Last week’s review of the macro market indicators saw heading into the first full week of March, the equity markets had entered more like a lion than a lamb. Elsewhere looked for gold (GLD (NYSE:GLD)) to continue the pullback in its uptrend while crude oil ($USO) consolidated with a bias for a break to the downside. The U.S. dollar index (DXY) looked to continue higher short term while U.S. Treasuries (TLT (NASDAQ:TLT)) continued to consolidate in their downtrend.

The Shanghai Composite (ASHR (NYSE:ASHR)) continued to drift higher while Emerging Markets (EEM (NYSE:EEM)) pulled back in their uptrend. Volatility (VXX (NYSE:VXX)) looked to remain at abnormally low levels keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), IWM (NYSE:IWM) and QQQ (NASDAQ:QQQ). Their charts showed continued strength in the SPY and QQQ, especially on the longer timeframe, with the IWM in consolidation mode again on both timeframes.

The week played out with gold driving lower to 1200 while crude oil also broke to the downside, but not until mid week. The U.S. dollar moved higher until it gave all the gains back Friday while Treasuries pressed lower against the bottom of consolidation. The Shanghai Composite started higher but lost its support Thursday while Emerging Markets continued lower.

Volatility continued in a narrow range at abnormally low levels. The Equity Index ETF’s started the week moving lower, led by the IWM on the way down. The QQQ settled and held in a tight range, ending near all-time highs on a move higher Friday, while the SPY bounced later Thursday, both leaving the IWM at its lows for the week. What does this mean for the coming week? Lets look at some charts.

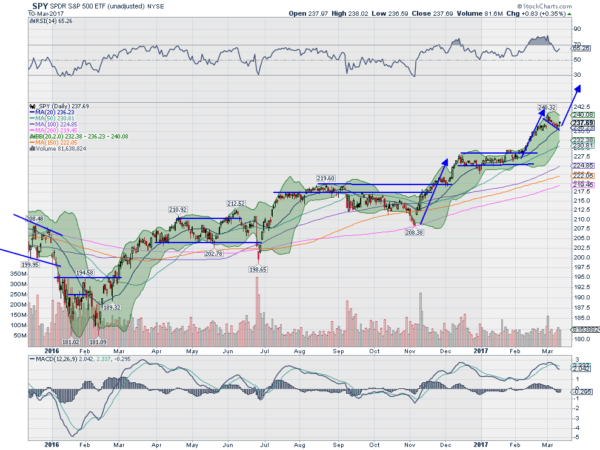

SPY Daily

The SPY entered the week with a small island hanging over the longer trend higher. It started lower Monday and continued with small body candles until Thursday it reached the 20 day SMA and had closed the gap from the start of the month. Friday it moved back higher confirming the pullback as a bull flag and establishing an upside target to 247.

The daily chart shows the Bollinger Bands® have squeezed in, often a precursor to a move. The momentum indicators have cooled off but remain in bullish ranges. The RSI worked off the technically overbought condition with the MACD lower. The weekly chart remains strong but with a couple of indications to watch. The doji Harami candle, or inside week, could be a warning for a possible reversal but needs confirmation.

The Bollinger Bands are rising pointing the way higher. The RSI is strong and bullish while the MACD is rising and nearing extremes. There is resistance at 239.80 and then free air above. Support lower comes at 237.10 and 233.75 followed by 232.20 and 229.40. Continued Uptrend.

SPY Weekly

Heading into March options Expiration week, the Equity markets seem to have completed their reset after the most recent leg higher. Elsewhere look for Gold to continue in its downtrend while Crude Oil also continues lower. The U.S. dollar index looks to continue to pullback while U.S. Treasuries are biased lower, possibly ready top break consolidation. The Shanghai Composite is pulling back in the uptrend and Emerging Markets are biased to the downside.

Everything lower so far. Volatility looks to remain at abnormally low levels, keeping the wind at the backs of the equity index ETF’s SPY, IWM and QQQ. Their charts show the SPY and QQQ reversing short term pullbacks and the IWM arresting its drop. Longer term the SPY and QQQ remain strong, while the IWM has cracked and moved lower. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.