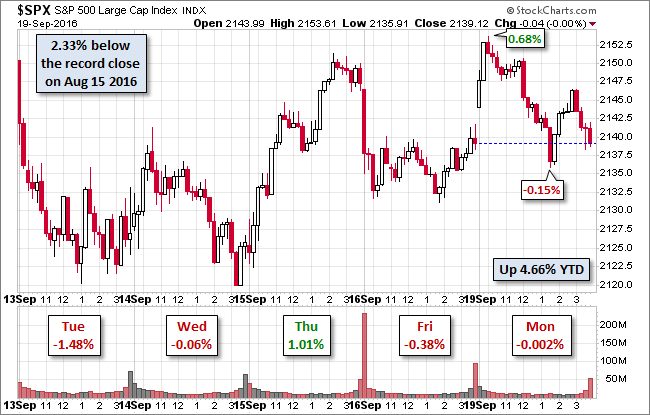

In advance of the Wednesday outcome of the meetings by the Federal Reserve's FOMC and the Bank of Japan, our benchmark S&P 500 ended a choppy session with a flat finish (technically in the red at -0.002% to three decimal places).

The choppiness was reflected in the opening rally to a 0.68% that sold off to a -0.15 intraday low in the early afternoon. A bit of early day-trading ended the session on a cautious note.

The yield on the 10-year note closed at at 1.70%, unchanged from the previous session.

Here is a snapshot of past five sessions in the S&P 500.

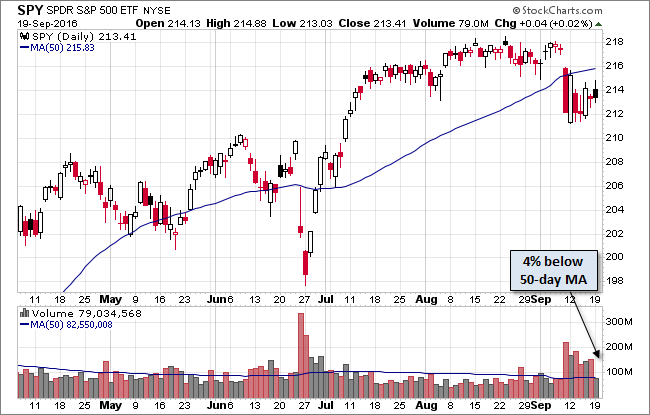

Here is daily chart of the SPDR S&P 500 (NYSE:SPY) ETF, which gives a better sense of investor participation in today's trade. After six mostly volatile sessions of high volume, today's volume was a touch below its 50-day moving average in advance of Central Bank Wednesday.

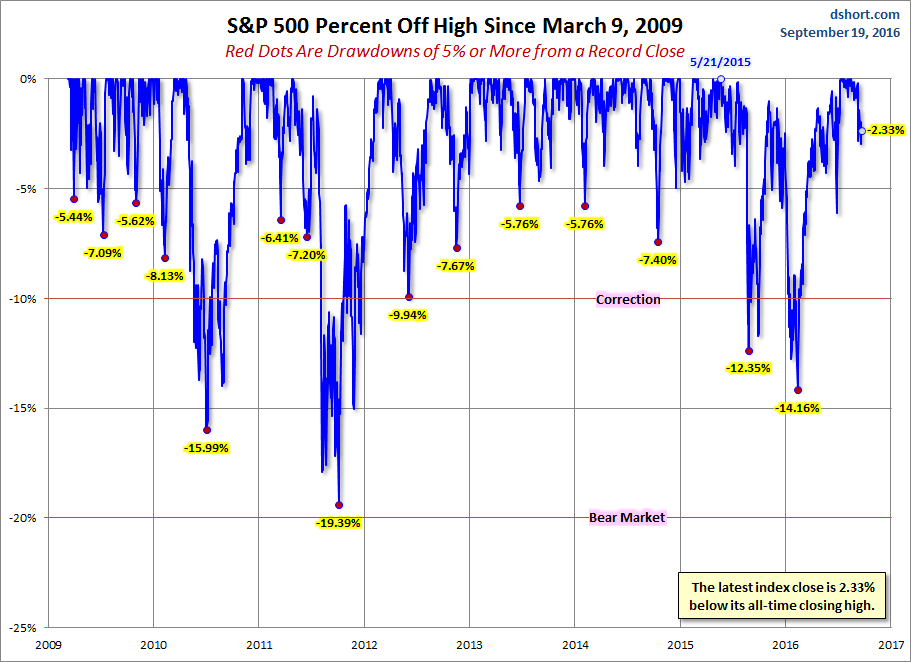

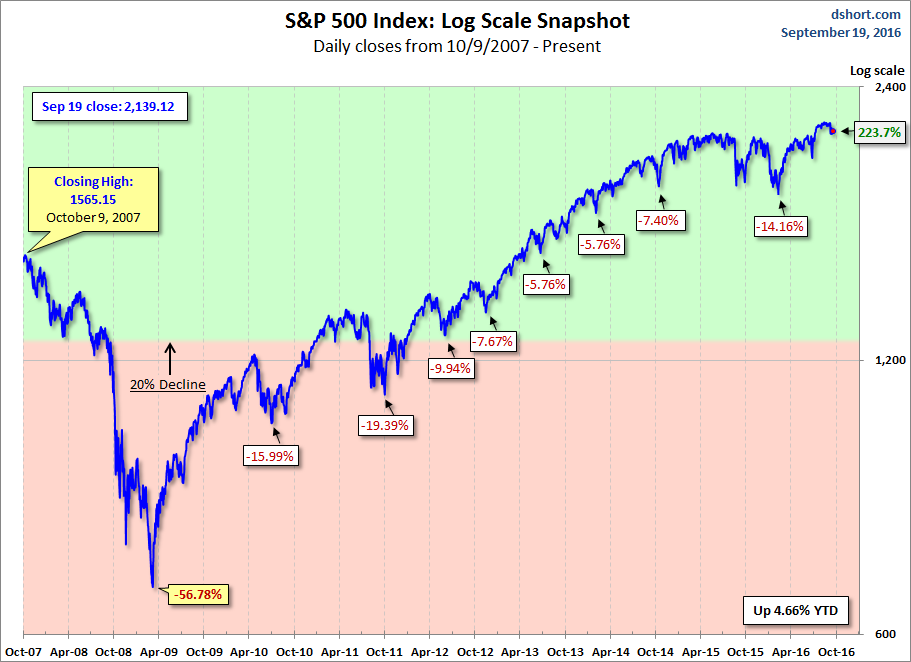

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

Here is a more conventional log-scale chart with drawdowns highlighted.

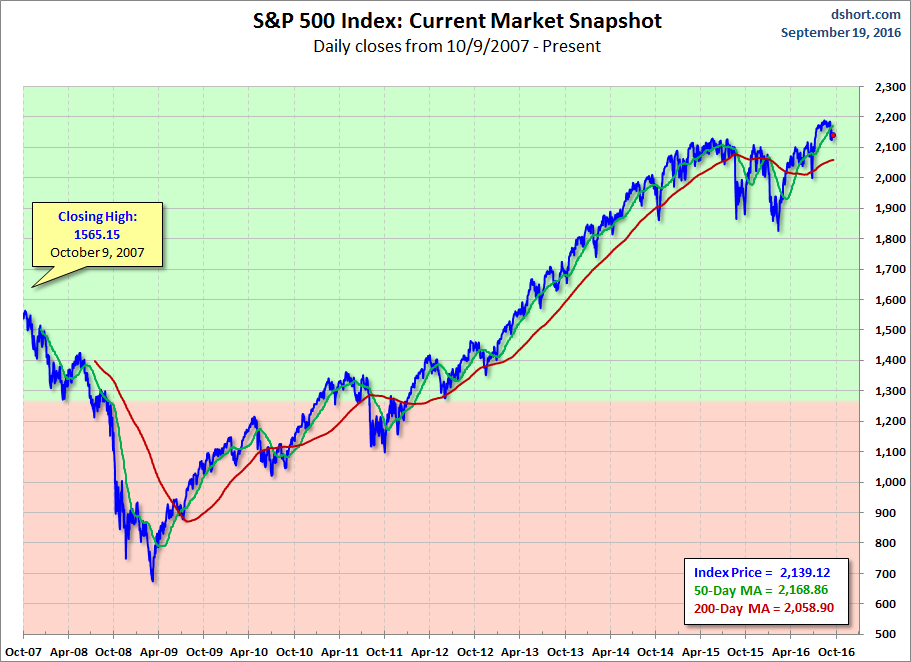

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

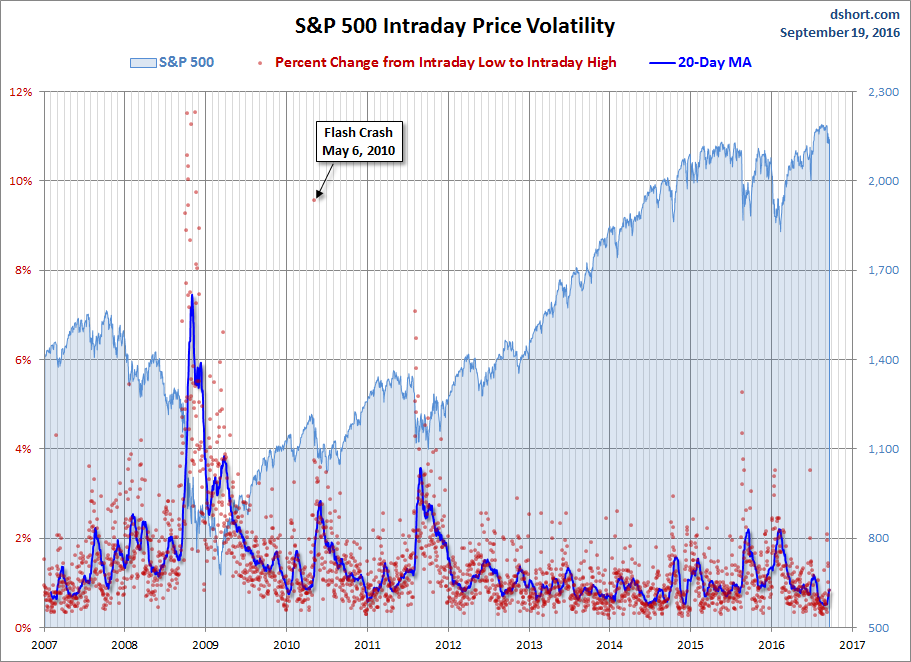

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.