Consolidation And Confusion Often Precede Big Moves In Stocks

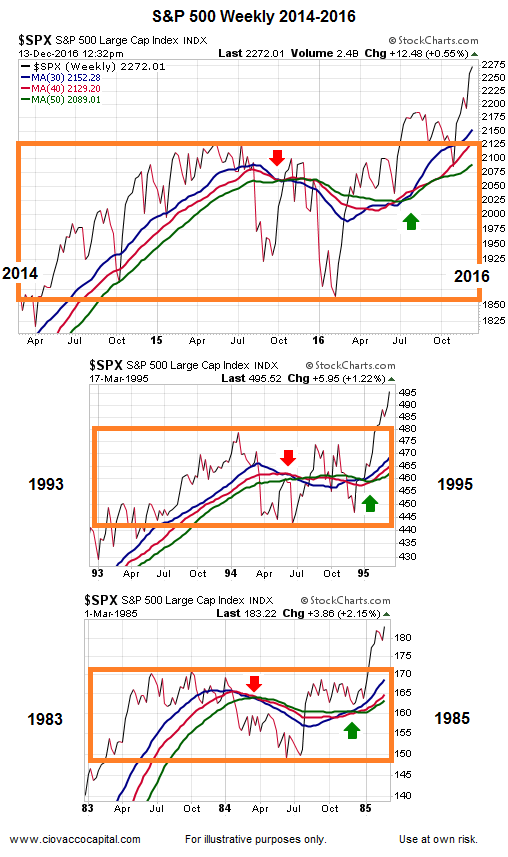

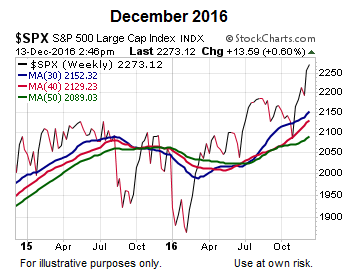

The S&P 500 recently broke out of a multiple-year consolidation box, similar to the breakouts in 1995 and 1985 (see three charts below). The possible relevance for 2016-2017 can be seen by reviewing the historical charts in this post (1982-2016).

Since human psychology, greed, and fear have remained consistent throughout human history, markets often trace out similar patterns near key turning points. The three weekly charts above reflect similar human behavior. In all three periods:

- Stocks consolidated for roughly two years, which is indicative of a relatively even match between bulls and bears.

- When fear dominated in the orange boxes, long-term trends flipped negative for a relatively brief period (red arrows).

- Bullish conviction eventually was strong enough to flip the long-term trends back in the bull’s favor (green arrows).

- Eventually, the period of consolidation and indecisiveness ended as stocks broke above the orange boxes.

Only Ten Similar Trend Changes Have Occurred Since 1982

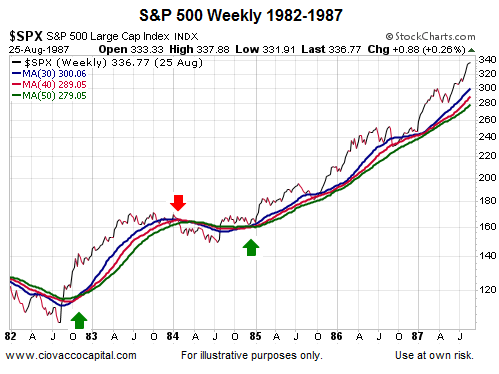

While 2016 is radically different in many ways to every year between 1982 and 2015, markets move based on the net interpretation of all the fundamental data of the day. When the net interpretation flips bearish, negative trends tend to form (red arrows). When the net interpretation flips to the bullish end of the spectrum, long-term bullish trends tend to dominate (green arrows). Therefore, while the mix of fundamental data (valuations, earnings, Fed policy,…) varies from period to period, the consistent theme is markets move based on the net interpretation of all the fundamental data. Once the net interpretation flipped bullish in the chart below, stocks rallied for some time.

Keep in mind, the first set of charts in this post showed the similarities between investor psychology in 1985 and 2016; the chart above shows what happened next in 1985.

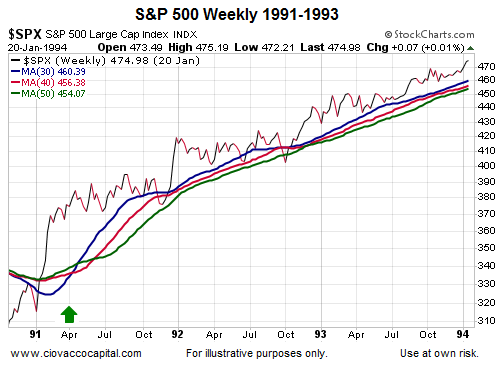

1991 Was Significantly Different Than 1982

While the mix of fundamental data was different, good things still happened after the net aggregate interpretation of the data flipped bullish in 1991 (green arrow below).

Detailed Look At All Ten Bullish Turns 1982-2015

The historical charts above were first covered in the August 19 video below. Since the bullish signals were published, the S&P 500 has gained 4.2%.

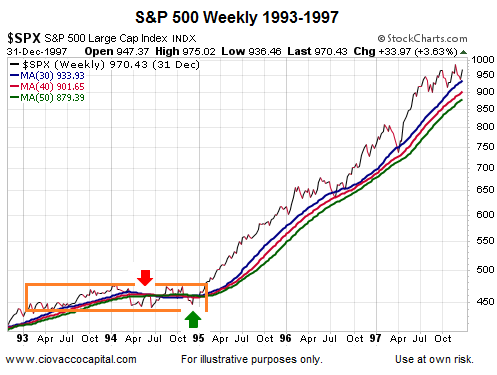

1994: The Longer A Market Goes Sideways

The chart below is a textbook example of the expression “the longer a market goes sideways, the bigger the move we can expect after either a bullish breakout or bearish breakdown”. Keep in mind, the first set of charts in this post showed the similarities between investor psychology in 1995 and 2016; the chart below shows what happened next in 1995.

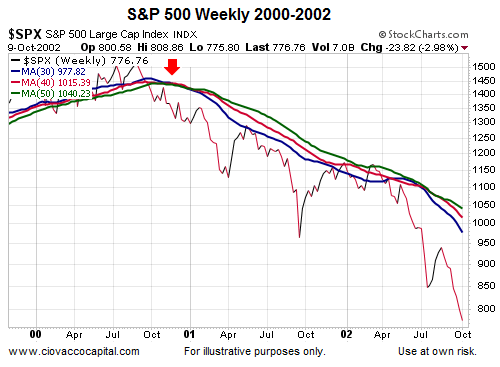

Bearish Breakdowns Are Part Of The Equation

While there is nothing magical about using the 30-, 40- and 50-week moving averages, they allow us to illustrate basic concepts about long-term trend shifts. Shifts can be bullish or shifts can be bearish, as shown in the 2000-2002 example below.

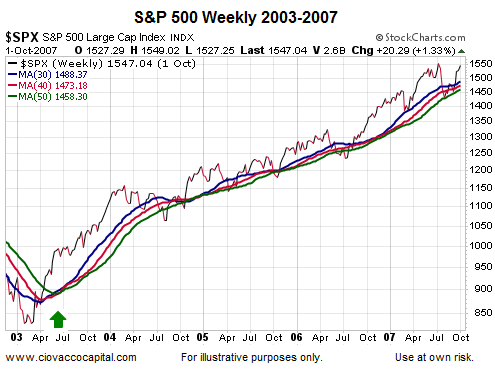

2003 Was Radically Different Than 1982

Are the fundamentals in 2016 different from the fundamentals in 1982 and 1994? Yes, just as the fundamentals were different in 2003 relative to 1982. The mix of fundamentals varies from year to year in the markets; a concept that has remained constant through history. Each year follows a unique script, with similarities sprinkled in among the variations.

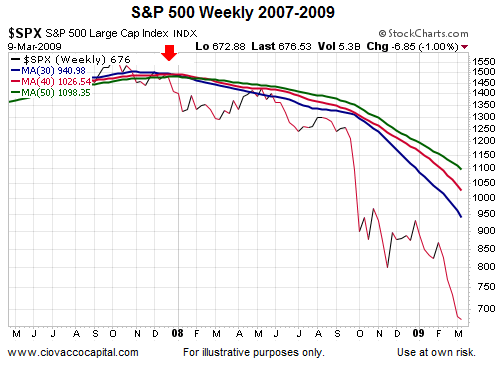

2007: Aggregate Opinion Turns Bearish

The net aggregate interpretation of all the fundamentals turned bearish in late 2007; stocks did not regain their footing until 2009.

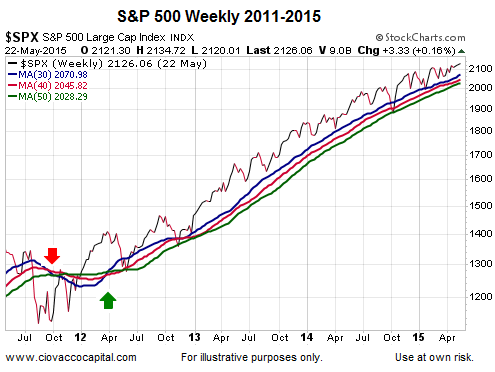

Harder Markets Often Followed By Easier Markets

Given the sideways price action within a wide range between late 2013 and late 2016, it is fair to say 2013-2016 falls into the “harder market” category when viewed from a long-term trend perspective. The easier period below (2013-2014) was preceded by a harder period (2010-2012).

Purpose Is To Understand Rather Than Forecast

This analysis shows the look of the present-day chart (below) and compares it to historical charts; nothing more…nothing less. The present day chart is a fact; the historical charts are facts; no opinions or political biases are involved.

Will the harder period (2013-2016) be followed by an easier period (2017-2019) marked by stronger and more decisive trends? Only time will tell. It should also be noted, these are long-term signals that assist us with probabilities looking out weeks, months, and years. These signals tell us very little about shorter-term outcomes (hours, minutes, days).

In our approach, if the trends remain in place, as they are today, we will maintain a growth-oriented stance. If the trends flip via another whipsaw, which is always possible, we will make the necessary defensive adjustments. Right now, the charts from a longer-term perspective look favorable. How they will look in three weeks, three months or three years falls into the to-be-determined category.