Market Brief

The US dollar is trading broadly lower against major currencies as investors wonder whether the rally has finally run out of steam. The greenback fell the most against the pound sterling with the cable rising 0.27%, on its way to test the 1.27 resistance area once again. Over the last few weeks, the pound has been trading with a positive bias with investors discounting the negative effect of the Brexit on the UK economy. Moreover, the mounting political risk facing the European Union as we head into 2017 has given a boost to the GBP. EUR/GBP continued to move lower on Wednesday and returned to 0.8583 during the Asian session. The main support level can be found at 0.8333 (low from September 6th), while on the upside a resistance lies at around 0.92 (multi highs).

Yesterday, the single currency was under renewed selling pressures amid the mixed ZEW survey from Germany. German economic sentiment improved more than expected in November, rising to 13.8 versus 8.1 expected, the highest level since June. On the other hand, the current condition index slid to 58.8, while market participants were expecting a further improvement (61.6 median forecast and 59.5 in October). EUR/USD fell 0.80 after the release of the news to 1.0720 in the late European session. The currency pair recovered slightly in the early Asian session before returning to 1.0715.

Yesterday, the US dollar got a little help from a surprisingly better-than-expected retail sales report. Advanced retail sales rose 0.8%m/m in October, beating median forecast of 0.6% and an upwardly revised figure of 1% in the previous month. The measure excluding auto and gas jumped to 0.6%m/m from 0.5% in September, also beating expectations of 0.3%. The main question now is whether this encouraging trading momentum can be sustained as we face 2017 under a Trump presidency. We believe that the uncertainty generated by the US election will likely cool consumer spending.

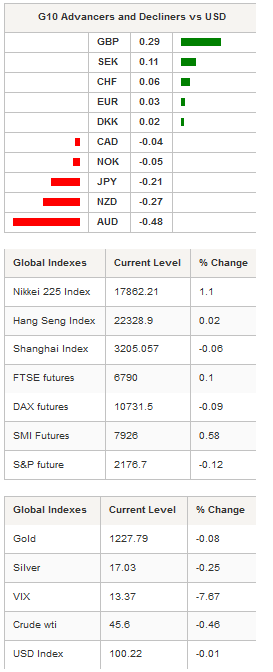

In the equity market, Asian markets are trading broadly higher with the Nikkei up 1.10%. In mainland China, the Shanghai and Shenzhen Composites were both trading flat. Offshore, Hong Kong’s Hang Seng edged up 0.09%, while in Taiwan the Taiex rose 0.35%. In Europe, equity futures were blinking green across the screen. The FTSE 100 was up 0.10%, the SMI 0.65%, while the Euro Stoxx 600 surged 0.44%.

Currency Tech

EUR/USD

R 2: 1.1259

R 1: 1.0954

CURRENT: 1.0717

S 1: 1.0709

S 2: 1.0524

GBP/USD

R 2: 1.2771

R 1: 1.2674

CURRENT: 1.2468

S 1: 1.2083

S 2: 1.1841

USD/JPY

R 2: 113.80

R 1: 111.45

CURRENT: 109.37

S 1: 106.14

S 2: 104.97

USD/CHF

R 2: 1.0328

R 1: 1.0093

CURRENT: 1.0018

S 1: 0.9632

S 2: 0.9537