Consumer discretionary stocks remain the top-performing US equity sector for the trailing 12-month period while energy is still caught in a bearish pattern. Meanwhile, the technology sector has perked up lately, inspiring some analysts to argue that positive momentum for this sector will push these stocks higher still.

“Investors are starting to embrace some of the big-picture secular trends that will drive growth in these companies for years to come,” Lew Piantedosi, at Eaton Vance Management tells Bloomberg. “Even though the group’s done pretty well, I think there’s a long way to go.”

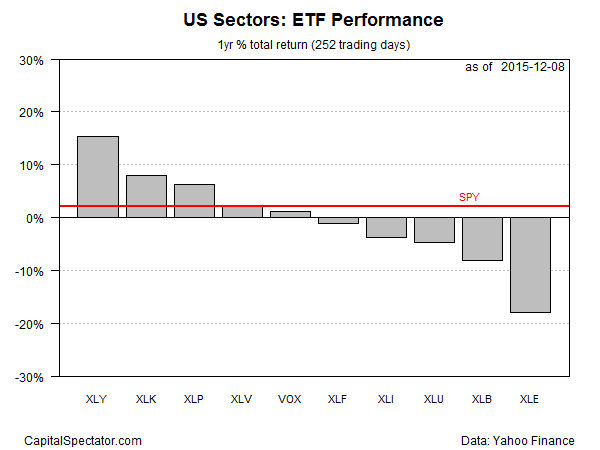

The Technology Select Sector SPDR (N:XLK) has climbed 8.1% on a total return basis for the trailing one-year period through yesterday (Dec. 9)—second only to the Consumer Discretionary Select Sector SPDR (N:XLY) which is up 15.3% over the past year. The returns represent healthy premiums over the US stock market’s 2.2% trailing one-year gain, based on the SPDR S&P 500 ETF (N:SPY).

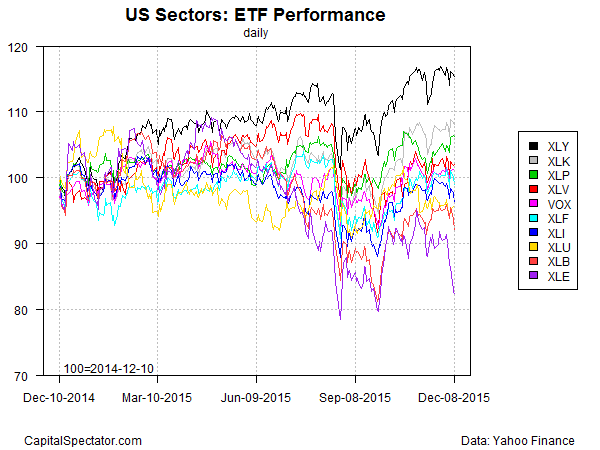

Energy, on the other hand, remains in the performance dog house. Although some analysts have been looking for a rebound recently, the bearish reports flowing from this week’s Opec meeting have renewed the downward trend in this sector. As a result, the slide in the Energy Select Sector SPDR (N:XLE) that began in mid-2014 shows no sign of reversing any time soon. As of yesterday, XLE had fallen 17.9% over the past year.

Thanks largely to energy’s weakness, the divergence between the performance extremes for the ten US sector ETFs has widened lately. As you can see in the next chart below, XLE’s decline has accelerated in recent days and appears headed to retest the lows of recent months.

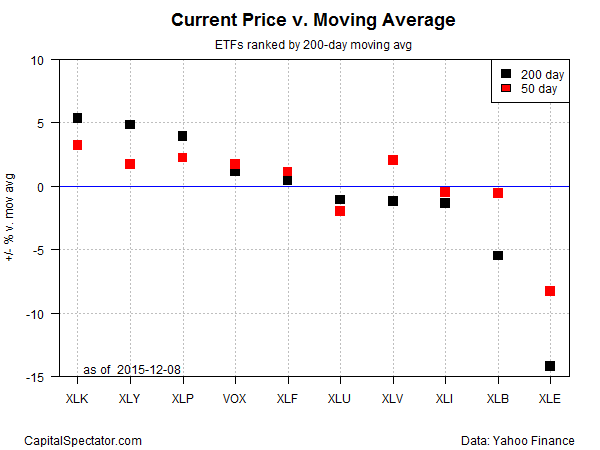

The divergence at the extremes of sector performance is no less striking by way of profiling performance history through moving averages. At one end is the upside leader: the Technology Select Sector SPDR (N:XLK). The latest price for the ETF is more than 5% above its 200-day moving average, for instance. Meanwhile, energy’s bearish technical profile stands in sharp contrast: XLE yesterday closed more than 14% below its 200-day average.

The latest stumble in energy shares throws cold water on recent comments from some analysts that this sector was due for a rebound. Last month, for instance, a strategist advised on Bloomberg TV that he was overweighting energy at the expense of the consumer discretionary sector. The generous interpretation of that call: the recommendation was early, although less-forgiving pundits might choose to apply a different set of adjectives to describe the advice.