On Monday, Wolfe Research maintained its Peerperform rating on PayPal Holdings Inc . (NASDAQ:PYPL) stock, with a fair value estimate range between $60 and $70. The assessment comes as PayPal's stock has underperformed year-to-date (YTD), declining by 5.5% compared to the S&P 500's 14.5% gain and the Wolfe FinTech Index's 1.3% decrease.

Wolfe Research acknowledges PayPal's efforts in streamlining operations, managing expenses, and returning capital to shareholders. Despite this, the firm anticipates the stock may stay range-bound in the near to medium term.

This forecast is attributed to concerns about the company's sensitivity to potential macroeconomic downturns, increasing competition, and uncertainties regarding long-term revenue and gross profit growth rates.

The research firm sees potential for PayPal to achieve higher single-digit revenue growth and mid-single-digit gross profit growth, with earnings per share (EPS) possibly reaching the mid to high teens in the long term.

However, Wolfe Research remains cautious and awaits evidence of PayPal's ability to maintain market share, enhance customer engagement, and improve margin performance, particularly in unbranded checkout services.

Investors are expected to seek several consecutive quarters of strength and stability before gaining confidence in PayPal's structural position within the market. Wolfe Research also points out that elevated stock-based compensation (SBC) may act as a valuation headwind for those evaluating the company based on SBC-expensed earnings.

As of the most recent market close on Friday, PayPal was trading at 13.3 times next twelve months (NTM) consensus EPS, compared to its one and three-year median multiples of 11.5x and 16.2x, respectively.

The current trading multiple reflects a 7.7x discount relative to the broader market on an NTM basis, which is a shift from its historical median discounts of 8.0x and 2.5x. Wolfe Research notes that the comparison to historical medians may be affected by PayPal's adjusted methodology for calculating non-GAAP EPS.

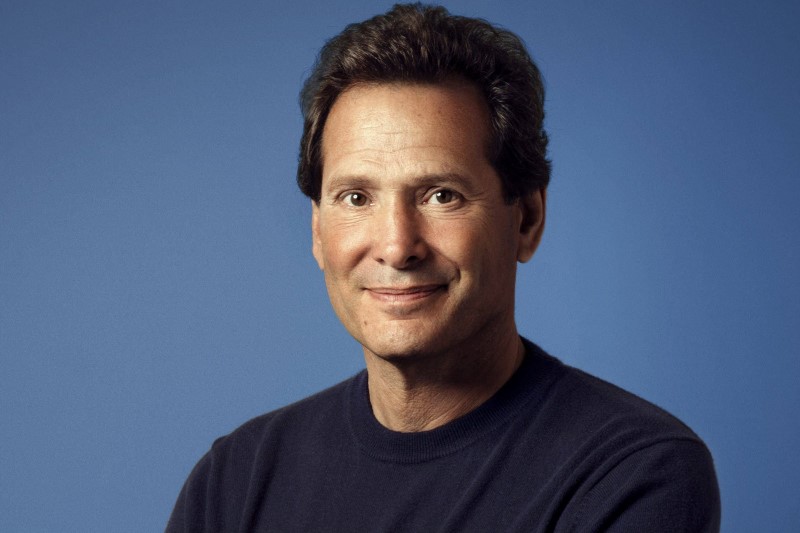

In other recent news, PayPal Holdings, Inc. has seen a flurry of activity. The company announced the expansion of its Board of Directors with the appointment of Carmine Di Sibio, effective July 1, 2024.

This move increases the Board's size from 11 to 12 members. Di Sibio is set to serve until the 2025 annual meeting of stockholders or until his successor is elected and qualified.

On the financial front, Mizuho revised PayPal's earnings and revenue estimates upward for 2025, setting them at $34.6 billion and $14.81 billion respectively. Meanwhile, RBC Capital maintained an Outperform rating for PayPal, highlighting the company's potential for long-term profitable growth. Goldman Sachs, however, assumed a neutral stance on PayPal's shares, citing potential earnings growth but expressing caution due to competitive pressures.

In the realm of digital financial services, PayPal has launched its PayPal USD stablecoin on the Solana blockchain, a move expected to enhance its functionality for digital commerce.

However, UBS reaffirmed a neutral rating on PayPal, following the expansion of Apple (NASDAQ:AAPL) Pay's services, which they perceive as a potential challenge to PayPal's market position.

Finally, PayPal ventured into advertising with the appointment of Mark Grether as Senior Vice President and General Manager of PayPal Ads, a move supported by JMP Securities, which maintained a Market Outperform rating on PayPal's shares.

InvestingPro Insights

In light of Wolfe Research's analysis, examining PayPal's financial metrics through InvestingPro provides additional context. The company's market capitalization stands at a robust $60.96 billion, reflecting its significant presence in the financial services industry. Notably, PayPal's Price to Earnings (P/E) ratio, at 14.54, suggests the stock is trading at a low valuation relative to near-term earnings growth—a point that aligns with Wolfe Research's fair value estimate range. Additionally, the company's Price to Earnings Growth (PEG) ratio for the last twelve months as of Q1 2024 is at an attractive level of 0.2, indicating potential for investment value based on earnings growth expectations.

InvestingPro Tips further highlight that PayPal's management has been proactively buying back shares, signaling confidence in the company's value. Moreover, analysts predict profitability for the year, backed by an impressive revenue growth of 8.39% over the last twelve months as of Q1 2024. These financial strengths could provide the stability and strength investors are looking for, as mentioned by Wolfe Research.

For those seeking a deeper dive into PayPal's financials and strategic positioning, InvestingPro offers a comprehensive array of additional tips. By using the coupon code PRONEWS24, readers can access these insights with an extra 10% off a yearly or biyearly Pro and Pro+ subscription, including a detailed analysis of PayPal's competitive standing and future outlook.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.