By Summer Zhen

HONG KONG (Reuters) - Japanese banks have attracted larger foreign investment flows than other sectors, as investors see them as top beneficiaries of potential monetary tightening.

Analysts said Japan's emergence from decades of deflation and higher rates will mean better earnings for banks, supporting their stock prices.

WHY IT'S IMPORTANT

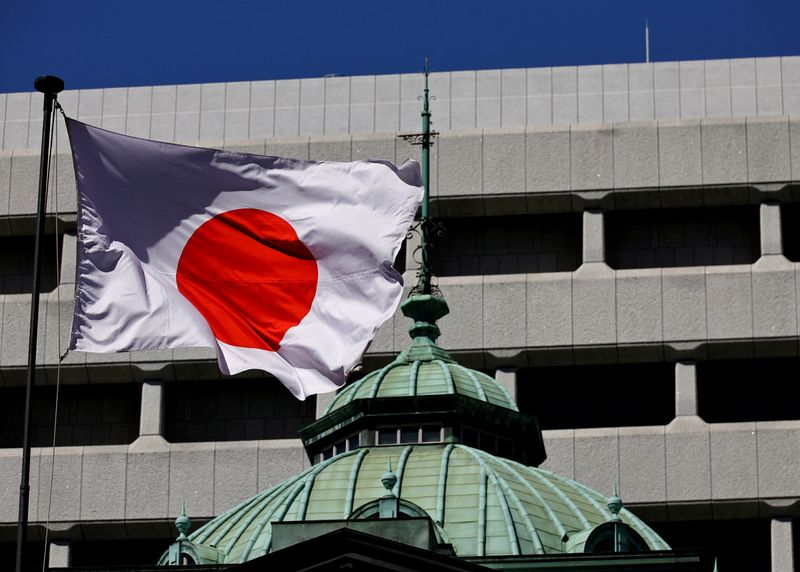

The Bank of Japan ends a two-day policy meeting on Wednesday and could raise interest rates and taper its purchases of bonds, following its ending of negative interest rates in March.

As it prepares to unwind a decade of monetary stimulus, investors who have witnessed the Nikkei stock index rally 20% in the past year are trying to pick winners.

BY THE NUMBERS

Banks and automobiles are two sectors with net foreign investment inflows so far this year.

Banks lured an estimated 472 billion yen ($3.1 billion) of net stock purchases in the year to July 25, more than double the flows into the automobiles and components sector, according to J.P. Morgan quantitative strategy team.

CONTEXT

Japan's three biggest banks forecast record profits in the coming year, thanks to better interest margins and growing funding demand, after being squeezed by negative rates for years.

Shares of Sumitomo Mitsui (NYSE:SMFG) Financial Group, Mitsubishi UFJ (NYSE:MUFG) Financial Group and Mizuho Financial Group have surged 53%, 39% and 36% year-to-date, respectively.

Overseas investors have also been buying more domestic-oriented sectors such as services and pharmaceuticals, on expectations of further gains in the yen.

KEY QUOTES

Yue Bamba, Blackrock (NYSE:BLK)'s head of active investments for Japan: "We are going from very difficult times to much more conducive environment for all the banks. We think their outperformance can continue... even incremental increases in interest rates result in direct benefits from an ROE perspective."

Zuhair Khan, senior portfolio manager at UBP: "Mega-banks will be beneficiaries of rising rates as they have more lending opportunities than regional banks, however I believe this benefit is already more than priced into the stocks."

($1 = 153.7200 yen)