The Bank of Canada left interest rates unchanged overnight, pulling an over expectant USD/CAD down to support.

Lower growth forecasts and concerns about stroking a red hot housing market in major cities Vancouver and Toronto saw the bank keep things in check within the statement.

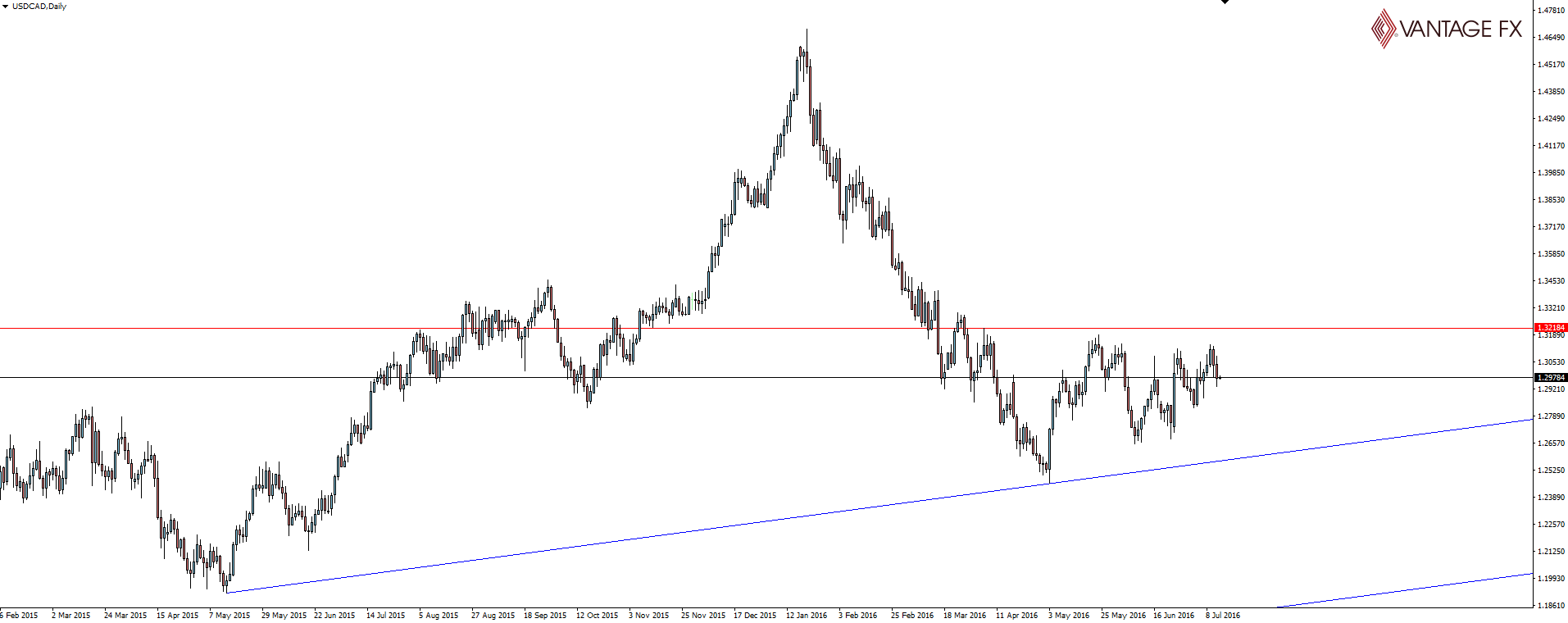

USD/CAD Daily:

Fundamentally, the BoC seems to be taking the path that issues of lower growth have been caused by temporary speed-bumps such as wildfire influenced oil output and external pressures stemming from the Brexit vote. This uncertainty has seen targets for a ‘return to normal economic conditions’ pushed back further into 2017.

Taking a look at the above USD/CAD daily chart, even with the 2000 pip drop between January and May, the higher time frame charts still show USD/CAD in a strong bullish trend.

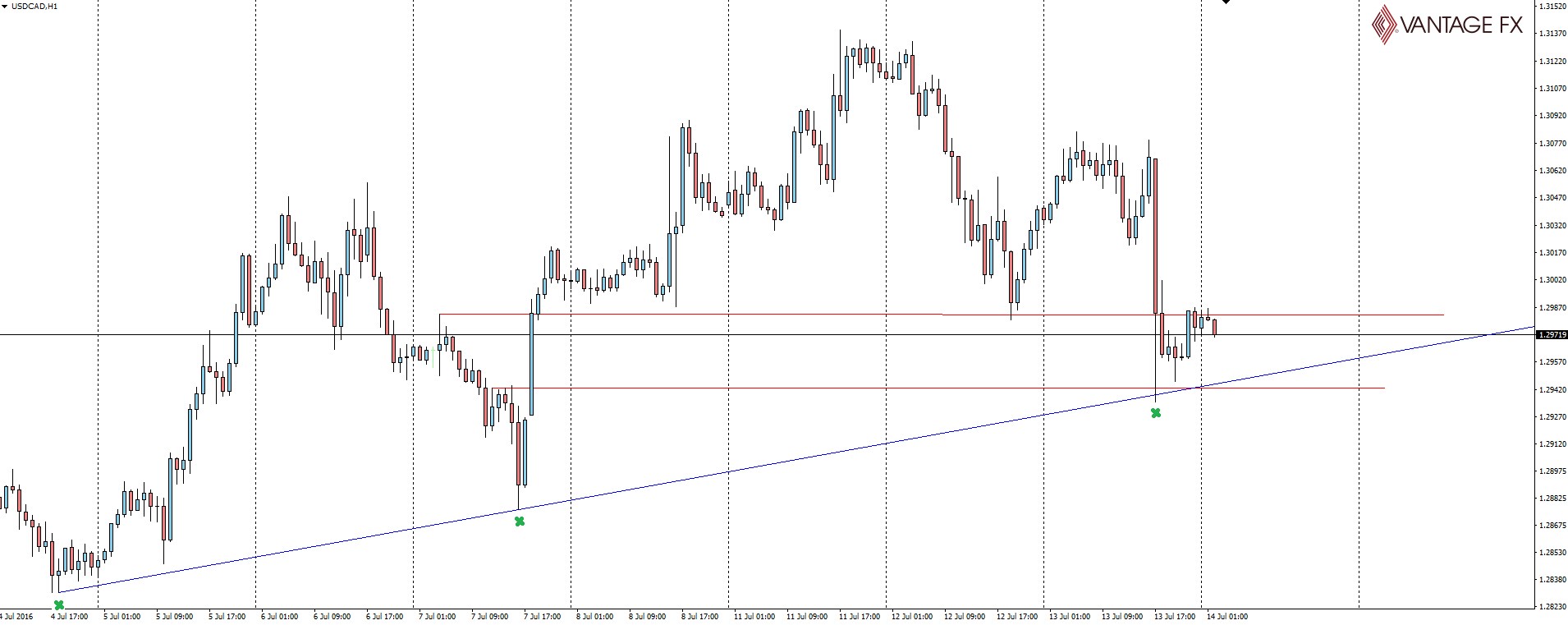

Following the rate decision, and more importantly the accompanying statement, the pair has been respecting the lower time frame levels nicely too.

These are your clearly defined levels to manage your risk around. Now you have to make the call whether you play for a bounce off trend line support and buy a pullback into an intra-day previous resistance turned support level, or position yourself for a bearish breakout through support and target the daily trend line.

The BoC has kept a calm external face which has supported the CAD and caused the sell-off in USD/CAD. Absorb that fundamental standing into your higher time frame trading and try to use market expectations in your trading decisions.

Next up on the central bank merry-go-round, we have the Bank of England who are expected to cut the official bank rate tonight from 0.50% to 0.25%.

It wasn’t that long ago that we were sharing that curve chart displaying the stance of central banks and the only two on the hawkish side were the Fed and the BoE. How quickly and easily things change!

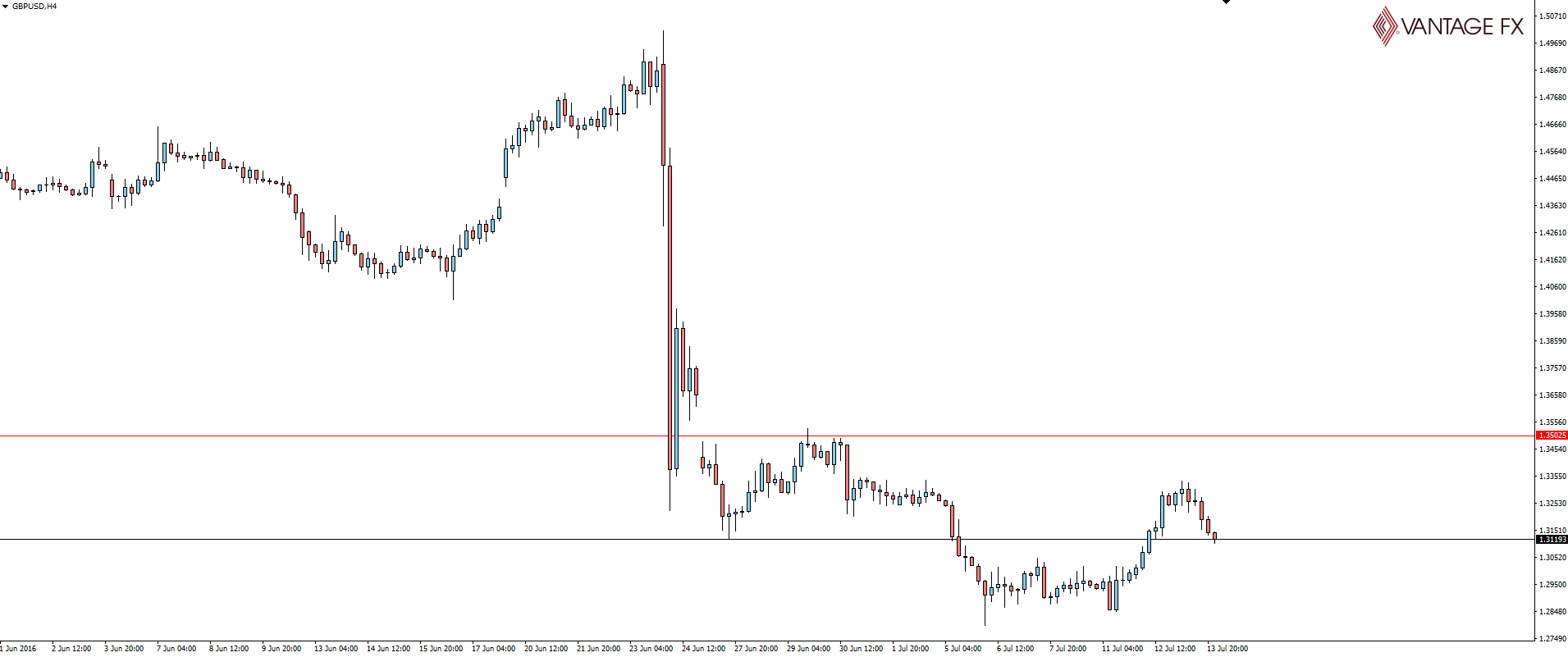

GBP/USD 4 Hour:

Levels on Cable are difficult now that price is printing new lows. You have the major line being the GFC low and then the post-Brexit weekend gap just above it, but that’s about it.

While markets are expecting an interest rate cut tonight, if it doesn’t come then it’s definitely coming in August. Cable has already started to sell off today and it will be interesting to see the downside reaction whichever way the BoE goes because of the way it has now all but been priced in.

While we’re still guiding our way through the Brexit fallout, it’s really hard to make a call on market position. If you see opportunity in the uncertainty, just be aware of your key levels.

Finally just a heads up that we have Aussie employment data up next. Yes, the release that economists and traders don’t trust. Beware.

On the Calendar Thursday:

AUD Employment Change

AUD Unemployment Rate

“The French National Day commemorates the Fête de la Fédération of 1790, which celebrated the unity of the French people one year after the Storming of the Bastille.”

GBP MPC Official Bank Rate Votes

GBP Monetary Policy Summary

GBP Official Bank Rate

USD PPI m/m

USD Unemployment Claims

Dane Williams – @VantageFX

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.