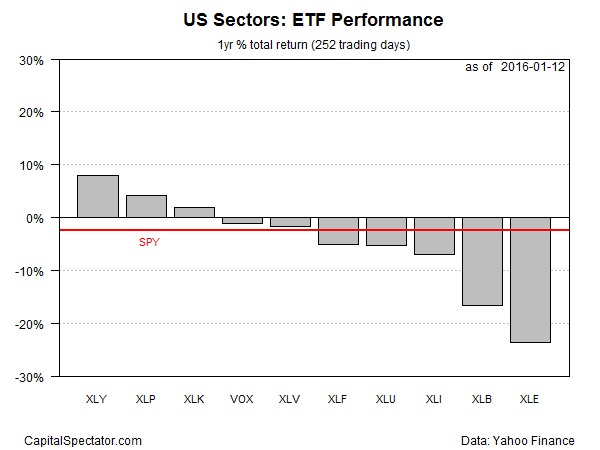

Consumer discretionary stocks are holding on to their leadership position for the trailing 1-year period, but the edge is fading. Meantime, the worst-performing US equity sector—energy—has slipped deeper into negative territory, based on analysis of a set of sector ETFs.

The Consumer Discretionary SPDR ETF (N:XLY) is up 7.9% on a total return basis for the trailing 1-year period through yesterday (Jan. 12). The performance puts the sector comfortably ahead of the field, although the fund’s one-year gain has been cut in half since last month’s sector report.

Last week’s encouraging employment report offers support for thinking that the consumer sector is in no immediate danger from a macro perspective. Indeed, nonfarm payrolls for the private sector rebounded sharply in December, which implies that the critical factor for spending on Main Street—higher employment—is still skewing positive.

Nonetheless, market sentiment is on the defensive these days. Seven of ten sectors are in the red for the trailing 1-year period. The market overall has lost ground for the past year as well, based on the SPDR S&P 500 ETF (N:SPY).

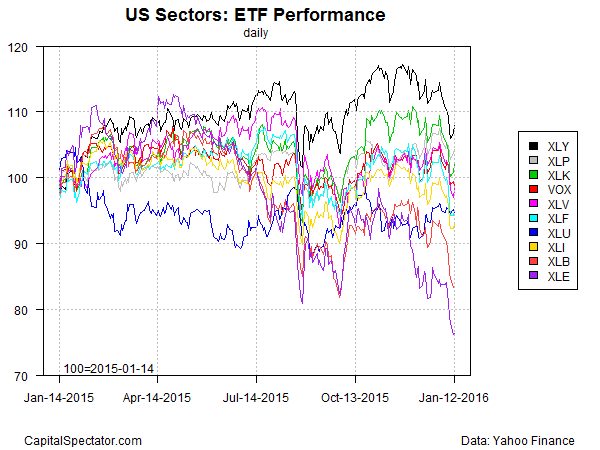

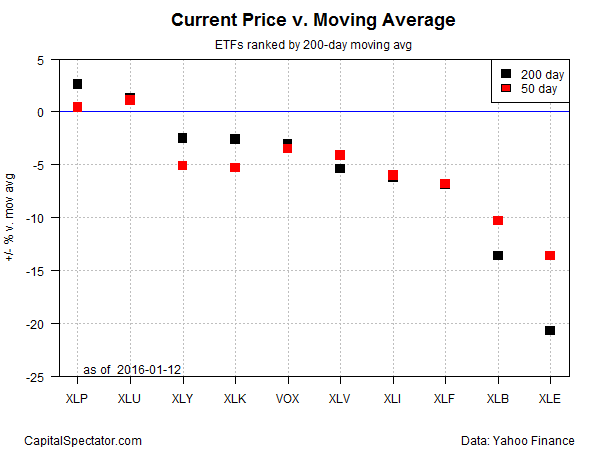

Energy continues to lead the way lower. The Energy SPDR ETF (N:XLE) is in the hole by nearly 24% for the past year in total-return terms. With the ETF trading well below its 50- and 200-day moving averages, negative momentum still has the upper hand in this corner and so even marginal signs of a rebound for these stocks are nowhere on the near-term horizon.

The slide in energy companies is unusually stark, even by recent standards—particularly when compared with the rest of the equity sectors. As you can see in the next chart below, XLE has recently plumbed new depths in the new year.

Although energy’s in a class of its own in terms of red ink, upside momentum generally is in short supply across the sector landscape. Measured by 50- and 200-day moving averages, only two ETFS are posting positive price momentum through Jan 12: Consumer Staples Select Sector SPDR ETF (N:XLP) and Utilities Select Sector SPDR ETF (N:XLU).

Perhaps the only factor that’s keeping US equities generally from deeper trouble is the expectation that the American economy will continue to grow. “The risk of a full-blown bear market remains low without a recession, which our economists see as unlikely,” advises (N:Bank of America Merrill Lynch) US equity strategist Savita Subramanian in a recent research report. He adds, however, that “some near-term caution is warranted until earnings growth improves.”