(Bloomberg) -- A year ago, as the pandemic ravaged country after country and economies shuddered, consumers were the ones panic-buying. Today, on the rebound, it’s companies furiously stocking up.

Mattress producers to car manufacturers to aluminum foil makers are buying more material than they need to survive the breakneck speed at which demand for goods is recovering and assuage that primal fear of running out. The corporate buying and hoarding is pushing supply chains to the brink of seizing up. Shortages, transportation bottlenecks and price spikes are nearing the highest levels in recent memory, raising concern that a supercharged global economy will stoke inflation.

Copper, iron ore and steel. Corn, coffee, wheat and soybeans. Lumber, semiconductors, plastic and cardboard for packaging. The world is seemingly low on all of it. “You name it, and we have a shortage on it,” Tom Linebarger, chairman and chief executive of engine and generator manufacturer Cummins Inc (NYSE:CMI)., said on a call this month. Clients are “trying to get everything they can because they see high demand,” Jennifer Rumsey, the Columbus, Indiana-based company’s president, said. “They think it’s going to extend into next year.”

The difference between the big crunch of 2021 and past supply disruptions is the sheer magnitude of it, and the fact that there is — as far as anyone can tell — no clear end in sight. Big or small, few businesses are spared. Europe’s largest fleet of trucks, Girteka Logistics, says there’s been a struggle to find enough capacity. Monster Beverage Corp (NASDAQ:MNST). of Corona, California, is dealing with an aluminum can scarcity. Hong Kong’s MOMAX Technology Ltd. is delaying production of a new product because of a dearth of semiconductors.

Further exacerbating the situation is an unusually long and growing list of calamities that have rocked commodities in recent months. A freak accident in the Suez Canal backed up global shipping in March. Drought has wreaked havoc upon agricultural crops. A deep freeze and mass blackout wiped out energy and petrochemicals operations across the central U.S. in February. Less than two weeks ago, hackers brought down the largest fuel pipeline in the U.S., driving gasoline prices above $3 a gallon for the first time since 2014. Now India’s massive Covid-19 outbreak is threatening its biggest ports.

For anyone who thinks it’s all going to end in a few months, consider the somewhat obscure U.S. economic indicator known as the Logistics Managers’ Index. The gauge is built on a monthly survey of corporate supply chiefs that asks where they see inventory, transportation and warehouse expenses — the three key components of managing supply chains — now and in 12 months. The current index is at its second-highest level in records dating back to 2016, and the future gauge shows little respite a year from now. The index has proven unnervingly accurate in the past, matching up with actual costs about 90% of the time.

To Zac Rogers (NYSE:ROG), who helps compile the index as an assistant professor at Colorado State University’s College of Business, it’s a paradigm shift. In the past, those three areas were optimized for low costs and reliability. Today, with e-commerce demand soaring, warehouses have moved from the cheap outskirts of urban areas to prime parking garages downtown or vacant department-store space where deliveries can be made quickly, albeit with pricier real estate, labor and utilities. Once viewed as liabilities before the pandemic, fatter inventories are in vogue. Transport costs, more volatile than the other two, won’t lighten up until demand does.

“Essentially what people are telling us to expect is that it’s going to be hard to get supply up to a place where it matches demand,” Rogers said, “and because of that, we’re going to continue to see some price increases over the next 12 months.”

More well-known barometers are starting to reflect the higher costs for households and companies. An index of U.S. consumer prices that excludes food and fuel jumped in April from a month earlier by the most since 1982. At the factory gate, the increase in prices charged by American producers was twice as large as economists expected. Unless companies pass that cost along to consumers and boost productivity, it'll eat into their profit margins.

A growing chorus of observers are warning that inflation is bound to quicken. The threat has been enough to send tremors through world capitals, central banks, factories and supermarkets. The U.S. Federal Reserve is facing new questions about when it will hike rates to stave off inflation — and the perceived political risk already threatens to upset President Joe Biden's spending plans.

“You bring all of these factors in, and it’s an environment that’s ripe for significant inflation, with limited levers” for monetary authorities to pull, said David Landau, chief product officer at BluJay Solutions, a U.K.-based logistics software and services provider.

Policy makers, however, have laid out a number of reasons why they don’t expect inflationary pressures to get out of hand. Fed Governor Lael Brainard said recently that officials should be “patient though the transitory surge.” Among the reasons for calm: The big surges lately are partly blamed on skewed comparisons to the steep drops of a year ago, and many companies that have held the line on price hikes for years remain reticent about them now. What's more, U.S. retail sales stalled in April after a sharp rise in the month earlier, and commodities prices have recently retreated from multi-year highs.

Read More: Fed Officials Have Six Reasons to Bet Inflation Spike Will Pass

Caught in the crosscurrents is Dennis Wolkin, whose family has run a business making crib mattresses for three generations. Economic expansions are usually good for baby bed sales. But the extra demand means little without the key ingredient: foam padding. There has been a run on the kind of polyurethane foam Wolkin uses — in part because of the deep freeze across the U.S. South in February, and because of “companies over-ordering and trying to hoard what they can.”

“It’s gotten out of control, especially in the past month,” said Wolkin, vice president of operations at Atlanta-based Colgate Mattress, a 35-employee company that sells products at Target (NYSE:TGT) stores and independent retailers. “We’ve never seen anything like this.”

Though polyurethane foam is 50% more expensive than it was before the Covid-19 pandemic, Wolkin would buy twice the amount he needs and look for warehouse space rather than reject orders from new customers. “Every company like us is going to overbuy,” he said.

Even multinational companies with digital supply-management systems and teams of people monitoring them are just trying to cope. Whirlpool Corp. CEO Marc Bitzer told Bloomberg Television this month its supply chain is “pretty much upside down” and the appliance maker is phasing in price increases. Usually Whirlpool (NYSE:WHR) and other large manufacturers produce goods based on incoming orders and forecasts for those sales. Now it’s producing based on what parts are available.

“It is anything but efficient or normal, but that is how you have to run it right now,” Bitzer said. “I know there’s talk of a temporary blip, but we do see this elevated for a sustained period.”

The strains stretch all the way back to global output of raw materials and may persist because the capacity to produce more of what’s scarce — with either additional capital or labor — is slow and expensive to ramp up. The price of lumber, copper, iron ore and steel have all surged in recent months as supplies constrict in the face of stronger demand from the U.S. and China, the world’s two largest economies.

Crude oil is also on the rise, as are the prices of industrial materials from plastics to rubber and chemicals. Some of the increases are already making their ways to the store shelf. Reynolds Consumer Products (NASDAQ:REYN) Inc., the maker of the namesake aluminum foil and Hefty trash bags, is planning another round of price increases — its third in 2021 alone.

Food costs are climbing, too. The world’s most consumed edible oil, processed from the fruit of oil palm trees, has jumped by more than 135% in the past year to a record. Soybeans topped $16 a bushel for the first time since 2012. Corn futures hit an eight-year high while wheat futures rose to the highest since 2013.

A United Nations gauge of world food costs climbed for an 11th month in April, extending its gain to the highest in seven years. Prices are in their longest advance in more than a decade amid weather worries and a crop-buying spree in China that’s tightening supplies, threatening faster inflation.

Earlier this month, the Bloomberg Commodity Spot Index touched the highest level since 2011.

A big reason for the rally is a U.S. economy that’s recovering faster than most. The evidence of that is floating off the coast of California, where dozens of container ships are waiting to offload at ports from Oakland to Los Angeles. Most goods are flooding in from China, where government figures last week showed producer prices climbed by the most since 2017 in April, adding to evidence that cost pressures for that nation’s factories pose another risk if those are passed on to retailers and other customers abroad.

Across the world’s manufacturing hub of East Asia, the blockages are especially acute. The dearth of semiconductors has already spread from the automotive sector to Asia’s highly complex supply chains for smartphones.

Read More: World Is Short of Computer Chips. Here’s Why: QuickTake

John Cheng runs a consumer electronics manufacturer that makes everything from wireless magnetic smartphone chargers to smart home air purifiers. The supply choke has complicated his efforts to develop new products and enter new markets, according to Cheng, the CEO of Hong Kong-based MOMAX, which has about two-thirds of its 300 employees working in a Shenzhen factory. One example: Production of a new power bank for Apple (NASDAQ:AAPL) products such as the iPhone, Airpods, iPad and Apple watch has been delayed because of the chip shortage.

Instead of proving to be a short-lived disruption, the semiconductor crunch is threatening the broader electronics sector and may start to squeeze Asia’s high-performing export economies, according to Vincent Tsui of Gavekal Research. It’s “not simply the result of a few temporary glitches,” Tsui wrote in a note. “They are more structural in nature, and they affect a whole range of industries, not just automobile production.”

In an indication of just how serious the chips crunch is, South Korea plans to spend roughly $450 billion to build the world’s biggest chipmaking base over the next decade.

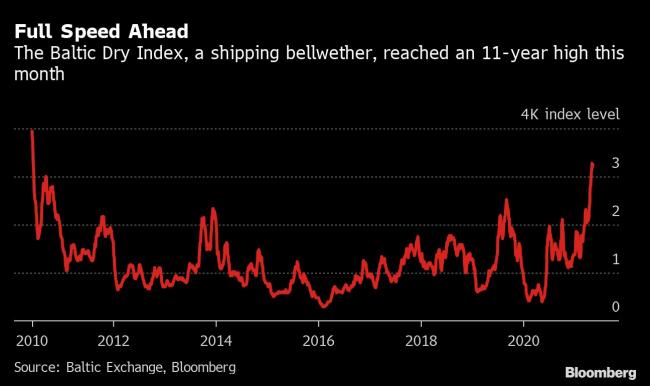

Meanwhile, running full tilt between factories and consumers are the ships, trucks and trains that move parts along a global production process and finished goods to market. Container vessels are running at capacity, pushing ocean cargo rates to record highs and clogging up ports. So much so that Columbia Sportswear Co.’s merchandise shipments were delayed for three weeks and the retailer expects its fall product lineup will arrive late as well.

Executives at A.P. Moller-Maersk A/S, the world’s No. 1 container carrier, say they see only a gradual decline in seaborne freight rates for the rest of the year. And even then, they don’t expect a return to the ultra-cheap ocean cargo service of the past decade. More capacity is coming in the form of new ships on order, but they take two or three years to build.

HSBC trade economist Shanella Rajanayagam estimates that the surge in container rates over the past year could raise producer prices in the euro zone by as much as 2 percent.

Rail and trucking rates are elevated, too. The Cass Freight Index measure of expenditures reached a record in April — its fourth in five months. Spot prices for truckload service are on track to rise 70% in the second quarter from a year earlier, and are set to be up about 30% this year compared with 2020, Todd Fowler, a KeyBanc Capital Markets analyst, said in a May 10 note.

“We expect pricing to remain elevated given lean inventories, seasonal demand and improving economic activity, all of which is underpinned by capacity constraints from truck production limitations and driver availability challenges,” Fowler said.

What Bloomberg Intelligence Says:

“Most modes of freight transportation have pricing power. Supply-demand imbalances should help keep rates high, albeit they should moderate for current unsustainable levels as supply chains improve. This is stressing networks, creating bottlenecks in the supply chains and capacity constraints.”--Lee Klaskow, senior analyst

For London-based packaging company DS Smith Plc, challenges are coming from multiple sides. During the pandemic, customers rushed to online purchases, raising demand for its ePack boxes and other shipping materials by 700%. Then came the doubling of its supply costs to 200 euros ($243) a ton for the recycled fiber it uses to make its products.

“That’s a significant cost” for a company that buys 4 to 5 million tons of used fiber annually, said Miles Roberts, DS Smith’s group chief executive, who doesn’t see the lockdown-inspired web purchasing as a temporary trend. “The e-commerce that has increased is here to stay.”

At Colgate Mattress, Wolkin used to be able to order foam on Mondays and have it delivered on Thursdays. Now, his suppliers can’t promise anything. What’s clear is he can’t sustain the higher input costs forever and still maintain quality. “This is kind of a long-term issue,” Wolkin said. “Inflation is coming — at some point, you’ve got to pass this along.”

©2021 Bloomberg L.P.