The weekend was all about the diminishing odds of a Brexit, as polling started to shift back toward Bremain and the media fallout of Joe Cox’s murder stayed front and centre.

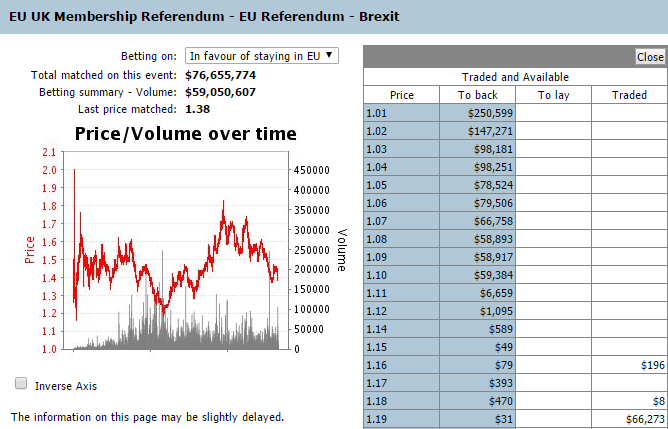

This has caused the bookies’/betting exchange odds for remain to come further in as highlighted by the following Betfair price/volume over time chart:

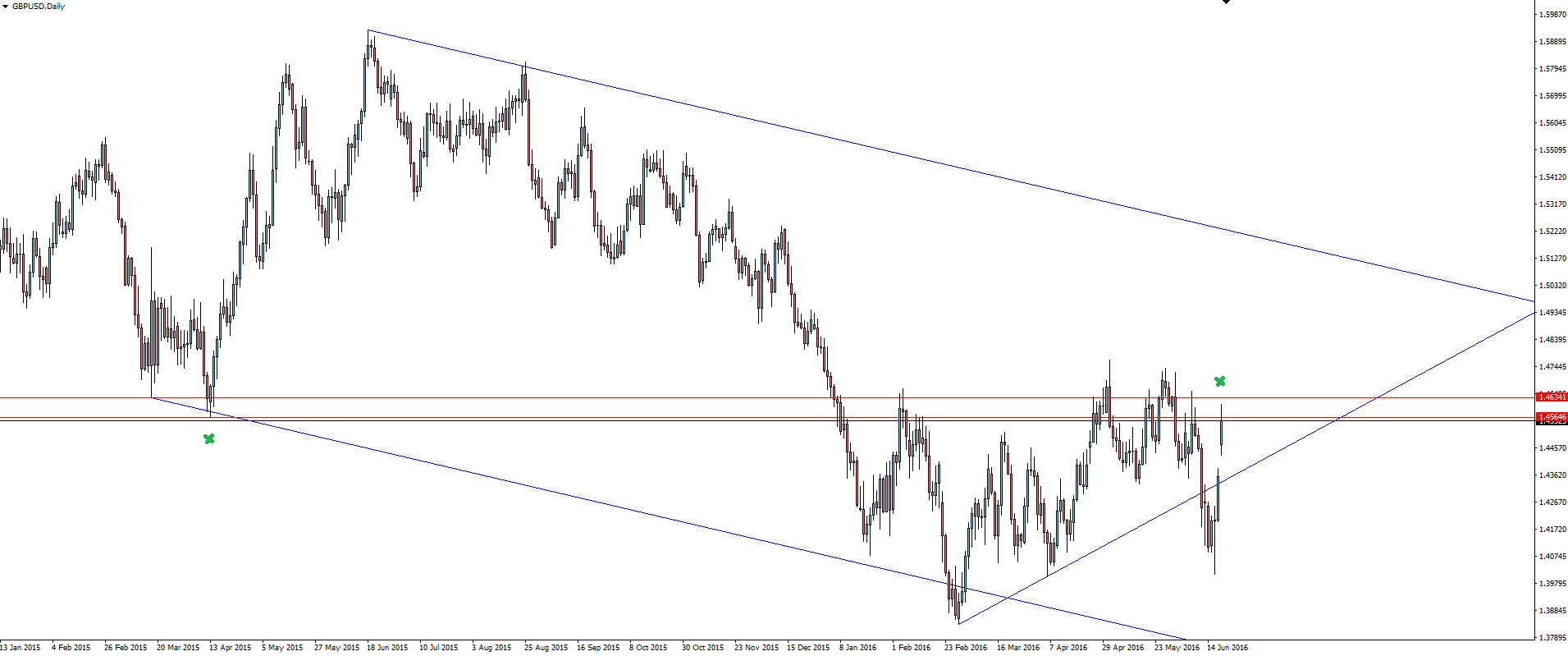

Across financial markets, this has seen a shift back into risk, most notably of course in cable as shown by the price action in our charts of the day below.

From a fundamental point of view, it’s all about the polls. Polls that have zero scientific backing, tiny sample size and run by organisations with self interest one way or the other. This is what makes trading this vote so tough and why price is so up and down.

Here is a weekend Brexit Poll rundown from ForexLive to give you a snapshot of why Cable is rallying:

Opinium: 44% Leave, 44% Stay

YouGov: 43% Leave, 44% Stay, 9% Undecided

Survation: 42% Leave, 45% Stay, 13% Undecided

Another aspect of the campaign race is the way that each of the major British newspapers has come out and publicly backed a side in the race. The Guardian ran a nice story over the weekend featuring each of the major paper’s published stances.

The Sunday Times being the latest of the big players to back a Brexit:

Just like the polls, following the papers is tough for traders because each decision is so shrouded in self political interest. For example The Sunday Times weekday sister paper backed remain midweek… I’m sure some of our British traders with greater knowledge of the tabloid landscape can comment further on this.

Heading into Brexit week, just be aware that with our client’s best interests in mind that we have made some risk management calls surrounding some of our markets:

– Temporary Change in Margin Requirements

– ‘Close Only’ Forex Pairs

Chart of the Day:

While I can’t advocate trading GBP/USD heading into this week, it’s kind of like a car crash you can’t look away from.

GBP/USD Daily:

The weekend’s polling action has given us a huge gap and rally to the upside, straight into higher time frame (HTF) resistance that we’ve had on our cable daily chart for a while now.

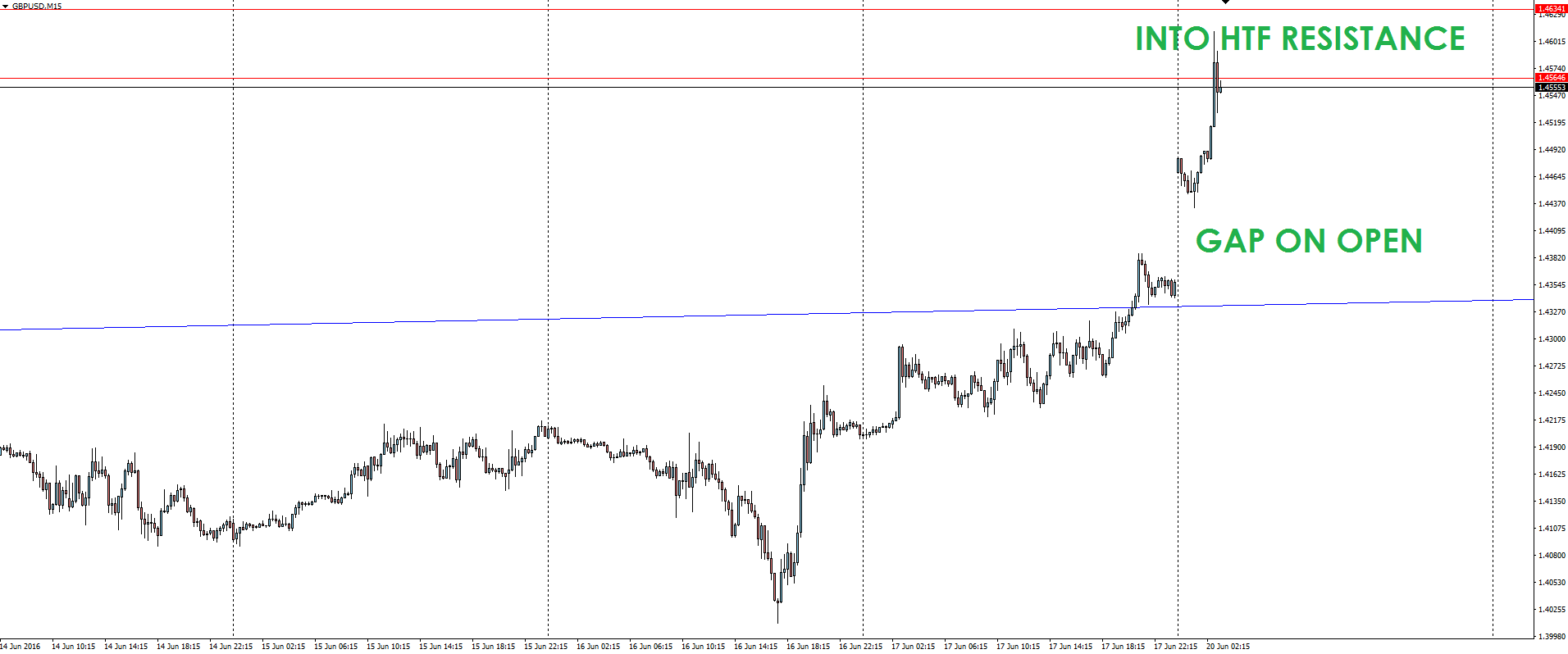

GBP/USD 15 Minute:

The 15 minute chart shows the opening price action well. Price has taken its first breather exactly where it’s expected to. For now.

Are you trading GBP pairs heading into the referendum? Let us know by mentioning @VantageFX on Twitter.

On the Calendar Monday:

No tier one news to start the week. All about Brexit headlines and polls tonight so keep Twitter or your News Terminal open.

Just be aware that surrounding the big ticket Brexit vote, we have the RBA minutes as well as two testimonies from Janet Yellen and US unemployment to contend with.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.