A look at the day ahead in European and global markets from Wayne Cole.

Asia has seen an extension of the Powell rally so far on Monday with yields and the dollar down, and most stocks edging higher. The major exception being the Nikkei, which really doesn't appreciate the yen's climb through 144.00 per dollar.

Oil prices climbed 0.7% after Israel and Hezbollah traded rocket salvos and air strikes on Sunday, stirring worries about possible supply disruptions if the conflict escalated.

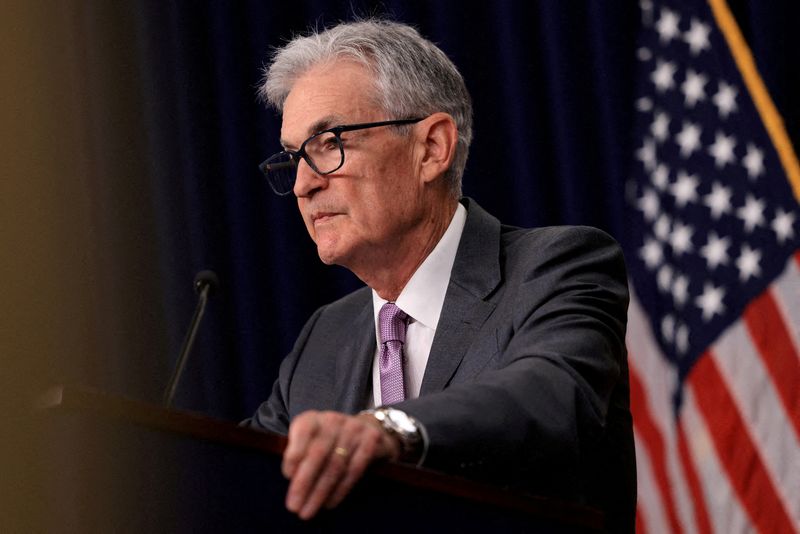

Powell put the cat among the doves with his sudden emphasis on the health of the labour market over and above inflation, basically saying the Fed won't tolerate a weaker employment outlook. That lowered the bar for an outsized cut of 50 basis points in September, with futures now implying a 38% chance of such a move and 103 basis points of easing by Christmas.

Ten-year yields of 3.79% are just 10 basis points under the two-year and it can't be long before the curve turns properly positive. Indeed, it's surprising that hasn't happened already, particularly given the sheer scale of Treasury issuance, and suggests something extra is keeping longer-term yields down.

Time is also running out for the inverted curve to predict a recession, though the Atlanta Fed GDPNow measure has slowed to an annualised 2.0%, from 2.4% mid-month. Figures on real consumer spending on Friday will help refine that number, and could actually be more important than the core PCE deflator given Powell's focus on growth and employment.

Flash estimates for EU inflation are also due on Friday and analysts assume it will be benign enough for the ECB to cut as expected on Sept. 19.

The other main event of the week will be Nvidia (NASDAQ:NVDA)'s results on Wednesday where it will have to beat consensus by a lot to justify its stratospheric p/e of 37 forward earnings.

Markets are looking for $28.8 billion of sales and Q3 guidance around $32 billion, and it will have to top that by at least a couple of billion. Options imply a move of 9% or more is likely after the results, a serious amount of cash given its market cap is almost $3.2 trillion.

Key developments that could influence markets on Monday:

- Riksbank publishes minutes from monetary policy meeting

- German Business Climate Ifo for Aug

- U.S. durable goods orders, Dallas Fed manufacturing survey

- Federal Reserve Bank of San Francisco President Mary Daly speaks

(By Wayne Cole; Editing by Muralikumar Anantharaman)