By Geoffrey Smith

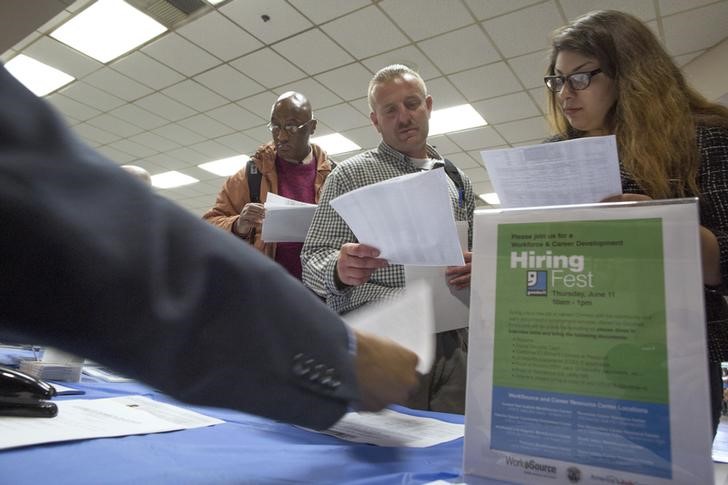

Investing.com -- The U.S. labor market appears to be cooling at last.

The number of people making initial claims for jobless benefits rose by more than expected last week to 251,000, its highest level since January, the Labor Department said.

Continuing claims likewise ticked up by about 50,000 to 1.384 million, in a sign that it is starting to get a little harder for the newly laid-off to find another job immediately.

The numbers corroborate increasing anecdotal reports of companies either laying staff off or slowing hiring, as the U.S. economy begins to cool under the impact of higher interest rates. This week alone, Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT) and Google (NASDAQ:GOOGL) have been the subject of such reports.

That cooling process was also reflected elsewhere on Thursday as the Philadephia Federal Reserve's index of manufacturing activity fell much more than expected in July to -12.3, its lowest level since May 2020. Analysts had expected a modest bounce from last month's reading of -3.3. The index of general business conditions also fell to -18.6.

The survey showed sharp drops in all of the subindices that go to make up the main index. New orders fell particularly sharply, but the employment and prices paid indices also declined.