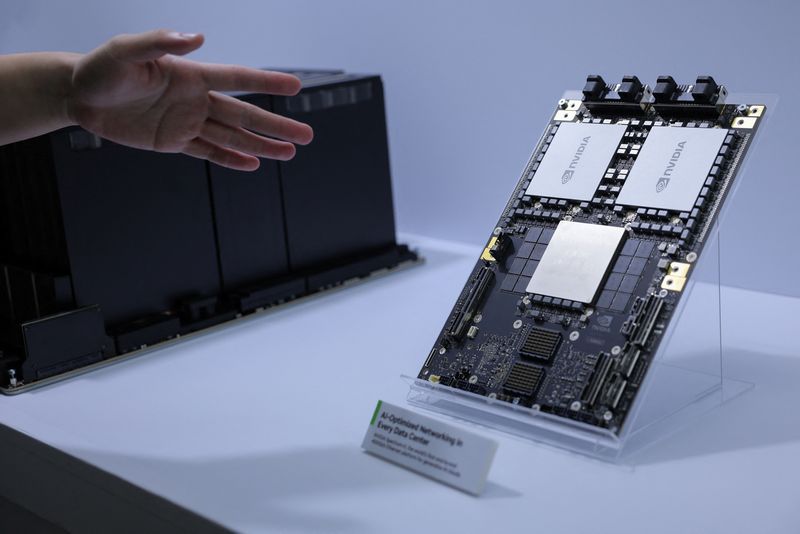

(Reuters) - Nvidia (NASDAQ:NVDA) led a surge in market value among global firms in October, buoyed by unrelenting demand for its new supercomputing artificial intelligence chips as more companies integrate AI into their daily operations.

Nvidia's market cap rose 9.3% in October to $3.26 trillion, while the company's supplier, TSMC, saw its market value increase 6.5% to $832.8 billion. The gains came after the world's largest contract chipmaker posted better-than-expected third-quarter earnings and gave a robust outlook for AI demand.

Apple (NASDAQ:AAPL) briefly ceded its top global market capitalization spot to Nvidia, with a 3% decline to $3.4 trillion last month on a modest growth forecast and sluggish sales in China, before bouncing back.

The market values of Meta Platforms (NASDAQ:META) and Microsoft (NASDAQ:MSFT) fell in October after both companies warned about escalating AI costs.

Mark Haefele, chief investment officer at UBS Global Wealth Management, maintained his positive outlook on AI, advising investors to use near-term volatility as an opportunity to increase exposure to quality AI stocks.

"We continue to favor select semi names and big tech, and we expect our AI portfolio to deliver 35% earnings growth in 2024 and 25% in 2025."

In Asia, the market value of Tencent Holdings (OTC:TCEHY) fell 9% to $483 billion in October, carried by a wider decline in Chinese shares due to sluggish economic data, geopolitical tensions and as investors paused to assess government support measures.

U.S. drugmaker Eli Lilly (NYSE:LLY)'s market value dropped 6.45% to $787.6 billion last month as its quarterly sales of high-profile weight-loss and diabetes drugs failed to meet Wall Street's sales estimates, resulting in a sharp decline in its shares.