U.S. factory activity has overcome its persistent sluggishness of last year on the back of steady job creation, a stable dollar and strong overseas demand. The industrials sector has also been gaining a lot of traction lately thanks to President Trump’s plan to increase infrastructure spending.

For the first quarter, industrial production – a measure of output at factories, mines and utilities – rose at an annual rate of 1.5 %. The momentum continued in the second quarter with U.S. industrial production logging growth of 1.1% in April compared with March, marking its biggest gain since Feb 2014. Industrial production remained unchanged in May compared with April.

A drop in manufacturing output was offset by increases in mining and utilities output to keep the index flat in May. Though manufacturing output declined 0.4% in May; it is well within the range of normal monthly volatility. Factory production has gone up 1.4 % in the last 12 months. Total industrial production in May was 2.2% above year-earlier level.

Growth Momentum to Continue in Q2

The Industrial Products sector (one of the 16 broad Zacks sectors), put up a 28.5% growth in earnings in first-quarter 2017 on the back of 8.7% increase in revenues. The proportion of companies beating both earnings and revenue estimates was 72.7%. For second-quarter 2017, an 11.5% growth in earnings is projected on the back of a 12.2% rise in revenues. (Read more: Earnings Growth to Continue in Q2)

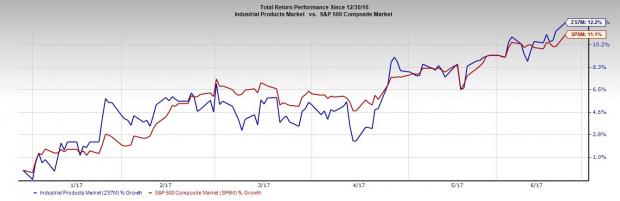

An Outperformer

Year to date, the industrial products sector has outperformed the S&P 500. The industry has clocked a gain of 12.2%, ahead of the S&P 500’s gain of 11.1%.

Favorable Position

The bullish Zacks Sector Rank of 2 carried by the industrial products sector is a testimony to the fact that it is back in favor. The favorable rank places the sector in the top 13% of the 16 sectors we cover.

Thus it would be a prudent idea to invest in some industrial stocks that have compelling prospects and are well poised to run higher leveraging improving market conditions. We highlight the following stocks, armed with a Zacks Rank #1 (Strong Buy) or 2 (Buy), and are worth considering for investment right now. You can see the complete list of today’s Zacks #1 Rank stocks here.

Caterpillar Inc. (NYSE:CAT) , the mining and construction equipment behemoth boasts a Zacks Rank #1 and is a good pick at the moment. It has a long-term earnings growth rate of 9.5%.

The company delivered a positive average earnings surprise of 40.25% in the last four quarters. The Zacks Consensus Estimate for fiscal 2017 has gone up 28% in the past 60 days and is currently at $4.13, reflecting year-over-year growth of 20.73%. The estimate for fiscal 2018 has gone up 18% to $5.15, reflecting 24.75% year-over-year growth.

Deere & Company (NYSE:DE) , producer of agricultural equipment and a leading manufacturer of construction, forestry, and commercial and consumer equipment flaunts a Zacks Rank #1. Deere has a long-term earnings growth rate of 9.17%.

Deere outpaced the Zacks Consensus Estimate in the trailing four quarters, generating an encouraging positive average earnings surprise of 70.41%. The estimate for fiscal 2017 climbed 32% to $6.31 in the past 60 days. The Zacks Consensus Estimate for fiscal 2018 also moved north 23% to $6.82. The projected growth rate for fiscal 2017 is 31.12% and for fiscal 2018 at 8.10%.

Parker-Hannifin Corporation (NYSE:PH) , a global diversified manufacturer of motion & control technologies and systems, sports a Zacks Rank #1. It has a long-term earnings growth rate of 9.39%.

The company has a robust earnings surprise history, with consecutive earnings beats in the four trailing quarters, with an average positive earnings surprise history of 14.94%. The Zacks Consensus Estimate for fiscal 2017 has gone up 5% in the past 60 days and is currently at $7.91, reflecting year-over-year growth of 22.37%. The estimate for fiscal 2018 has gone up 6% to $8.90, reflecting 12.62% year-over-year growth.

Pentair plc (NYSE:PNR) , a diversified industrial manufacturing company, carries a Zacks Rank #2. It has an estimated earnings growth rate of 11.41%.

Pentair outpaced the Zacks Consensus Estimate in the trailing four quarters, generating an encouraging positive average earnings surprise of 5.29%. The estimate for fiscal 2017 inched up 1% to $3.52. The Zacks Consensus Estimate for fiscal 2018 also moved north 2% to $3.92, in the past 60 days. The projected growth rate for fiscal 2017 is 15.52% and for fiscal 2018 at 11.23%.

Colfax Corporation (NYSE:CFX) , carrying a Zacks Rank #2, is one of the leading manufacturing and engineering companies, which specializes in products and services related to gas and fluid handling, and fabrication technology. It has a long-term earnings growth rate of 10.83%.

The company has an average positive earnings surprise of 9.45% in the last four quarters. The Zacks Consensus Estimate for fiscal 2017 has gone up 3% in the past 60 days and is currently at $1.71, reflecting a year-over-year growth of 9.81%. The estimate for fiscal 2018 has gone up 5% to $2.00, reflecting 16.93% year–over-year growth.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Parker-Hannifin Corporation (PH): Free Stock Analysis Report

Colfax Corporation (CFX): Free Stock Analysis Report

Pentair PLC. (PNR): Free Stock Analysis Report

Original post

Zacks Investment Research