For the 24 hours to 23:00 GMT, the USD declined 0.35% against the JPY and closed at 112.86.

In the Asian session, at GMT0400, the pair is trading at 113.08, with the USD trading 0.19% higher against the JPY from yesterday’s close.

According to the minutes of the Bank of Japan’s (BoJ) December meeting, most of the board members believe that Japanese economy remains on a moderate recovery path. At the meeting, the BoJ kept the monetary stimulus unchanged as expected and raised its assessment of the economy.

Earlier today, data indicated that Japan’s Nikkei services PMI eased to a level of 51.9 in January, after recording a level of 52.3 in the preceding month.

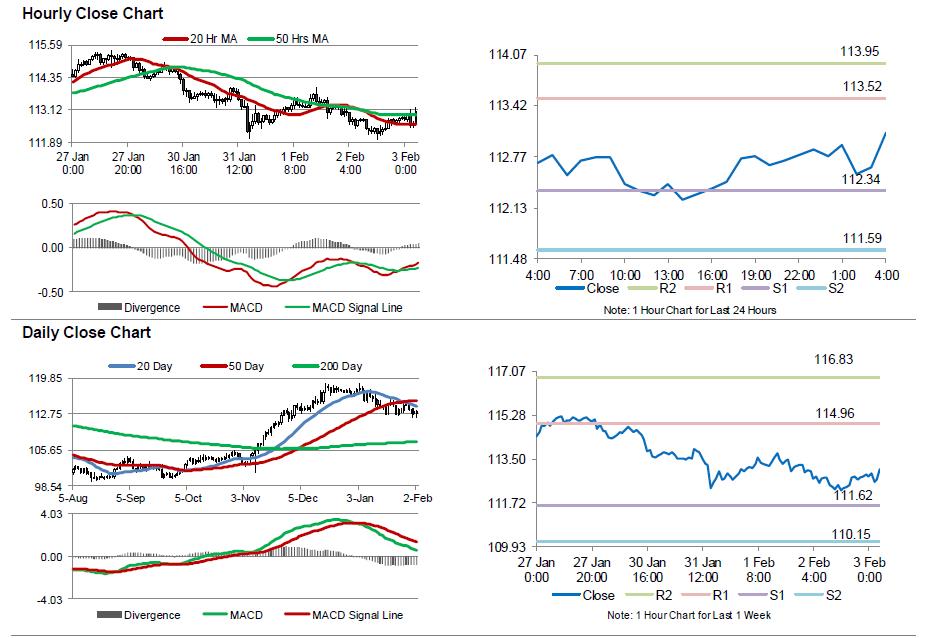

The pair is expected to find support at 112.34, and a fall through could take it to the next support level of 111.59. The pair is expected to find its first resistance at 113.52, and a rise through could take it to the next resistance level of 113.95.

Next week, investors will keep a close watch on BoJ’s summary of opinions report, trade balance (BOP basis) and Eco-Watchers survey data.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.