AVEO Pharmaceuticals, Inc. (NASDAQ:AVEO) announced on Friday that the Committee for Medicinal Products for Human Use (CHMP) has recommended the approval of its lead candidate, Fotivda (tivozanib), for the treatment of advanced renal cell carcinoma (RCC).

We note that the European Commission generally follows the recommendation of the CHMP but it is not bound by it. A final decision is expected in two months.

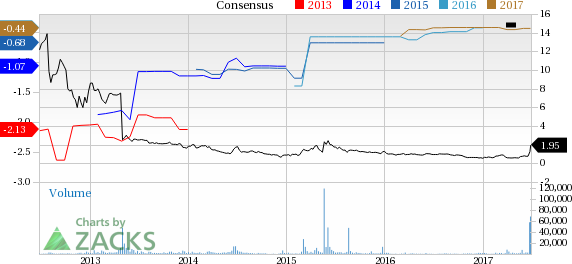

The company received a major boost with this recommendation. Its shares have surged nearly 167% since the announcement. In fact, the stock has outperformed the Zacks classified Medical - Biomedical and Genetics industry so far this year. Shares are up 270.3% compared with the industry’s gain of 11.5% in the period.

The company will receive a payment of $4 million from EUSA Pharma, a subsidiary of Jazz Pharmaceuticals PLC (NASDAQ:JAZZ) , upon approval of tivozanib by the European Medicines Agency (EMA). AVEO Pharma will also receive an additional $12 million milestone payments based on member state reimbursement and regulatory approvals. The company plans to use the funds for the head-to-head study of the candidate with Bayer (DE:BAYGN) AG’s Nexavarfor treating third-line RCC. The company is conducting the study to gain approval in the U.S.

The recommendation for the candidate comes after a string of setbacks in the last few years. AVEO does not have any approved product in its portfolio. The company’s top line mainly comprises collaboration revenues, milestone and other payments. Upon approval, the company may have a steady revenue stream.

Per the data from Cancer Research UK, RCC is the most common form of kidney cancer in Europe and it causes an estimated 49,000 deaths every year.

Meanwhile, , another phase II study is evaluating the candidate in combination with Bristol-Myers Squibb Company’s (NYSE:BMY) Opdivo in patients with advanced RCC.

However, the company will face competition from Exelixis, Inc.’s (NASDAQ:EXEL) Cabometyx, which was approved in the U.S. and EU last year for the treatment of advanced RCC.

Zacks Rank

AVEO Pharma currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Sell These Stocks. Now.

Just released, today's 220 Zacks Rank #5 Strong Sells demand urgent attention. If any are lurking in your portfolio or Watch List, they should be removed immediately. These are sinister companies because many appear to be sound investments. However, from 1988 through 2016, stocks from our Strong Sell list have actually performed 6X worse than the S&P 500.

See today's Zacks "Strong Sells" absolutely free >>.

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

Exelixis, Inc. (EXEL): Free Stock Analysis Report

AVEO Pharmaceuticals, Inc. (AVEO): Free Stock Analysis Report

Jazz Pharmaceuticals PLC (JAZZ): Free Stock Analysis Report

Original post

Zacks Investment Research