By Noel Randewich

(Reuters) - A look at the day ahead in Asian markets by Noel Randewich.

Asia investors will digest the near certainty of a September loosening of U.S. monetary policy on Monday after a speech by U.S. Federal Reserve Chair Jerome Powell on Friday confirmed that the United States is ready to begin cutting interest rates.

At his keynote speech to the Kansas City Fed's annual economic conference in Jackson Hole, Wyoming, Powell said "the time has come for policy to adjust," given that upside risks to inflation have diminished and downside risks to employment have increased.

Powell's comments lifted the yen and weakened the dollar index, with lower interest rates relative to Japanese rates making Japan's currency more attractive.

Dollar/yen hit its lowest since August 6 in late Friday trading.

Geopolitical risk ratcheted higher over the weekend as Hezbollah launched hundreds of rockets and drones at Israel early on Sunday while Israel's military said it struck Lebanon with around 100 jets to thwart a larger attack. It was one of the biggest clashes in more than 10 months of border warfare and raised the specter of Israel's war in Gaza turning into a wider conflict.

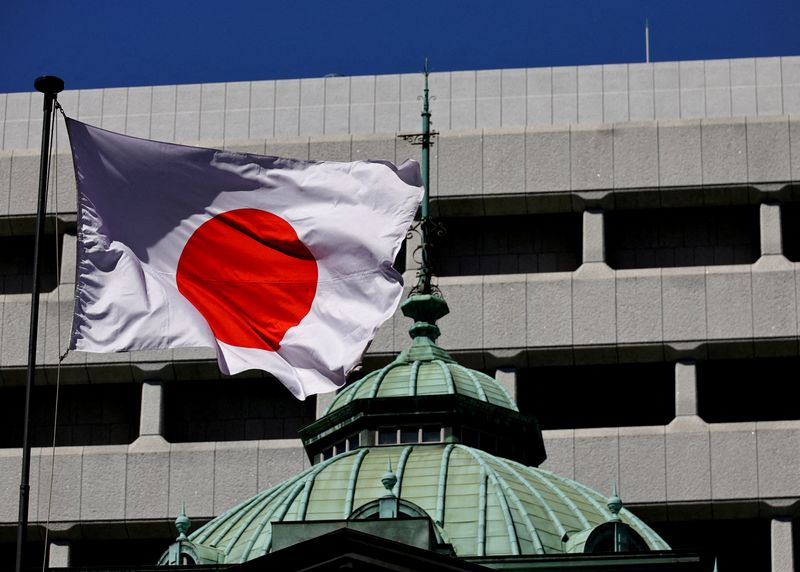

Investors will also mull the outlook for Japanese interest rates after Bank of Japan Governor Kazuo Ueda on Friday reaffirmed his resolve to raise interest rates if inflation stays on course to sustainably hit the 2% target.

Ueda's comments came as data showed Japan's core inflation accelerated for a third straight month in July, with a slowdown in demand-driven price growth potentially complicating the central bank's decision on further rate hikes.

The Nikkei share average ended up 0.4% on Friday following Ueda's parliamentary testimony.

Having spent all year trying to put a floor under the tumbling yuan, China's central bank is suddenly faced with the opposite problem and is turning to subtle ways to stop the currency from appreciating sharply.

The usually restrained yuan has strengthened 1.3% against the dollar in August, lifted by expectations of Fed rate cuts strengthening Japan's yen.

On China's commercial banking front, Bank of China Vice Chairman and President Liu Jin resigned on Sunday. The state-owned lender said its board had approved Chairman Ge Haijiao to serve as acting president.

The U.S. political landscape offered few new signs of certainty for global investors after Vice President Kamala Harris sealed the Democratic presidential nomination with a muscular speech on Thursday, laying down broad foreign policy principles and sharp contrasts with Republican rival and former President Donald Trump.

With 11 weeks left in the contest for the White House, contracts for a Harris victory are trading at 55 cents, with a potential $1 payout, on the PredictIt politics betting platform.

Contracts for a win by Trump, who has suggested he would impose tariffs of 60% or higher on all Chinese goods, are at 49 cents.

Tariffs were in the spotlight last week after China's Commerce Ministry met with automakers and industry associations to discuss raising import tariffs on large-engined gasoline vehicles, sounding a warning as the European Union nears a tariff decision on Chinese electric cars.

On Friday, the United States added 105 Russian and Chinese firms to a trade restriction list over their alleged support of the Russian military.

Here are key developments that could provide more direction to Asian markets on Monday:

- Singapore Manufacturing (July)

- Japan Leading Indicator (Revised) (June)