By Marc Jones and John O'Donnell

LONDON/ FRANKFURT (Reuters) - Euro zone bank stocks dipped to near four-year lows on Thursday as worry spread that a British exit from the European Union would worsen their already dim prospects.

The share slide underscores the problems that could face all European lenders if Britain votes to leave the EU next week, a step that the Bank of England warned would harm not just the UK economy but also spill over globally.

Europe's banks, still grappling with billions of euros of loans that may never be repaid as the region wallows in the doldrums and unemployment remains stubbornly high, are again in the front line of investor concerns.

"The global economic and political outlook is dark," said Chirantan Barua, an analyst with Bernstein. "Brexit is fuelling uncertainty and will have ripple effects across Europe. With so much uncertainty, why would you buy a bank stock now?"

A regional index of euro zone banks (SX7E) fell to its lowest level since August 2012, while shares in Germany's Deutsche Bank (DE:DBKGn) hit a record low. Banks are often a bellweather of economies and highly sensitive to market stress.

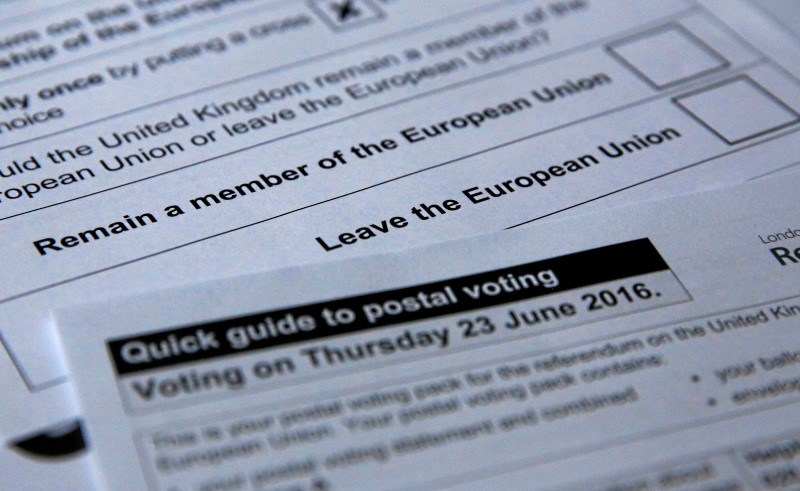

The stock moves illustrate a growing sense of alarm ahead of the June 23 referendum, which will determine Britain's future in trade and world affairs as well as that of the 28-member bloc.

This could have a knock-on effect on banks, which are still struggling with the aftermath of the financial crash.

With polls suggesting the chances of a 'Brexit' are increasing, investors took little consolation in the preparations that have been made by central banks.Officials told Reuters this week that the European Central Bank would publicly pledge to backstop financial markets with funding in tandem with the Bank of England, should Britain quit.

And Switzerland's central bank pledged to counter any surge in an already overvalued franc - seen as a safe currency in times of uncertainty.

SNB board member Andrea Maechler said the central bank had a team following Brexit developments 24 hours a day.

But were a recession to follow a British split, there would be little central banks, which have already cut borrowing rates to rock bottom and flooded markets with fresh money, could do.

GRAVEYARD STABILITY

Broader European financial stocks (SX7P) also dropped, bringing year-to-date losses to roughly 27 percent, making them the region's worst performing sector.

"The uncertainty is regarding the future of the UK in Europe but also probably regarding the future of Europe," said Barclays (LON:BARC) head of euro zone research Philippe Gudin de Vallerin.

"There is still some worry about banks and the extent to which banks have really been cleaned up and the possible reaction of banks to a UK exit."

The problems facing Europe's banks, however, go far deeper than Brexit. It has proved exceptionally hard, for instance, to kick-start borrowing in the euro zone because confidence has sunk to a low ebb and bad loans from the past are piled high.

Earlier this week, Yves Mersch, one of the European Central Bank's top officials, summarised the problems of the sector after the financial crisis. "We all want stability, but we should not want the stability of the graveyard."

Rating downgrades are also a threat. A Standard and Poor's model using Credit Default Swaps (CDS) shows that, over the last week, financial markets have started pricing Deutsche Bank's debt as if it were 'junk' grade.

While the bank's official credit rating does not have such a low status, the cost of insuring against a default on its debt, as measured by the CDS price, shows that investors see a higher risk of not getting repaid.

Swiss banks, which were also badly hit by the financial crisis, face further challenges too. The SNB said UBS (S:UBSG) and Credit Suisse (S:CSGN) would likely each need to raise an extra 10 billion Swiss francs in capital to meet new rules.