Over the past month, the US dollar has significantly passed positions in the foreign exchange market.

Quotations of gold futures on Wednesday reached a 1-month high near the mark of 1274.00 dollars per troy ounce against the backdrop of continuing geopolitical uncertainty and weakening of the dollar. The dollar, in practice, lost all the achievements it won earlier against the background of Donald Trump's victory in the presidential election in the US position.

This can not be said about US stock indexes, which significantly increased over the past month. The technological index NASDAQ grew particularly strong, which closed with growth for the seventh consecutive month, reaching new historical highs in May. It seems that investors are less concerned about the problem with the slip in the implementation of the new economic policy by the administration of Donald Trump. The American economy demonstrates stable growth, and this is the most encouraging of customers.

Today, the dollar and US indices are traded in a narrow range in anticipation of the publication of important macro statistics for the US. In the period from 12:15 to 14:00 (GMT) a whole block of important macroeconomic indicators is published. The most important of them are: the ISM business activity index in the manufacturing sector (for May) and the index of gradual inflation acceleration. We expect weaker indicators than in the previous month, which could negatively affect the dollar and stock indices before the publication of key labor market data for May. Nevertheless, in absolute terms, the figures look very decent.

Also worth paying attention to the report of ADP on the level of employment in the private sector of the US for May.

Usually this indicator has a strong impact on the market. Investors often consider it a harbinger of the NFP, although no direct correlation with Non-Farm Payrolls is usually noted. Strong data positively affects the dollar. Here, the growth is expected (185,000 versus 177,000 in April), which will support the US dollar and US stock indices.

In general, macro statistics are expected to be very positive, which will have a positive impact on the dollar.

The euro/dollar pair gained new support after statements by the president of the Bundesbank, Jens Weidmann, that "the ECB's governing council is beginning to discuss the timing and the possibility of adjusting further plans". ECB Board member Sabine Leutenschälger also noted that "it is necessary to be prepared for a slow reduction in the dose of monetary stimulus".

These statements are in contravention of the recent ECB President Mario Draghi's earlier statements that he made earlier it is premature to curtail the stimulus program for the Eurozone economy, but the ECB representatives' new statements nevertheless supported the euro.

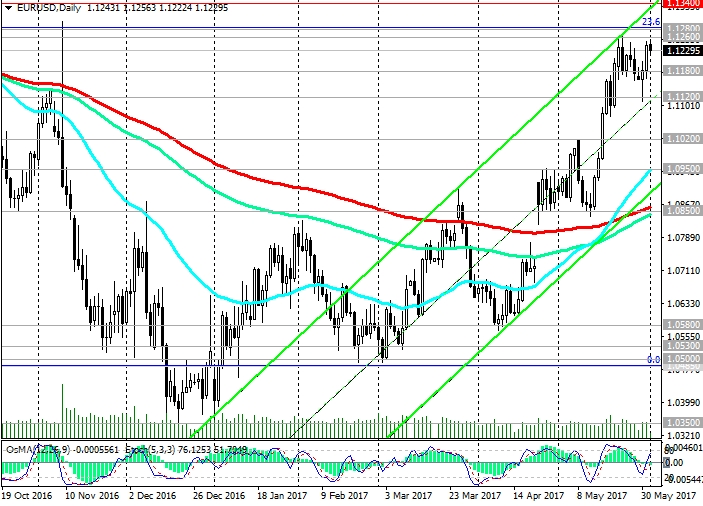

In May, the pair EUR/USD reached new annual highs near the level of 1.12600. Since the opening of today's trading day, there has been a decline in the EUR/USD pair.

Meanwhile, the pair EUR/USD keeps positive dynamics, trading in the uplink on the daily chart. Technical indicators on the daily, weekly, monthly charts are still on the buyers’ side. But on the 1-hour and 4-hour charts, the indicators unfold on short positions, signaling a downward correction. Its target can be the support levels 1.1180 (200-period moving average on the 1-hour chart, the bottom line of the uplink on the 4-hour chart), 1.1120 (May lows). However, only the breakdown of the support level 1.1020 (200-period moving average on the 4-hour chart) will call into question the uptrend of the pair. Finally, the uptrend can be reversed only after the breakdown of the key support level 1.0850 (200-period moving average on the daily chart).

Positive dynamics persists. In the case of resumption of growth, the targets will be the levels of 1.1260 (local and annual maximum), 1.1280 (Fibonacci level of 23.8% of corrective growth from the lows reached in February 2015 in the last wave of global decline from 1.3900), 1.1340 (144-period sliding Average on the weekly chart).

Support levels: 1.1180, 1.1155, 1.1120, 1.1100, 1.1020, 1.1000, 1.0950, 1.0850

Resistance levels: 1.1260, 1.1280, 1.1340

Trading recommendations

Sell Stop 1.1220. Stop-Loss 1.1255. Take-Profit 1.1200, 1.1180, 1.1120, 1.1020, 1.1000, 1.0950, 1.0850 Buy Stop 1.1255. Stop-Loss 1.1220. Take-Profit 1.1260, 1.1280, 1.1340