Today in the first half of the day the oil prices continued the correction growth, which started on Friday, but now are lowering again. In the nearest time the WTI oil price can lower to the area of the level of 42.00 again. The market’s mood is still negative, the number of the USA oil rigs is growing (according to the last Baker Hughes data, it reached the number of 758 rigs), and investors don’t believe in the soon reaching of the balance between the production and consumption.

There is a list of possibilities to change the situation, but all of them aren’t implying yet. In case of the further worsening of the Qatar crisis, the gas the country supplies can be displaced by oil. In addition, the further fall of oil prices can make Saudi Arabia to push the new production limitation via OPEC.

As for the short term factors, which can support the prices this week, the tropical storm Cindy, which happened in the Mexican gulf last week and caused the suspension of the number of rigs and lowering of the US oil production by 17%. This fact can lead to further oil resources decrease, according to API and EIA reports.

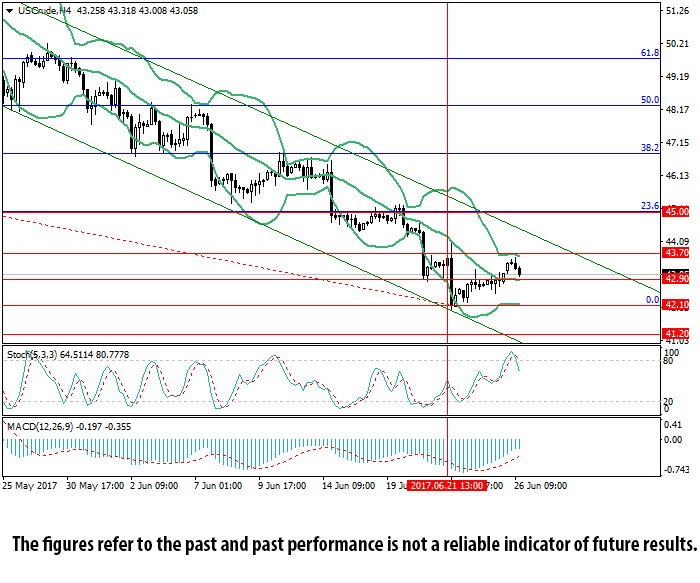

Technically the price is trading within the narrow downward channel, rebounded from its lower border and tried to be corrected. It couldn’t cross the level of 43.70 (the upper border of Bollinger Bands). In case of breakdown of the middle line of Bollinger Bands around 42.90 the further decrease to the levels of 42.10 and 41.20 is possible.

In case of the breakout of the level 43.70 and the upper border of the channel the further growth to the level of 45.00 (Fibonacci correction 23.6%) is possible, but this scenario seems less likely (Stochastic is leaving the overbought zone and forms a sell signal).

Support levels: 42.90, 42.10, 41.20.

Resistance levels: 43.70, 45.00.