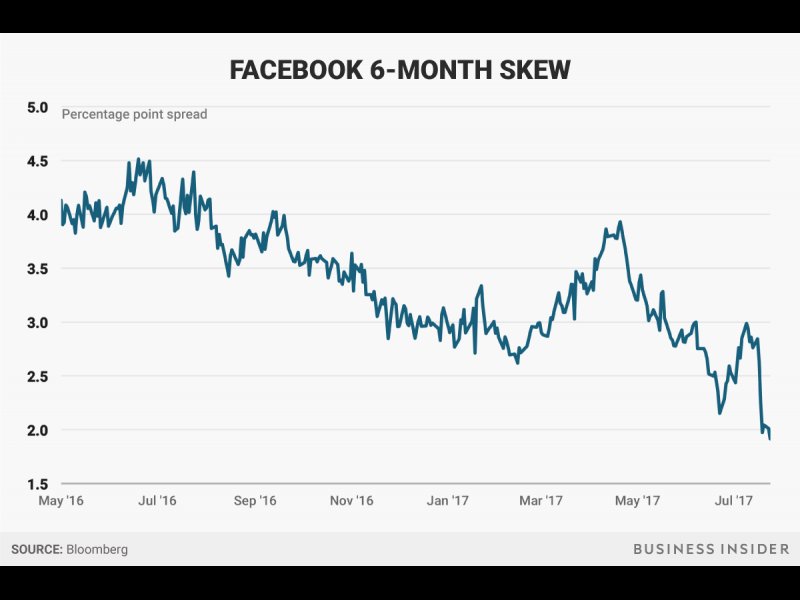

Options traders are paying the lowest premium in more than a year to guard against a decline in Facebook (NASDAQ:FB)'s stock, relative to bets on a gain, according to data compiled by Bloomberg.

In other words, they're feeling quite bullish, and not particularly inclined to hedge.

What's more, short interest — a measure of bets that share prices will drop — also hit its lowest level in more than a year last week, falling to just 0.69% of shares outstanding, IHS Markit data show.

The complete lack of shorting activity is a surprising reaction to a stock that's done as well as Facebook, which has surged 41% year-to-date, more than four times the benchmark S&P 500.

It looks like traders agree with Wall Street analysts, who collectively have 41 buy ratings, four holds and just one sell on Facebook's stock, according to Bloomberg. As part of the elite group known as FANG — along with Amazon (NASDAQ:AMZN), Netflix (NASDAQ:NFLX) and Google (NASDAQ:GOOGL) — the company has been a crucial component of one of the year's most popular and best-performing trades.

Based on recent history, it's a savvy move to brace for fluctuations heading into earnings, since the streaming-video service has moved an average of 5.3% in the day following its last 13 reports, on an absolute basis.