By Elizabeth Howcroft, Noel Randewich and Stanley White

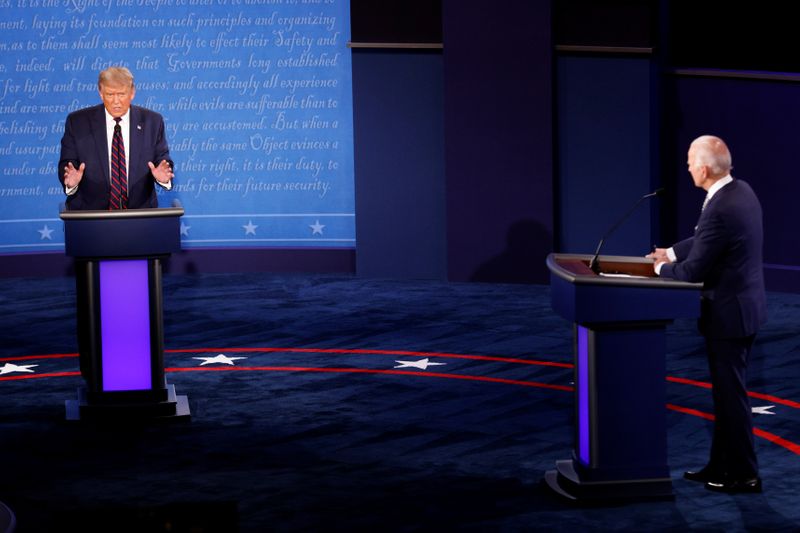

LONDON/SAN FRANCISCO/TOKYO (Reuters) - U.S. equity futures fell and volatility indicators turned jumpy as a chaotic presidential debate between incumbent Donald Trump and Democratic challenger Joe Biden heightened fears that a disputed ballot could lead to a messy transfer of power.

Nagging doubts over whether Republican President Trump would agree to hand over the keys to the White House if he loses have grown in recent weeks. And during the first debate on Tuesday, Trump declined to commit to accepting the results, repeating his unfounded complaint that mail-in ballots would lead to election fraud.

Trump repeatedly interrupted Democratic rival Joe Biden in the Cleveland debate, the first ahead of the Nov. 3 vote, as the rival candidates traded barbs over Trump's taxes, the economy, the coronavirus pandemic and the integrity of the election.

"The debate drew further attention to the potential for a contested election," said Hani Redha, global multi-asset portfolio manager, at Pinebridge. "It is likely market participants will continue to price in this issue, heightening volatility all the way to election day and its immediate aftermath."

U.S. stock futures

Options on the S&P 500 index show investors bracing for volatility in November and December -- likely because the use of mail-in ballots by voters concerned about the coronavirus could mean delays of weeks or even months in announcing the winner.

"You can see the concern especially if you look at the shift in U.S. index futures pre-debate to post debate... certainly the concern was centred on the scope for post-election disputes," said Chris Bailey, European strategist at Raymond James.

Trump declined last week to commit to a peaceful transfer of power if he loses, and said he expected the election battle to end up before the Supreme Court.

"Trump is very clearly laying the groundwork to dispute the election," said John Woolfitt, director of trading at Atlantic Capital Markets, a brokerage.

"Many Americans do not understand their own electoral process, it is not officially called on the night, it is usually unofficially called by the press and it requires the President (or challenger) to concede."

BIDEN AHEAD

Meanwhile, election betting odds on Betfair Exchange, the operator of the world's largest online betting bourse, showed Biden's probability of winning at 60%, up from 56% before the debate. Trump has a 40% probability of victory.

Biden, 77, has held a consistent lead over Trump, 74, in opinion polls, although surveys in the battleground states that will decide the election show a closer contest.

More than a million Americans are already casting early ballots and time is running out to change minds or influence the small sliver of undecided voters.

The first of three scheduled debates came at a fraught moment on Wall Street.

The S&P 500 (SPX) tumbled around 10% from record highs this month before paring some of those losses as investors fretted about the coronavirus impact and election uncertainty. Some investors view Biden as more likely to raise taxes, and see a second term for Trump, who favors tax cuts and deregulation, as better for the stock market. However, a Trump win could spell more tensions between Washington and Beijing.

Before the 2016 election, investors widely predicted that a Trump victory would hurt stocks due to his unpredictability and trade war threats against China and Mexico.

However, the S&P 500 surged 5% in the month following his unexpected election win.

"The markets almost always think they favor a Republican but did just fine under Clinton and Obama. There is comfort in that hindsight perspective regardless of what happens," said Jake Dollarhide, chief executive officer of Longbow Asset Management in Tulsa, Oklahoma.

(This story was refiled to correct typo in 'fuels' in headline)