We were expecting gold bulls to take advantage of Trump risk to open the week- an issue that keeps rearing its ugly head.

In my opinion, today’s world means that traditional polling is dead. Trump risk is real because ‘regular people’ don’t want to be outspoken in their backing for someone like Donald Trump (exactly the same end of the political spectrum as Brexit), in fear of being publicly shamed into being insular/racist/dumb etc.

Come voting day when they can cover themselves in a private booth, Trump is going to get more votes than the polls say. Times have changed. In today’s social media world where every one of your thoughts is publicly recorded, this is how it is.

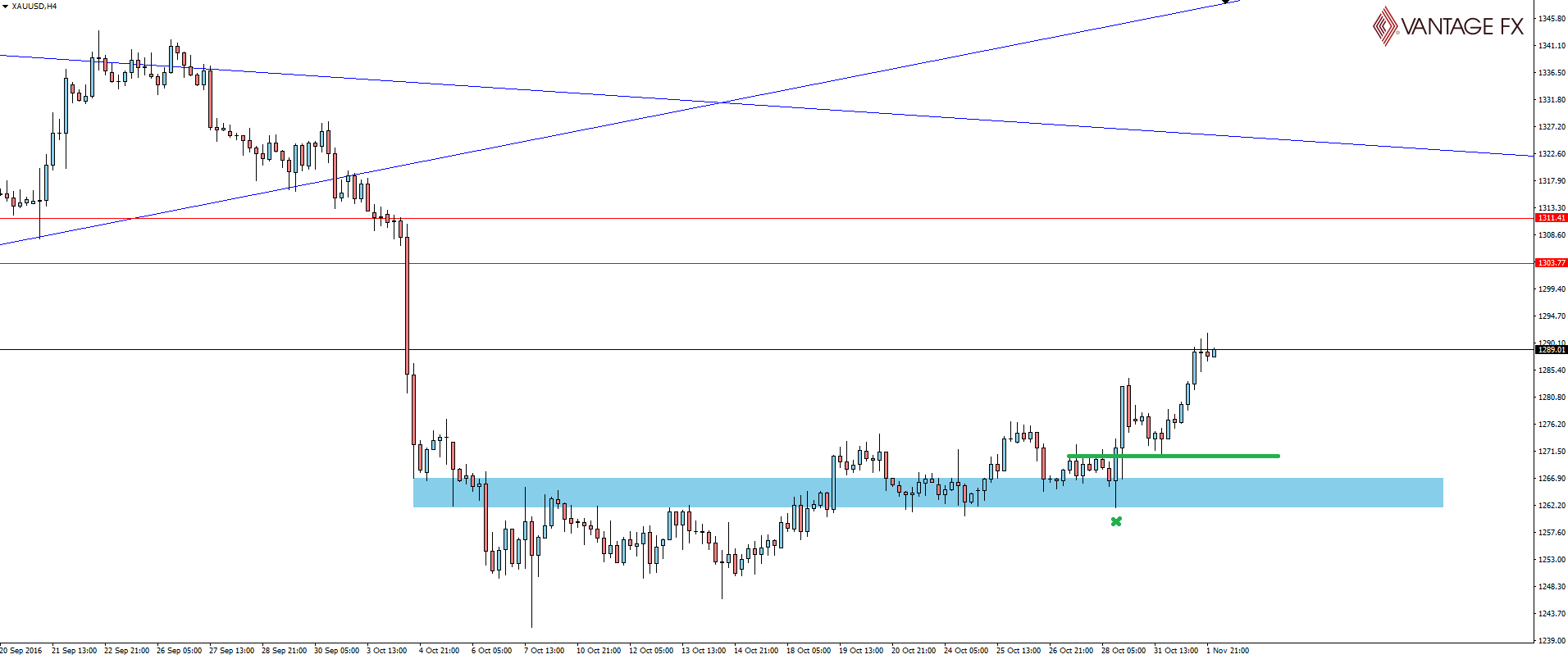

Anyway, back to ideas on how to take advantage of Trump risk in gold:

XAU/USD 4 Hour:

You can see that price on the gold daily pulled back nicely intra-day for a low risk, entry as soon as that retest of previous resistance held as support.

Gold longs are now sitting pretty with a potential free trade.

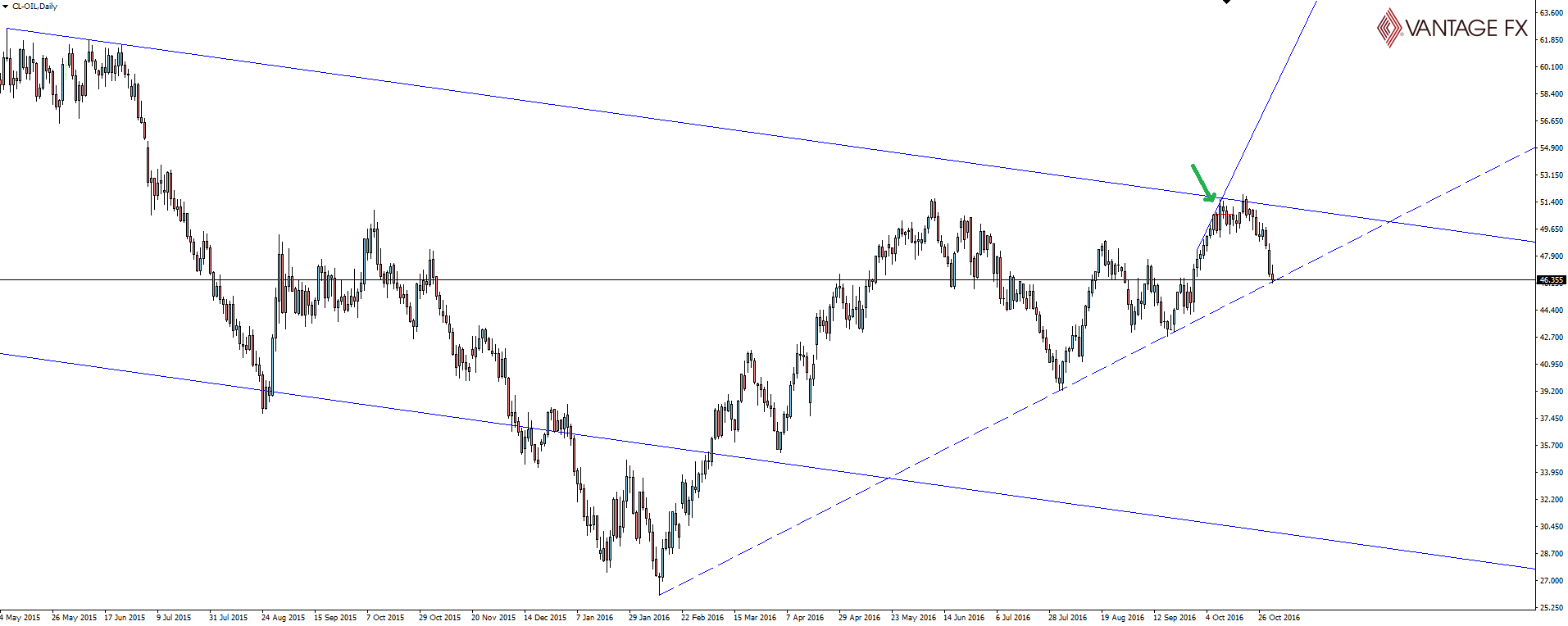

Moving onto commodities, remember the most recent OPEC production deal that we were sceptical of? Well as you can see on the chart, price had that one last headline momentum push into daily resistance on the news and that was that. Fade city!

It was here, we were happy to fade the endlessly hollow list of OPEC deals and agreements with this oil short setup.

Fast forward through the month to today’s daily candle, where price has settled on a nice counter-trend, trend line support level:

This is a good, major level that depending on a hold or break, you can look to zoom into and find intra-day levels to manage your risk around. Exactly the same as always, find the major higher time frame levels that are in play and then zoom in and look for intra-day retests to manage your risk around.

Wednesdays might be tough to get up for sometimes. But if you’re a trader, how can you not be excited to get in front of your charts with setups like these continuing to flow?!

On the Calendar Wednesday:

NZD Employment Change q/q

NZD Unemployment Rate

AUD Building Approvals m/m

NZD Inflation Expectations q/q

GBP Construction PMI

USD ADP Non-Farm Employment Change

USD Crude Oil Inventories

USD FOMC Statement

USD Federal Funds Rate

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.