since 2014, and revised figures on Thursday showed that Japan's economy barely grew in the fourth quarter.

Here are three key developments that could provide more direction to markets on Friday:

- Japan monetary policy decision

- U.S. non-farm payrolls & unemployment (February)

- India industrial production (January)

(By Jamie McGeever; Editing by Josie Kao)