Along with the regular media cycle dribble of fluctuating Brexit polls run by every second man and his dog, we get the first tier one data release for the week in Monetary Policy Minutes from the Reserve Bank of Australia.

While the RBA Minutes are unlikely to be game changing, the fact that Stevens wasn’t overly keen on further cuts during his statement two weeks ago could open up a little bit of risk in a surprise that way if there was more to it. I can’t say that I’m expecting anything out of the ordinary and the rhetoric used will most likely have been run of the mill in a month such as this.

August is still where the expectation lies for the next cut, but traders will be keeping an eye out for how the RBA views the Australian economy’s recent uptick in growth.

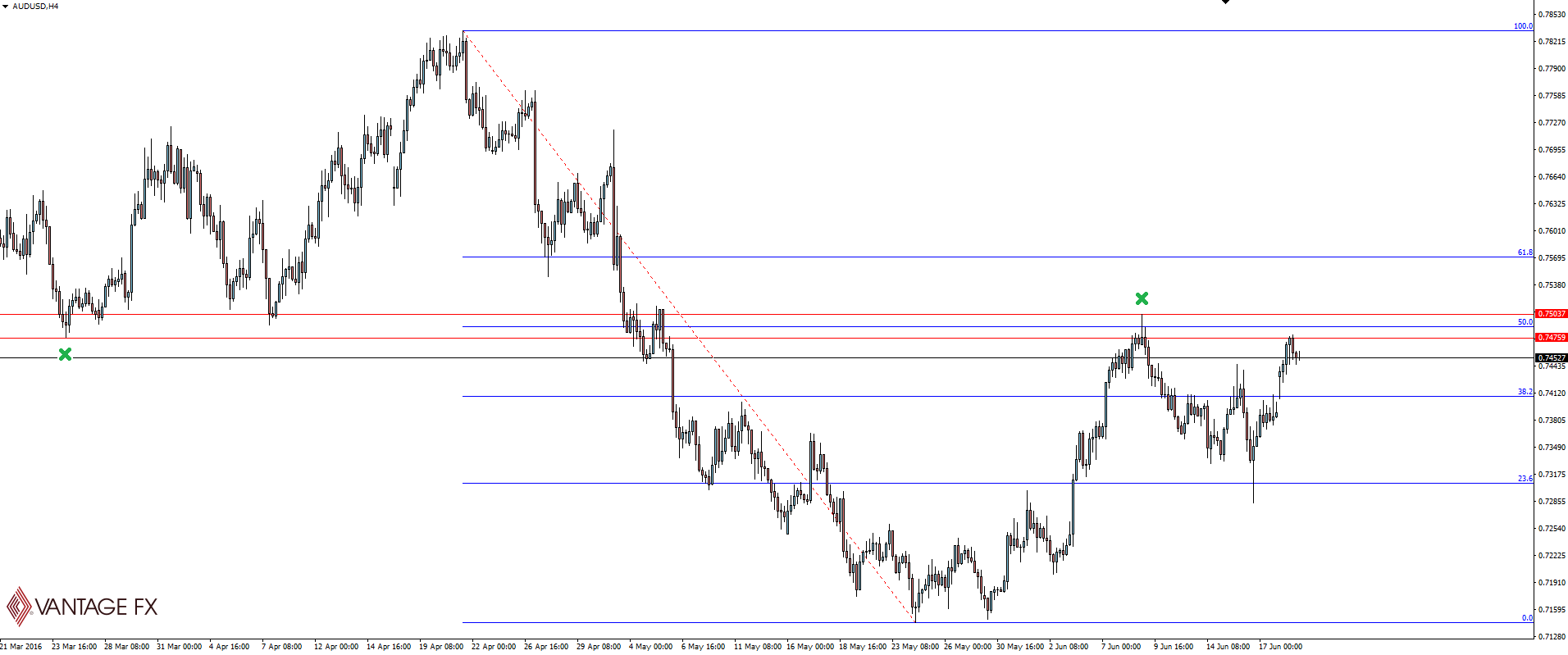

AUD/USD 4 Hour:

Taking a look at the AUD/USD chart and you can see the unclosed gap to start the week still in play as the Aussie rallied back up into resistance. The Aussie’s gains to start the week have been more about riding on the coattails of other risk assets, most notably the British pound, as traders start to get nervous about how reliable Brexit polling and bookie chatter about a Brexit result could be.

I love the fibs on this chart because the 50% level lines up exactly, smack bang in the middle of the resistance zone which has come back into play.

The risk on environment we’re seeing really is just a realisation by markets that last week they were scammed about the momentum that the Brexit campaign was building and that in their panic, they pushed the market too far. This rally really is just an unwinding of this panic trade rather than anything fundamentally different in sentiment.

I’ve been thinking about the change in polling results following British MP Jo Cox’s murder, and how any human being might react to a polling question posed to them even mentioning her name. If you were asked whether someone’s death is horrific circumstances would affect you, of course you are going to say yes. Whether it will have an effect come June 23rd behind closed doors on the other hand is completely different.

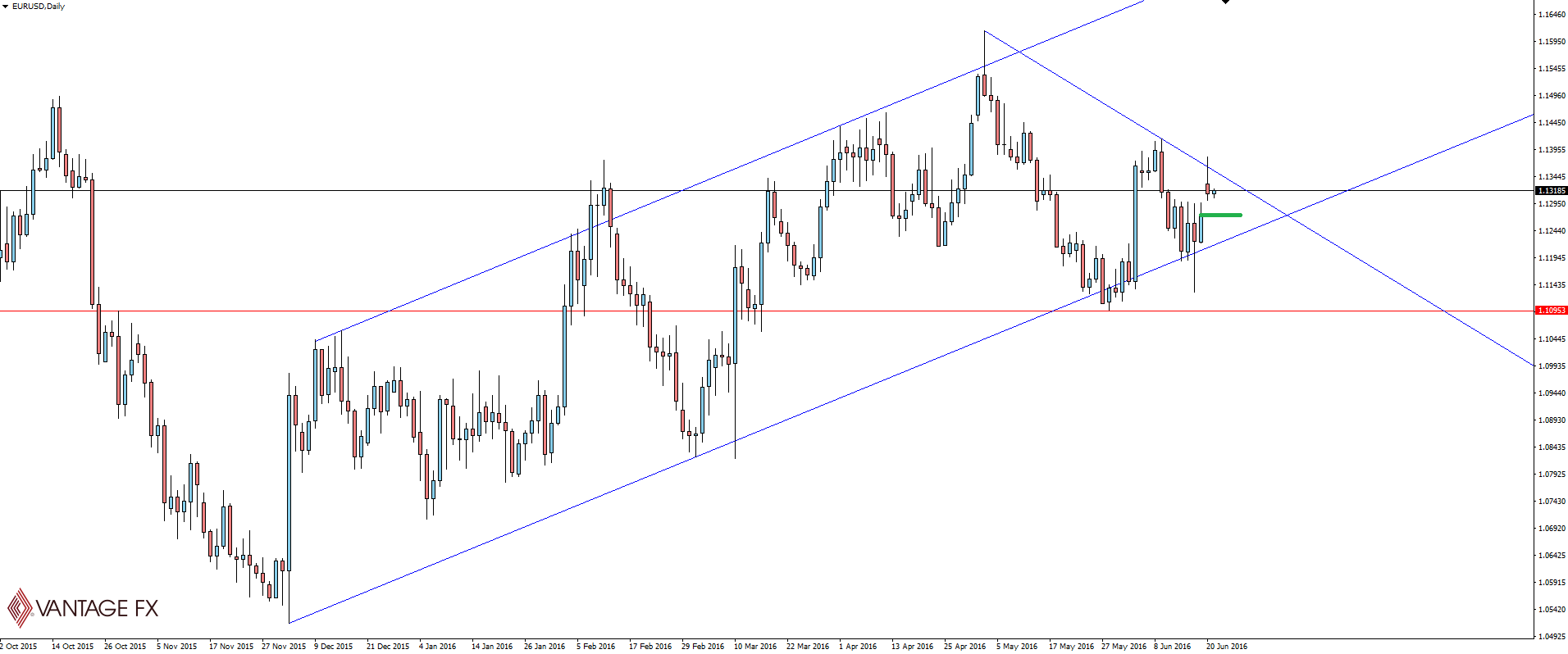

Chart of the Day:

Today’s chart of the day is for the gap-fill traders which I know we have on the Vantage FX book. If this is you, I could feel your eyes light up about today’s trading prospects when you saw all those Monday morning gaps pop up all over your MT4 charts.

Take your pick on where you want to play it, but EUR/USD looks to be in play to me.

EUR/USD Daily:

The bullish channel on the daily has been capped by a nice counter trend resistance line and the gap just looks ripe for the taking following that daily close.

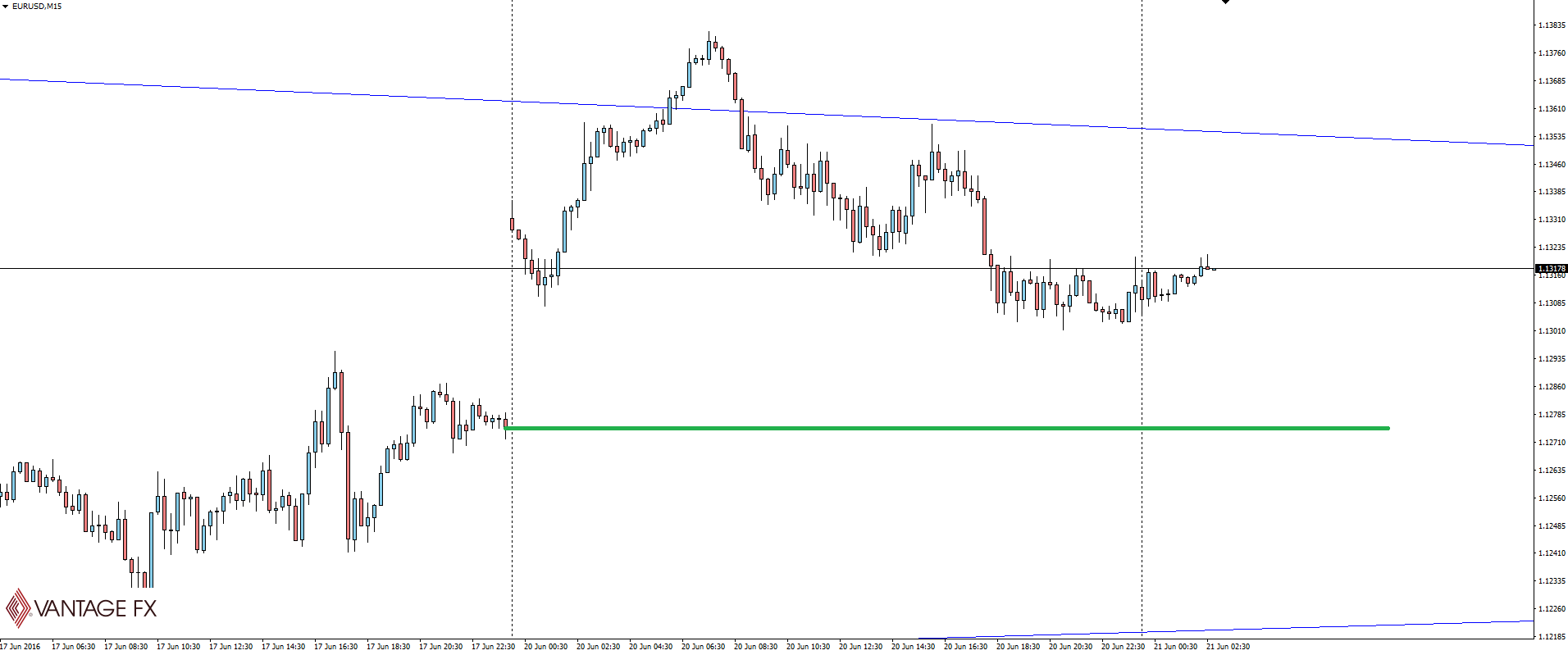

EUR/USD 15 Minute:

Is the setup too good to be true?

If you’re a gap-fill trader, where are you looking to play? Give @VantageFX a mention on Twitter and join the #TuesdayFX discussion!

On the Calendar Tuesday:

AUD Monetary Policy Meeting Minutes

EUR German Constitutional Court Ruling

“The German Federal Constitutional Court is due to announce a ruling regarding the constitutionality of the ECB’s Outright Monetary Transactions policy (OMT), in Karlsruhe.”

EUR German ZEW Economic Sentiment

EUR ECB President Draghi Speaks

USD Fed Chair Yellen Testifies

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.