(Bloomberg) -- Gold is rallying into the end of 2018 as turmoil in global equities, the partial U.S. government shutdown and concerns about the outlook for next year stoke demand, lifting prices to the highest in six months.

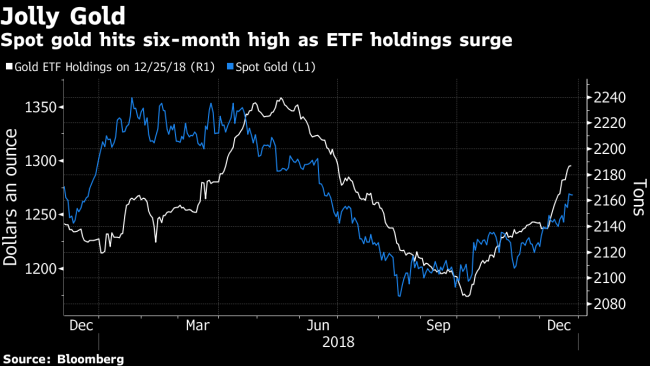

Bullion climbed as much as 0.5 percent on Wednesday, extending last week’s gain and on course for the biggest monthly advance since January 2017. Money managers are the most bullish on prices they’ve been in half a year.

The metal is proving to be a beneficiary of the sell-off that’s engulfed global equities after U.S. shares tanked on Monday followed by losses in Asia on Christmas Day. Investors are turning away from risk amid further signs of dysfunction in Washington, with multiple sources of concern including President Donald Trump’s showdown with the Federal Reserve, the impasse over the budget, and fall-out from the resignation of Defense Secretary James Mattis.

“Overall the latest move on gold should be a stark reminder to investors that gold in any form should be an essential part of any long-term investment strategy, as again the yellow metal has proven its weight when markets turn turbulent,” said Stephen Innes, head of Asia Pacific trading at Oanda Corp.

As U.S. equity futures fell, spot gold advanced to as much as $1,274.82 an ounce, the highest since June, and was at $1,273.20 at 7:22 a.m. in London, according to Bloomberg generic pricing. It’s up 4.3 percent so far this month, following smaller gains in October and November.

ETFs Surge

Holdings in gold-backed exchange-traded funds have ballooned as shares fell, and investors priced in expectations for fewer U.S. interest rate rises in 2019. They hit 2,187.2 tons on Dec. 25, up more than 100 tons since mid-October.

“This Christmas season, we have massive volatility in U.S. stocks and the Nikkei sank into a technical bear market,” said Huatai Futures Co.’s Xu Wenyu. “The U.S. government shutdown has added to the market’s list of worries.”

Nine of 15 federal departments and dozens of other agencies shut down on Saturday after Trump refused to sign a spending bill that didn’t include money for a wall along the southern border. Congress has left Washington until Dec. 27, delaying negotiations to end the shutdown.

Silver has also been lifted by the rush for precious metals. The price rose as much as 0.6 percent to $14.8675 an ounce, the highest since Nov. 2. Platinum and palladium climbed.