Slightly hard to be motivated to share chart setups with the Nice news flooding across my screens. A sad state of affairs on society reflected in markets not even batting an eyelid to another major terrorist attack. This is the new normal.

The show must go on and we saw GBP/USD whipsaw up and then back down as Mark Carney and the Bank of England left rates on hold at 0.5% overnight.

As we discussed in yesterday’s ‘bang bang cable‘ blog, market expectations for a rate cut was high, and the rally on last night’s no change highlights the misplaced expectations.

So this decision all but means that markets know that next month is go for a cut, and if the market was short expecting a cut now, how can you possibly be bullish the pair going forward? Well, bar a change in rhetoric from the Fed which we clearly aren’t going to get.

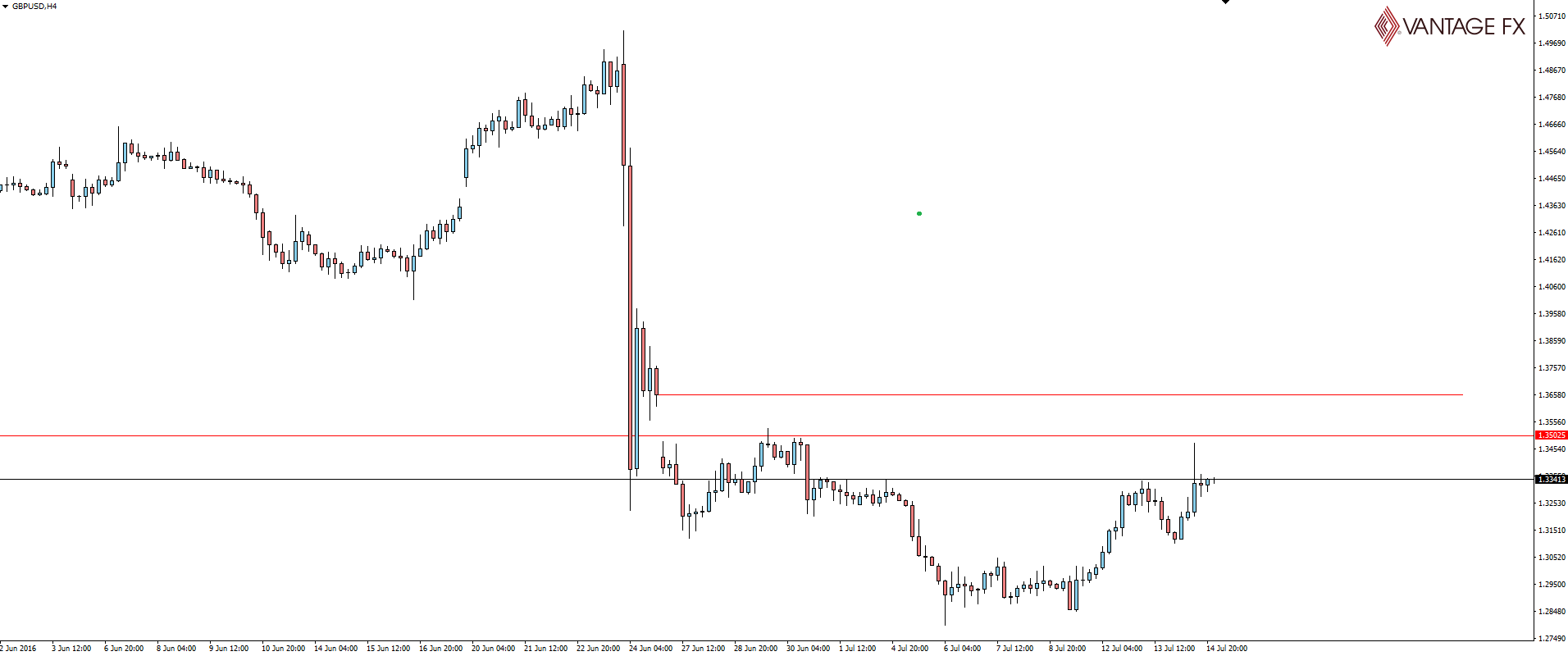

GBP/USD 4 Hour:

In the decision fallout, price has spiked up to test the GFC low line we have marked on our chart and was rejected quite hard. That level and the gap level that we highlighted yesterday might get some attention near term, but they have to be seen as selling opportunities, surely.

From a good news spike to a bad news spike, NZD/USD didn’t fare quite so well on the day and continues to be crushed in early Asian trade as I type.

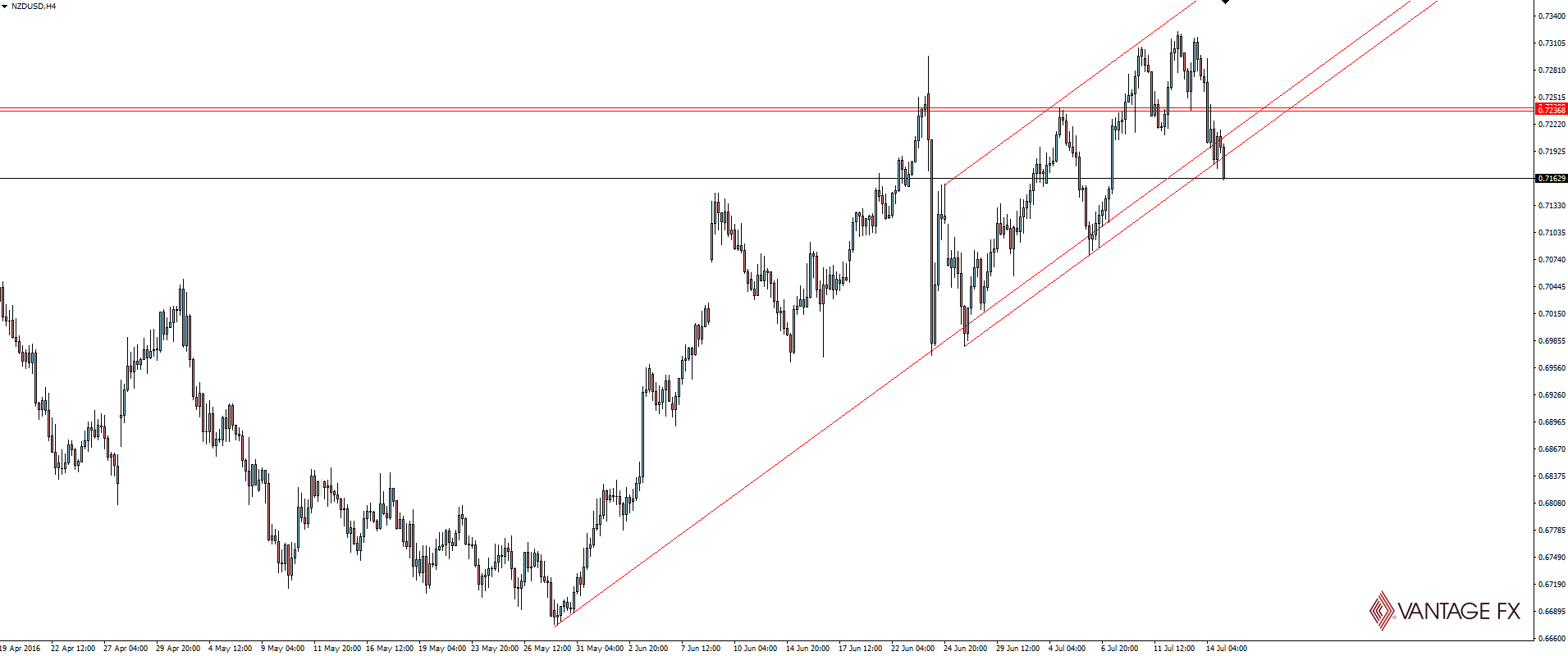

NZD/USD 4 Hour:

Yesterday saw the Reserve Bank of New Zealand opt to provide the market with an extra update on July 21, before it’s already scheduled communications later in the month.

Anything that needs to be communicated by a central bank ASAP must be bad… right? Kiwi traders certainly thinks that is the case anyway.

Lastly for the week, the helicopter money story continues to unfold on USD/JPY:

On the Calendar Friday:

CNY GDP y/y

CNY Industrial Production y/y

CAD Manufacturing Sales m/m

USD CPI m/m

USD Core CPI m/m

USD Core Retail Sales m/m

USD Retail Sales m/m

USD Prelim UoM Consumer Sentiment

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.