The pitch level of noise surrounding the markets is starting to elevate, and wouldn't you know it - right near the all-time highs. Right on cue! As we saw markets take out resistance on Friday following the strong jobs report, we continue to hear the drumbeat from the bearish side, that this most unbelievable market rally has to end soon.

Of course, no time estimate on that prediction - like the old economist's saw, 'give em a number or a date, but never both'. Especially at all-time highs, everyone is reaching for advice on what to do next. Clue: the market will tell you first and always.

There are a million reasons to sell but only ONE reason to buy. The latest being 'August is always a bad month, volatility rises'. Tell that excuse to the markets this week, which rallied .50% or more - pound sand! So, while we have markets at these elevated levels we have to focus on the internals, the quality of the market rallying.

It is this examination that will tell us how strong/weak the market is currently and whether it will retreat or continue higher. The rhetoric, hyperbole and threats coming from those in disbelief is strengthening. Remember just a couple months ago we heard Icahn, Soros, Druckenmiller and several others predicting doom and gloom for markets?

Lately, veteran hedge fund manager Jeff Gundlach, who has been a bull on bonds (and been very correct) alerted everyone that he is avoiding stocks, and just last week the famed Bill Gross said he hates stocks, bonds and just about everything except gold. Are these the experts we need to pay attention to? If you want to lose money, perhaps that is true.

Well, the markets hit all time highs regardless of the poorly-timed guesses. Thanks for nothing, guys! While they may eventually be right (heck, all markets go down at some point), we choose to let the markets tell us. Trying to time a market top is an exercise in futility, yet we hear so much of it these days.

'Generational low' or 'generational bottom' tell us NOTHING about what the current market or future is going to look like. It's easy to guess with no timeframe, perhaps some will forget about your poor call and you won't have to be accountable.

But does that help us make the money? Of course not! We need to focus on what the market is actually doing and not the noise in media, which is all about nothing. My advice, just turn it all off, focus on the market action, as it will always tell you how to proceed.

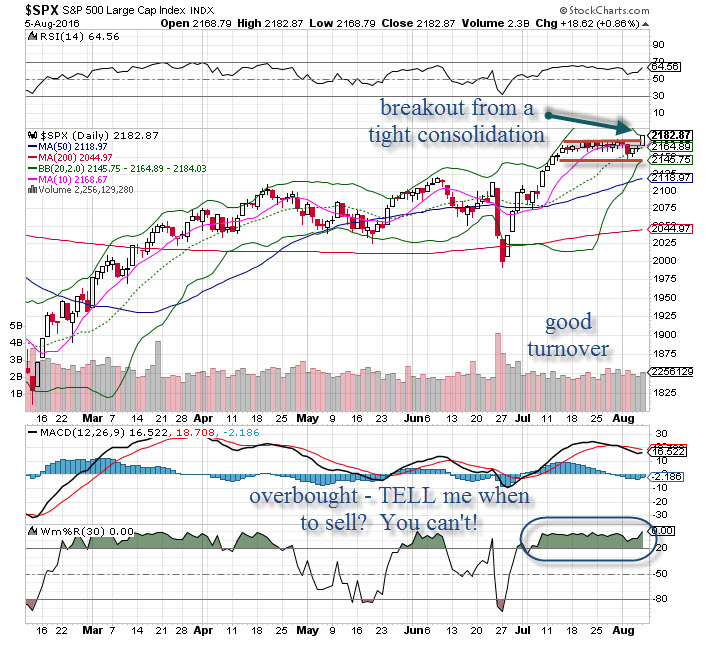

Let's take a look at the S&P 500 chart. A breakout Friday on expanded turnover after a sideways consolidation that could have gone either way. However, basing at a high level historically indicates the breakout will be higher, which is what we see. Confirmation is always key. But the indicators continue to reflect overbought conditions. The quality of this breakout is solid.

But, we know that is NOT a reason to sell or become bearish. Momentum trends can/do stay strong longer than most expect, hence why it is so difficult timing the markets. For now, we'll stay with the market trend with the expectation there will be some give back at some point. If a breakdown does occur, we'll see it - but won't rely on any noisy pundits with their guesses.