Apple Inc. (NASDAQ:AAPL) investors have been facing trying times. Yesterday, Target Corp. (NYSE:TGT) reported second-quarter 2016 results wherein revenues missed the Zacks Consensus Estimate while declining over 7% year over year. Management cited the weakness in sale of electronics, especially Apple products, as one of the key reasons for the dismal revenue numbers. Target also slashed its guidance for fiscal 2016.

At the earnings call, Target CEO Brian Cornell said that electronic category witnessed considerable pressure with comps falling in double-digits in the reported quarter and accounting for 70 bps of the overall comps decline. Apple products sale declined 20%, dampening electronics category sales to a large extent.

Cornell stressed on innovation throughout the earnings call. He said “our guests come to us looking for those products. They are looking for the newness and the innovation and we are putting together plans with Apple and our merchandising teams to make sure we are ready to take advantage of that in the back half of the year.”

Apple’s Troubles

This year hasn’t been a favorable one for Apple so far. The Cupertino-based tech behemoth faced a decline in its flagship product – iPhone– for the first time. Since the last two quarters, the demand for this device has been soft owing to global macroeconomic weakness, especially with currency volatility and declining commodity prices in some key regions across the globe (about 63% of Apple revenues come from International markets). In the last reported quarter, iPhone unit sales were down 15% year over year to 40.4 million units. Revenues from iPhone also fell 23% from the year-ago quarter to a little over $24 billion (57% of total revenue).

The concerns stem from the fact that iPhone alone contributes about 57% (in the third quarter) of Apple’s total revenues. Additionally, we need to keep in mind that iPhone is also at the core of Apple’s ecosystem strength. The company has been seeing slowdown in demand from key regions like China, which, if it continues, can significantly impact Apple’s financials going ahead. Also, since the beginning of this fiscal, Apple is facing less than desirable inventory accumulation, a part of which is likely due to expansion of manufacturing capacity that it undertook in 2015.

Management also gave bleak guidance for the fourth quarter of fiscal 2016. Apple forecasts revenues in the range of $45.5 billion to $47.5 billion compared with revenues of $51.5 billion in the year-ago quarter.

Should Investors Press the Panic Button Yet?

iPhone remains Apple’s primary revenue driver. However, we believe investors need not worry about Apple so much.

iPhone 7 slated for launch this September could boost Apple’s revenues as well as that of retailers like Target. Though rumors indicate that iPhone 7 will not bring much innovation, analysts are hopeful that Apple’s loyal customer base won’t disappoint. Moreover, analysts believe that Tim Cook has a big surprise in store for Apple lovers in 2017. Per rumors, Apple is planning to launch iPhone 8 next year on the 10th anniversary of the first iPhone. The new iPhone, reportedly, will have unbelievable features including a glass body, a dual curved edge-to-edge OLED display with a built-in Touch ID sensor, wireless charging and so on. This should (hopefully) evoke a similar frenzy witnessed at the time when Apple launched its first iPhone a decade back.

Plus, Apple is now expanding beyond iPhone, which is also a big positive. Apple has some revolutionary offerings when it comes to Apple Pay, Apple Watch, Apple Music and Apple TV. Also, the company is working on boosting the sales of iPad. The dismal performance should abate once Apple releases its next-gen Mac book Pro. Apple’s move into the enterprise market is also a major positive. Though there has been no official update on the iCar, but if the rumors about Project Titan being in the works are true, it could be a long-term growth driver for this iconic company.

Apart from the U.S. and China, Apple has been taking a lot of initiatives to boost its presence in emerging nations like India. India presents an attractive growth opportunity for the company over the long run, given its younger population and increasing investment in broadband network by the government. This makes it ideal for Apple’s consumer retail business.

Tim Cook at present is in China on a goodwill tour as reported by The Wall Street Journal. Cook had earlier announced increasing investments in the country. China remains the largest smartphone market and the second largest iPhone market. The report further added that by increasing investments, Apple is working to boost the local economy, something that the Chinese government strongly expects from foreign companies.

Moreover, Apple’s strong shareholder return policy should keep investors’ interest in the stock alive. In the last quarter, the company’s cash balance stood at $61 billion and it returned over $13 billion to shareholders, of which $3.2 billion was through dividends.

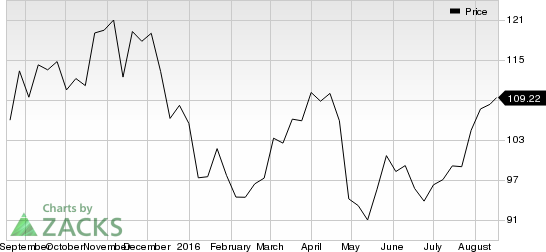

Also, throughout the “turmoil”, its share price, despite falling to the $90s, bounced back to $108. Year-to-date, its shares are up 3.7%.

Though Apple’s near-term outlook is cautious but over the long term, there are a number of things going in its favor. Therefore, we don’t see reasons for Apple investors to panic as yet.

At present, Apple carries a Zacks Rank #3 (Hold). Better-ranked stocks include Facebook Inc (NASDAQ:FB) and MeetMe Inc (NASDAQ:MEET) . While Facebook is a Zacks Rank #1 (Strong Buy) stock, MeetMe carries a Zacks Rank #2 (Buy).

APPLE INC (AAPL): Free Stock Analysis Report

TARGET CORP (TGT): Free Stock Analysis Report

FACEBOOK INC-A (FB): Free Stock Analysis Report

MEETME INC (MEET): Free Stock Analysis Report

Original post

Zacks Investment Research