Gold settled out the week yesterday, (Friday) at 1302. The last time gold closed above 1300 to finish a week was for that ending 15 August 2014: 1300 then felt terrible, today it feels terrific, even if but half what it "ought be" by the above scoreboard level of 2587. Still, at 1302, gold is +22.7% in 2016, and that's with 54% of the trading year yet in the balance. Oh were such pace only linear: we'd close out 2016 at 1584.

That noted, upon which we've oft doted, "change is an illusion, whereas price is the truth". And price being here at 1302 is very important, for not only is it above the 1240-1280 resistance zone, but moreover 'tis (barely) above Neverland, aka "The Whiny 1290s", wherein -- to reiterate -- gold became completely stuck ad nausea as the centerpiece area for some 16 months of trading in oscillating between the lower 1300s and upper 1200s from June 2013 through September 2014. And in just this past week alone, gold was thoroughly thrashed this way and that within those very 1290s such as to make many-a-marketeer reach for the barf bag. To have settled the week above 1300? Grand; but best to keep your trade station manned. In hindsight by 2016's end, we'll look back to right here as gold's greatest technical test of the year.

For if in the new week -- replete with the United Kingdom's Brexit referendum (Thursday 23 June) and an otherwise light calendar for incoming EconData -- Gold throughout stays north of 1280, we'll formally declare that "we now know that the bottom is in", (as measured from last 03 December's low of 1045). In turn, that shall enable us to revise our projected high for this year from 1280, (which was met on 04 March), northward to one of our most noted landmark levels from back in 2013: Base Camp 1377. That'd be an increase in 2016 just shy of 30%. Can gold actually rise by that much in a single year? Remember 2007? (+31%).

To be sure, the Gold Gloves were out in full punch this past week, price refusing to relent after briefly falling back into the 1240-1280 resistance zone, whilst jabbing and counter-punching time-and-again against the weakening Shorts whom lurk in The Whiny 1290s. On Thursday alone, gold fell from an intra-day -- and 2016 -- high of 1318, smack down to 1280, only to -- in the fighting spirit of the great Ali -- bob, weave and box its way back up yesterday to regain the 1300s.

And credit the Golden Glow borne of uncertainty. In last week's missive "A Gold-Positive Danger Signal", we cited recent failings within generally-reliable technical signals from reaching our Market Rhythm Targets for those components that make up BEGOS (Bond / Euro / Gold / Oil / S&P). This lack of follow-through-to-target phenomenon was underscored in the wee hours here yesterday morning when an analyst quipped on Bloomy Radio that with respect to the current market environment, "...good luck forecasting anything...". 'Twas quite the gold positive we'd anticipated.

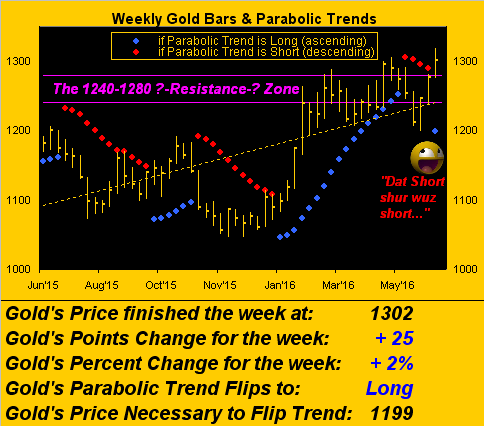

Here's another gold positive: price's gaining 2% this past week was enough to flip the parabolic Short trend back to Long on the weekly bars. That ended the prior Short trend's duration as denoted by the red dots on the below chart at just four weeks. And how short was just four "Short" weeks? Short enough to tie for the third shortest Short trend this millennium. Moreover: the last time a Short trend was this short in duration was for the four-week period ending 04 Jan 2008, after which gold embarked on an 11-week parabolic Long run, rising as much at 19% from 866 to 1034. To repeat that from here would blow price well beyond Base Camp 1377. Here are the weekly bars from one year ago-to-date, the rightmost blue dot heralding the new parabolic Long trend:

Toward the vote on Brexit, regardless of the polling data, the betting parlours remain odds-on (Ladbrokes (LON:LAD) presently at 4-to-9) that "Brexit shan't passit", the UK thus to remain as the third most-populous member of the 28-state European Union. But upon Brexit's failing, should gold not become too brow-beaten such as to fall well back down and get stuck in the 1240-1280 resistance zone, Base Camp 1377 by year's end shall start to look really good. Still, when it comes to odds, recall the Carolina Panthers being a double digit "no-brainer" favourite to win the Super Bowl over the "old man " Denver Broncos this past February? Oops.

Speaking of "oops" let's turn for a moment to the stock market. As we highlighted last week, (and having so done on many occasions), an S&P 500 trading at double its earnings valuation is quite scary. Now: consider these FinMedia headlines which crossed the wire this past week: "Scared investors flee to cash at highest levels since 2001" - "In recent weeks global fund managers have increased their cash stockpiles to the highest level since November 2001" - "China Is Now Dumping US Stocks" - "There Have Almost Never Been This Many Global Stocks in Decline". Even former Federal Reserve Bank of Dallas President Richard Fisher was just quoted as saying: "All my very rich friends are holding a lot of cash". Query: Given all that presumed selling activity, how come the stock market isn't going down, hmmmmm? The S&P's settle yesterday at 2071 is but a wee 2% below its highest close year-to-date (at 2119 less than two weeks ago on 08 June). "Oh S&P, how doth thou ever buoy thyself when all around ye flee?"

"Sinister forces are at work, mmb..."

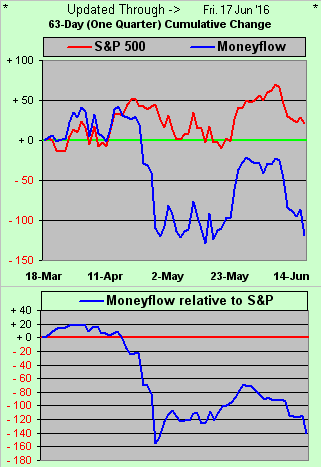

Ah, Squire, a brilliant quotation there from the beloved Inspecteur Clouseau. But be it buoying in the S&P futures contract by sinister spoofing, algorithmic aggression, or just a plain ole love of stocks, believe me thee: the "Oops of the Millennium" is sittin' out there. Don't forget the two BEGOS Markets which suffered the least adversity through the Black Swan event of 2008/2009 were the Bond and Gold. And even though the S&P remains breathtakingly buoyed, its declining moneyflow supports those above cited headlines about serious stocks selling. Here from three months ago-to-date is the percentage track of the S&P 500 (red), that of our moneyflow measure (blue) as regressed into S&P points, and the difference of the two in lower panel of the graphic:

"Oops" indeed. That said, despite the Federal Open Market Committee's interest rate balk on Wednesday, the Economic Barometer, too, remains buoyed by last week's reported improvements in Business Inventories acceleration, up-ticks in Wholesale Inflation data, swings from negative to positive readings in both the New York State Empire Index and Philadelphia Fed Index, the NAHB Housing Index returning above 60 for the first time since January, and a rise in Building Permits. Here's the Baro:

'Course, the FOMC balked upon May job creation getting boffed. Further, speculation is now such that the FedFunds target may get upped but only once more this year, (from 0.50% to 0.75%). And conservatively came a BNP Paribas (PA:BNPP) analyst this past week saying they see no rate increase for the next two years, economic growth being lackluster. As well, Allianz (DE:ALVG)'s Mohamed El-Erian emphasized on Tuesday in this "new normal", slow growth era that the FOMC has become "overly data dependent" and that its members "don't have a vision" of economic direction. At least you and I can watch the Baro.

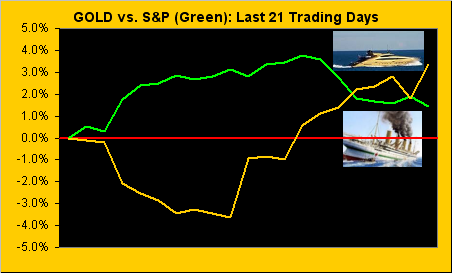

Bringing gold back into the fold, here we've its percentage track over the past 21 trading days (one month) versus that of the S&P; reminiscent of great ships that pass in the night:

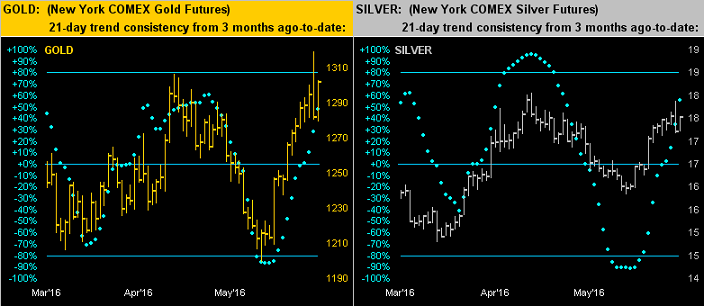

Next to our "Baby Blues" graphic for the Precious Metals, displaying their daily bars from three months ago-to-date. And not only are the two price paths for both gold on the left and silver on the right similarly shaped, but so too are the tracks of their respective baby blue dots -- those daily readings of 21-day linear regression trend consistency -- both sets rising with alacrity since May's end. Indeed month-to-date in June alone, the gold price is +7.1%, whilst that for silver is +9.5%:

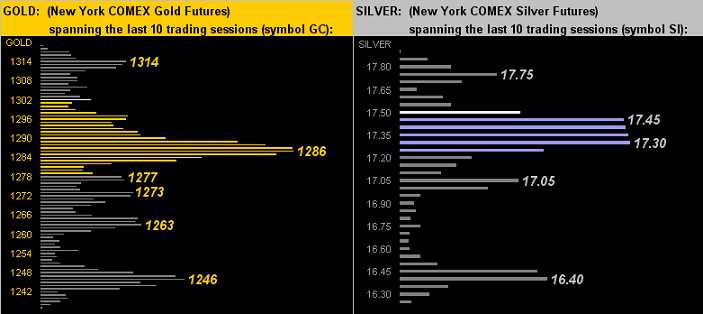

Similarly side-by-side, here are the Precious Metals' 10-day Market Profiles, (the horizontal bars representing contract volume traded per price point). For gold (left) -- notably with respect to Brexit if the UK rejects it -- the knee-jerk reaction to dump gold ought test its ability to hold at that 1286 apex. And same can be said for Sister Silver (right) toward surviving above her 17.45-to-17.30 profile shelf:

So with "Nuthin' But Brexit" in the balance for the ensuing week, we'll leave you with these few worldly notes:

■ You no doubt saw that the yield on die Deutsche Bundesbank 10-year bond went negative this past week. That's right out of the ole "You can pay us to lend to us" play-book. Ach du lieber!

■ Indeed, can things be that slow in the EuroZone, given its Industrial Production just rebounded in April by 1.1% following two months of decline? According to the EU's statistical arm, Eurostat, April saw improved output in capital goods, furniture, kitchen machinery ("Il faut manger!") as well as in non-durable consumer goods. But as the economics of the EuroZone maintain the stance of the EuroYoyo, shall they actually sell all that stuff?

■ Meanwhile, the ever-prescient Schweizerische Nationalbank is on alert -- if Brexit pulls the upset -- to go into action should the Swiss franc then go upside gonzo nutz. Fortunately, there's no one Goldenische Nationalbank to keep the lid on there.

■ And speaking of banks, is the world ninth-largest one by assets - Bank of America (NYSE:BAC) - shrinking? So 'twould seem on various fronts. Its investment arm is seeing clients shrink to cash at never before recorded levels; its stock price at this writing has shrunk year-to-date by 20%; and now the work force is to shrink by some 8,400 jobs as digital banking enables the closure of branches. Pity the poor bank teller. I started at the BNP as a bank teller, pre-digital. We kept customer accounts on ledger cards, engaged in writing cash-in and cash-out tickets, and typed cashiers checks and foreign drafts on IBM (NYSE:IBM) Selectric II typewriters. Today's teller operates with the click of a mouse and the rather over-enthusiastic "How is your day going?" chit-chat of a Walmart (NYSE:WMT) greeter. Mind the June payrolls report (due 08 July).