(Bloomberg) -- China’s economy unexpectedly held up in the first three months of the year as stimulus measures kicked in, helping stabilize sentiment rattled by trade tensions with the U.S.

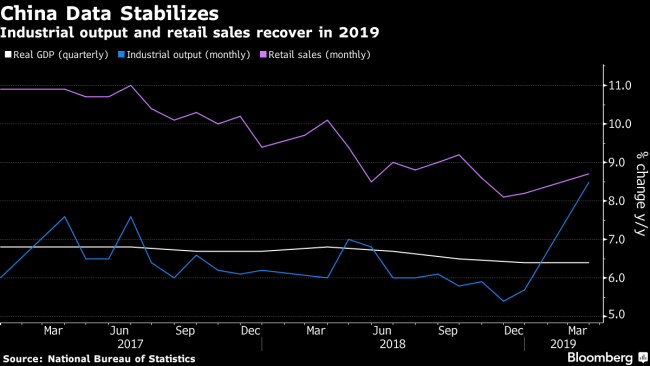

Gross domestic product rose 6.4 percent in the first quarter from a year earlier, exceeding economist estimates and matching the previous three months. In March, factory output jumped 8.5 percent from a year earlier, much higher than forecast. Retail sales expanded 8.7 percent, while investment was up 6.3 percent in the year to date.

Pro-growth policies have helped arrest a slowdown that’s rattled investors and cast doubt over the global expansion. The stronger-than-expected performance spurred debate over whether more stimulus measures are needed or if the central bank and finance ministry should now begin paring back their support.

“The recovery has come earlier than expected on the back of policy support,” said Grace Ng, a China economist at JPMorgan Chase & Co (NYSE:JPM). in Hong Kong. “Macro policy won’t significantly ease further but won’t tighten either in the next few months. Fiscal policy may fade off approaching the end of the year after significant front-loading of spending early this year.”

The Shanghai Composite rose immediately after the data before dropping back to trade little changed. Ten-year bond yields also climbed and then reversed course, while the Australian dollar advanced on the bullish numbers.

The better-than-forecast China numbers coincide with shipping data that offer the latest signs of reprieve for global trade as the U.S. and China inch toward an agreement.

Investment by state-owned firms quickened to 6.7 percent and slowed for private firms to 6.4 percent, underscoring the government’s role in supporting growth. Economists forecast a full-year growth rate of 6.2 percent in 2019, down from 6.6 percent last year.

What Bloomberg’s Economists Say

"We expect the economy to continue to stabilize in 2Q, but believe continued policy support is warranted. Government-led infrastructure spending has kick started the recovery. What’s needed still -- a turnaround in the private sector to drive self-sustaining growth."Chang Shu, Bloomberg EconomicsClick here for the full note

Within the unexpectedly strong industrial output numbers, car production grew in March for the first time since September, showing manufacturers might be growing more optimistic after the sales slump last year. China’s aluminum and steel output also reached records in the first quarter as producers ramped up operations amid prospects for better demand in the world’s biggest commodities consumer.

It wasn’t all good news. The surveyed jobless rate remained over 5 percent for a third month and the nominal growth rate, which is un-adjusted for price trends, decelerated.

(Updates with economist’s comment, details on industrial output, market reaction.)