This time it has to be different, right?

With key OPEC nations reaching a deal to limit the production output of oil to help support prices, we overnight saw the yearly high smashed.

No matter the 'boy that cried wolf' implications, deals keep being reported because it really is a never ending battle between key oil producers, with nobody wanting to give the upper hand to a business and political rival, even if it means taking a hit themselves.

The crazy inner politics of a monopolistic cartel, right!

Anyway, it was the addition of Russia to OPEC’s market price stabilisation efforts that saw price take out those yearly highs and put some real technical pressure on the chart.

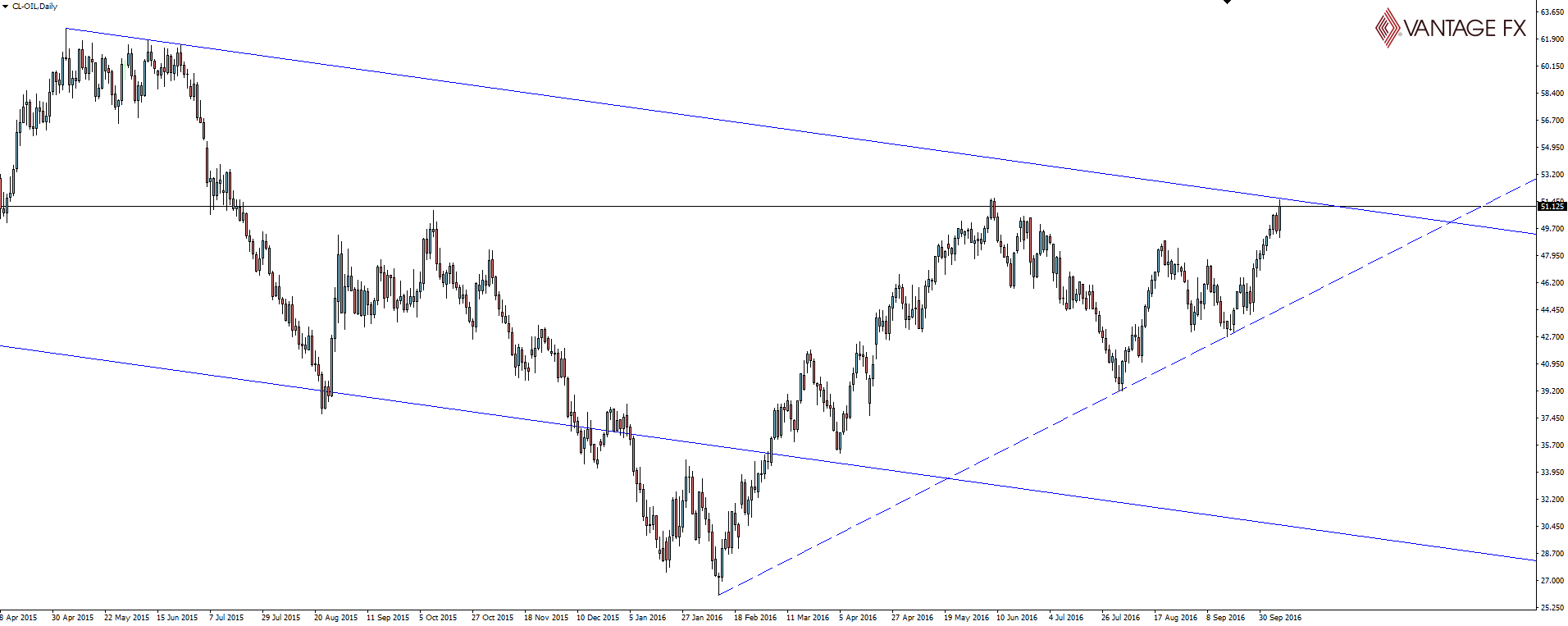

Oil Daily:

Price has continued to rally hard for the last couple of months and finally reached channel resistance overnight.

As you can see on the daily, price has given the level a little kiss.

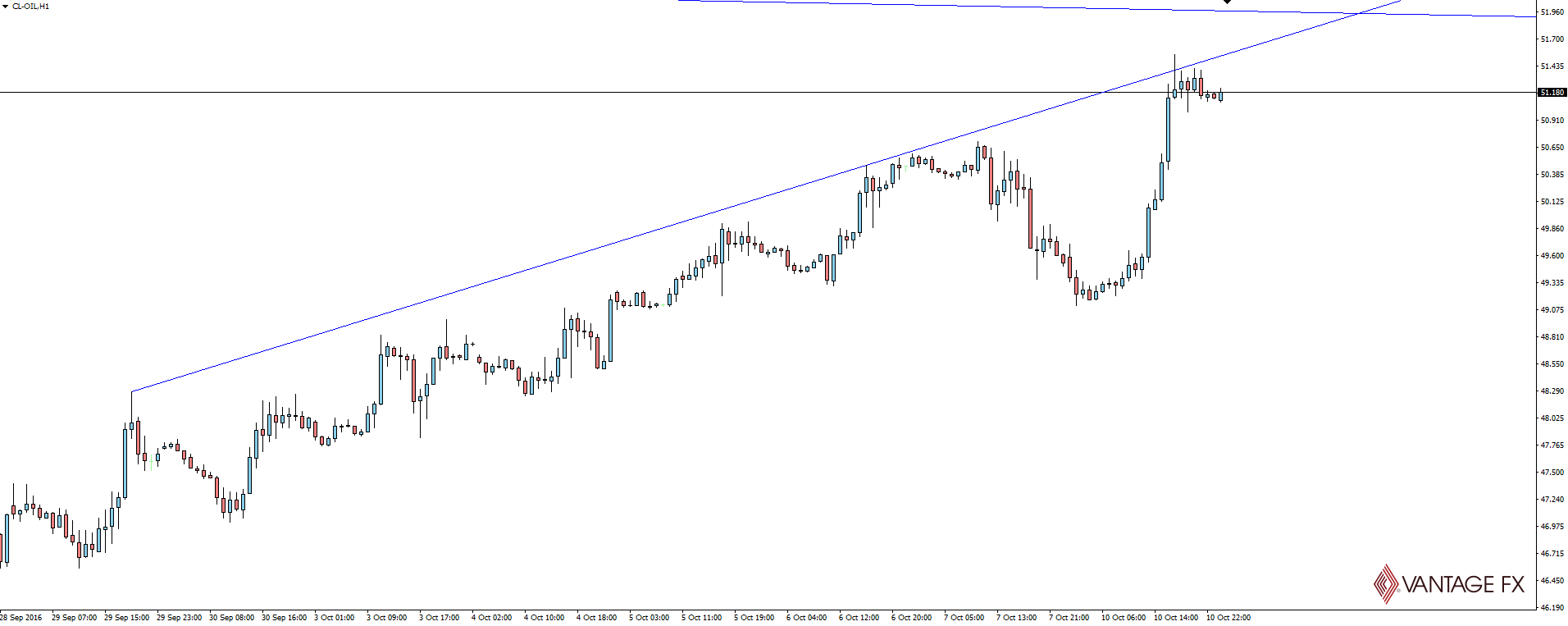

Oil Hourly:

Zooming into the hourly and taking a look at the chart from a day trading perspective, that higher time frame resistance level is the key. If the level holds, then in the same way that we marked yesterday’s Euro’s post bounce price action, we’ll be looking for the same sort of setups but from the short side here in oil.

If you were to read some of the headlines doing the rounds this morning you’d see that this time the oil deal is different and price will carry onto the moon!

….Probably.

…Probably not.

…Who cares, trade the scenario that plays out.

On the Calendar Tuesday:

EUR German ZEW Economic Sentiment

Just be aware that each of today’s highlighted calendar releases are second tier. With the US still coming back to their desks following yesterday’s Columbus Day holiday, expect holiday trading conditions to continue throughout Asia and probably into London.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.